MNB: the decline in vulnerability reduces the risks in Hungary

The fact that Hungary’s vulnerability considerably decreased in the past years reduces the risks that will occur because of the Brexit.

The outcome of the British referendum caused volatility in international financial markets and in the Hungarian assets as well, but the Hungarian National Bank (MNB) is constantly monitoring the developments on the money market and government securities market and is prepared for risk management and do everything in order to maintain financial stability – the central bank announced on Friday. (MTI)

Related news

January inflation data paves the way for February interest rate cut

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >K&H Insurance receives MNB award for green finance

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Amikor a megszámlálhatatlan megszámlálhatóvá válik

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >The number of Hungarian dishes has increased to one hundred with the terpertős pogácsa and Vecsés sauerkraut

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

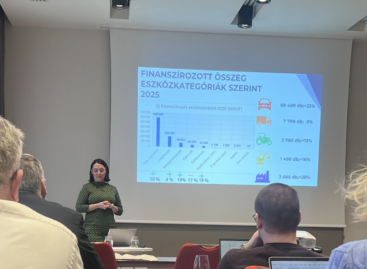

Read more >The leasing market was able to grow last year in a stable environment

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >