METRO GROUP substantially strengthens its financial foundation despite tough trading conditions

METRO GROUP succeeded in further strengthening its financial foundation in the first half of 2013 despite consumer sentiment remaining weak across Europe. The Düsseldorf-based retailer was able to again significantly improve its EBIT and cash flow as well as its net debt while sales showed a stable trend. And this although many countries, especially in Western Europe, experienced a recession also in the second quarter.

- Sales adjusted for portfolio changes remain on prior year level despite weak economic situation across Europe: +0.1% in H1 (in local currency: + 0.5%) and -0.5% in Q2 (in local currency: +0.1%), also due to the earlier Easter business

- EBIT after special items reaches €364 million in H1 2013 (H1 2012: €63 million) and €362 million in Q2 2013 (Q2 2012: €71 million) – positive effects from the closings of Real in Russia and Ukraine

- Operating cash flow up €283 million; net debt considerably reduced by €1.9 billion

- Sales and earnings guidance for the short financial year 2013 confirmed

- H1: Delivery service with almost 20% sales growth, share of own brand sales reaches 11.6%, online sales grow by more than 70%

“The disposable income and purchasing power of our customers in nearly all European countries were still burdened by austerity measures”, said Olaf Koch, Chairman of the Management Board of METRO AG. “Nevertheless, we continued to significantly strengthen our balance sheet and achieved overall a positive business development. This is also one of the reasons why we remain convinced to fulfil our sales and earnings guidance for the stub year 2013”. At the same time, METRO GROUP and its sales lines achieved important successes in further developing and modernising their business models. “During the past quarter we made significant progress in the customer-orientated realignment of our company”, said Koch. “This applies for measures relating to business operations, like for example the expansion of the online and delivery business, and also for the necessary changes relating to structures, processes and portfolio”. During the period from January to June 2013, METRO GROUP generated €30.8 billion in sales (H1 2012: €31.5 billion). This corresponds to a decrease of 2.3%. In local currency, METRO GROUP sales were down 1.9% on the previous year. Adjusted for the already implemented and announced portfolio changes (MAKRO Cash & Carry in the United Kingdom, Real Eastern Europe and Media Markt China), sales rose slightly by 0.1% (in local currency: +0.5%). In the 2nd quarter 2013, sales receded by 3.6% to €15.3 billion (Q2 2012: €15.8 billion). This is in particular attributable to the earlier Easter Business in the year under review. Moreover, in the year-earlier period, especially Media-Saturn had benefited from the UEFA EURO 2012. Adjusted for the already implemented and announced portfolio changes, sales receded by only 0.5% (in local currency: +0.1%). METRO GROUP continued to intensively implement the customer-centric realignment of the company also in the second quarter 2013. Accordingly, delivery sales rose significantly by 19.2% to €1.3 billion in H1 2013. In Q2, they even climbed by 21.8% to €0.7 billion. The share of own brand sales increased noticeably to 11.6% in H1 2013 (H1 2012: 11.4%). Q2 was particularly successful, since the share of own brand sales rose from 11.7% to 12.1%. In H1 2013, METRO GROUP generated online sales of €0.6 billion, up 72.0% on H1 2012. Online sales came to €0.3 billion in Q2 2013 (+88.5%).

Related news

Related news

0.5 percent of Hungarian GDP is related to Nestlé’s domestic operations

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Wolt’s financing program offered 1 million euros in loans domestically in six months

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

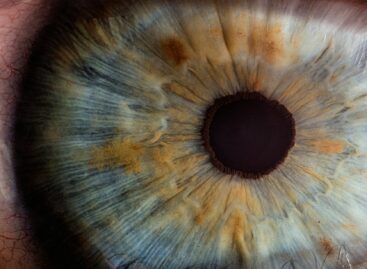

Read more >Vision Express launches eyeglass subscription in Hungary

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >