Fed hasn’t changed key interest rates

In conjunction with the Federal Open Market Committee (FOMC) meeting held on September 21-22, 2021, meeting participants submitted their projections of the most likely outcomes for real gross domestic product (GDP) growth, the unemployment rate, and inflation for each year from 2021 to 2024 and over the longer run. Each participant’s projections were based on information available at the time of the meeting, together with her or his assessment of appropriate monetary policy–including a path for the federal funds rate and its longer-run value–and assumptions about other factors likely to affect economic outcomes. The longer-run projections represent each participant’s assessment of the value to which each variable would be expected to converge, over time, under appropriate monetary policy and in the absence of further shocks to the economy. “Appropriate monetary policy” is defined as the future path of policy that each participant deems most likely to foster outcomes for economic activity and inflation that best satisfy his or her individual interpretation of the statutory mandate to promote maximum employment and price stability.

Related news

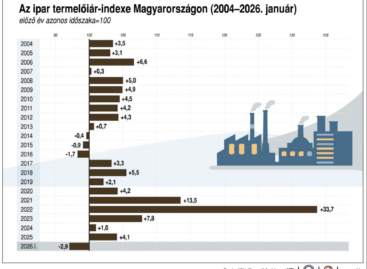

KSH: In January 2026, industrial producer prices were on average 2.9 percent lower than a year earlier and 0.9 percent higher than the previous month

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >GDP growth in OECD member countries slowed to 0.3 percent in the last quarter of last year

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

A stable compass in the Hungarian FMCG sector for 20 years

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >