MONEY.HU: The value of payment requests has increased eightfold

The value of transfers initiated in response to payment requests per transaction has increased eightfold in just one year, according to a recent analysis by money.hu. Such transactions, conducted through the Instant Payment System (AFR), are not only fast and convenient, but also offer significant cost advantages, especially in the case of large transfers. The trend is clear: the payment request is no longer used by bank account holders to settle joint dinners and pocket money, but also to process transfers of hundreds of thousands or even millions.

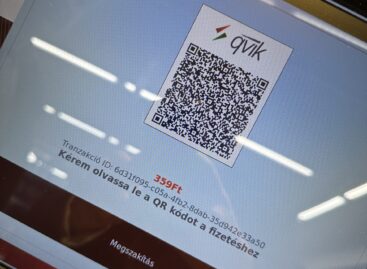

The essence of the payment request is that the party initiating the transfer does not manually enter the account number, amount and message, but the party expecting the money sends a “request”, which the other party can fulfill with approval. This not only makes the transfer more convenient, but also safer, as the number of errors when entering the account number and amount is reduced.

The essence of the payment request is that the party initiating the transfer does not manually enter the account number, amount and message, but the party expecting the money sends a “request”, which the other party can fulfill with approval. This not only makes the transfer more convenient, but also safer, as the number of errors when entering the account number and amount is reduced.

According to the MNB, in the first quarter of 2025, nearly 800 thousand payment requests were processed, totaling more than 290 billion forints. However, what is truly remarkable is that the average value of transactions has increased eightfold in one year and now exceeds 365 thousand forints. For comparison: in the first quarter of 2024, this amount was only around 43 thousand forints.

The payment request was primarily intended for situations where smaller amounts of money are transferred between individuals or to smaller service providers:

Cost sharing between friends: E.g. sharing dinner, movie tickets, distributing gifts.

Payment for smaller services: E.g. summer camp fees, private lessons, minor repairs.

Settlement of ad-hoc debts: A simple, quick way to repay.

However, the latest available data, particularly the average value per transaction of transfers initiated in response to payment requests, show a completely new trend.

“While the total number and value of AFR transactions is growing dynamically – which in itself is a success of the digital payment flow – the development of the average value per transaction of the payment request is particularly outstanding. The most likely and most significant driver of this trend may be the exemption from transaction fees for transfers initiated on payment requests. This cost advantage becomes particularly significant for higher-value transactions. The sending and receiving limit per transaction is HUF 20 million in the case of a payment request. However, transfer fees must also be taken into account in the case of transfers initiated on payment requests. The fee for large transfers varies greatly from bank to bank, and can be almost free or extremely expensive. In any case, it is worth choosing the account package carefully for frequent large transfers, as there are significant differences even in the case of transfers of HUF 1 million, and we can encounter bank fees ranging from zero to over HUF 6,000,”

emphasized Levente Korponai, the head of money.hu.

Related news

Instant payments have taken over, with most transfers arriving within seconds.

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >MONEY.HU: What can we expect from the planned apartment cafeteria program

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >MONEY.HU: Hungarians are optimistic about their financial situation

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Focus on the domestic fishing sector at SIRHA Budapest

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >High-protein products are taking over

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >