Aldi US doubles down on EDLP price promise

Aldi Süd in the USA highlights the low-price appeal of its discount model. The retailer especially emphasizes the simplicity and inclusiveness of its EDLP strategy. The discounter challenges the paid membership programs of industry leaders such as Walmart, Costco or Target. Aldi plans to extend its presence to national level.

Aldi Süd emphasizes its claim to price leadership in the US. In a company announcement the discounter highlights the advantages of its Everyday Low-Price approach and contrasts its strategy with a slightly sarcastic reference to other US competitors’ exclusive, mostly paid membership schemes. Under the guise of launching a fictional loyalty program called ‘Aldi+’ the retailer points to its price competitiveness available to ‘331.9 million members on day one’ – the equivalent of the US population – ‘with no additional fees’. According to Aldi, consumers can save up to 40% on their weekly shopping spend at the German discounter, without having to pay a monthly fee. With this commitment to simplicity and the best deal for the weekly basket Aldi is deliberately bucking the industry trend of ‘discounts versus data’ – exclusive prices only for registered loyalty shoppers. What’s more, Walmart’s Walmart+ program, Target’s Target Circle 360 rewards program and Costco’s Executive Membership don’t come for free. They all set back customers around 100 US-dollars (USD) a year.

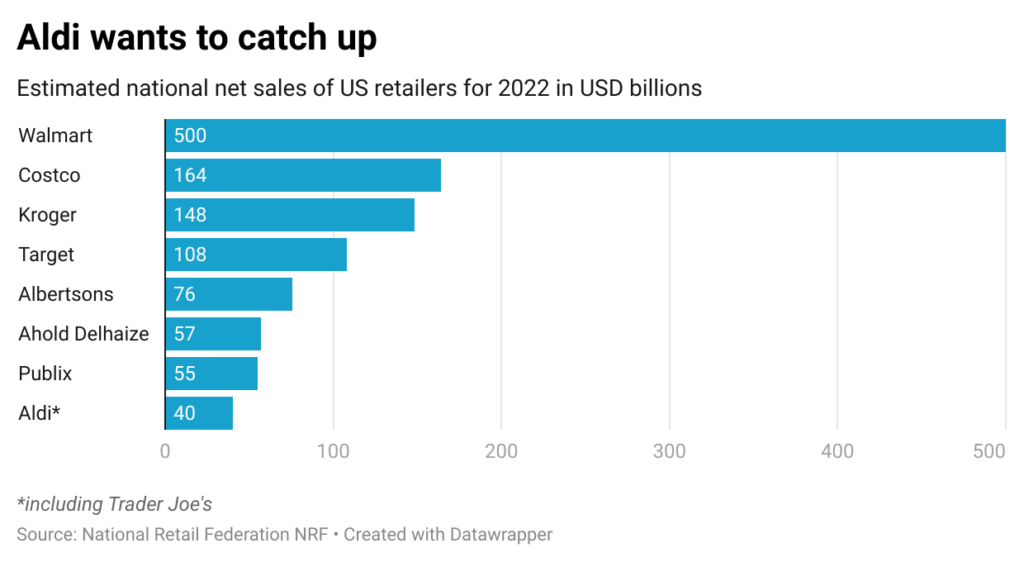

The statement comes as a challenge to current industry leaders, who dwarf the German discounter in terms of sales. According to data released by the National Retail Federation NRF market leader Walmart’s US sales in 2022 are estimated at up to 500 billion USD, Costco’s at 164 billion USD, while Kroger and Target generated 148 billion and 108 billion USD, respectively. And while the retailer association estimates the global sales of the two Aldis at 124 billion USD, in the US Aldi has so far played only a minor role, with a comparatively small market share of 40 billion USD. Aldi is looking to take its place among the retail heavyweights. The discounter recently announced plans to add 800 stores to its current 2370 in the US by 2028.

Aldi can also widen the gap to rival Lidl. According to a recent analysis published by placer.ai, Aldi’s footfall increased by 28.5% in February this year year over year, compared to 8.6% for competitor Lidl. Over the past twelve months Aldi has consistently attracted more shoppers than Lidl, the data shows. One reason for this could be that in the current economic situation, where food prices have risen by around 25% since 2020, Aldi attracts lower-income segments than Lidl. According to the market research, the median household income of potential shoppers in the catchment area of Aldi stores is estimated at 67,000 USD per year, while the respective value for Lidl comes to 79,000 USD. Placer.ai estimates the actual value of the current Lidl shopper to be even higher, at 88,000 USD per year.

Related news

Schwarz Group Gets Approval For Acquisition Of La Cocoș In Romania

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Breakfast goes pouch, premium and protein at Lidl Poland

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >How Lidl uses Poland’s new deposit system as a loyalty tool

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Sentix: investor sentiment in the eurozone deteriorated in March

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Research: Coupons don’t determine which brands we stay loyal to

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >New trend in online shopping: Hungarians pay later

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >