NAV is not slowing down with digitalization improvements

Following the successful introduction of the online invoicing system, the National Tax and Customs Board (NAV) is launching technological developments in additional areas.

From 1 July, 2020, companies will be required to provide online information to all domestic taxpayers’ invoices, and from spring 2021, the companies may prepare a draft business tax return. At the EY’s professional conference Czöndör Szabolcs, Head of Unit, emphasized that, in parallel, preparations for an even broader control disclosure obligation had begun.

Related news

NAV: a large quantity of smuggled cigarettes, tobacco and alcohol was found in a house in Debrecen

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Amikor a megszámlálhatatlan megszámlálhatóvá válik

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >The number of Hungarian dishes has increased to one hundred with the terpertős pogácsa and Vecsés sauerkraut

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

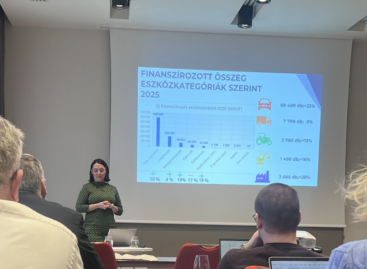

Read more >The leasing market was able to grow last year in a stable environment

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >