MBH quick analysis: Industry performance remains subdued

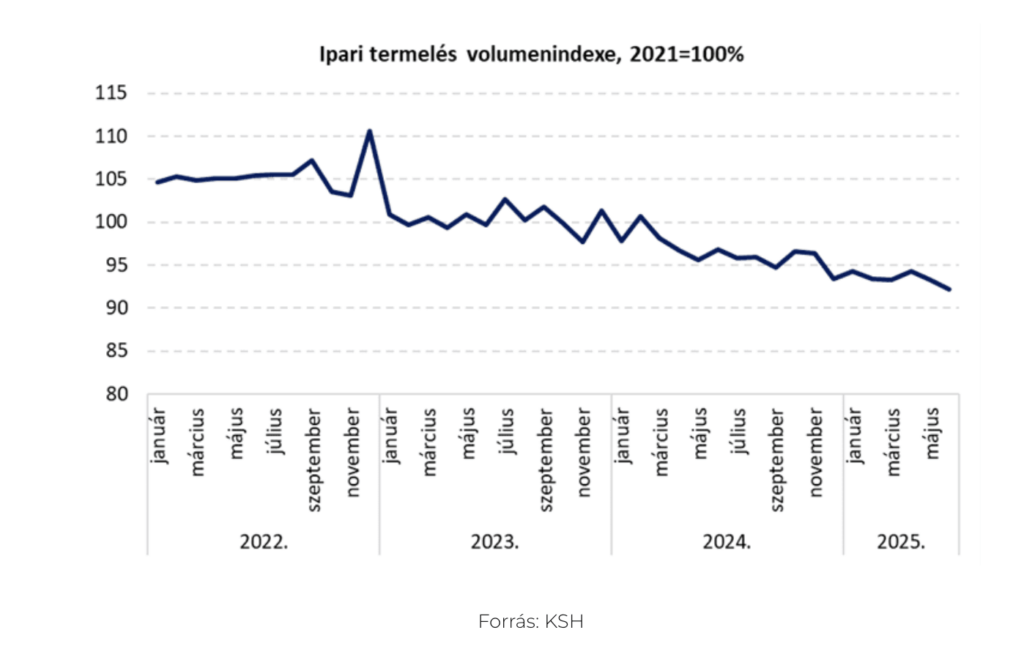

Industry continues to deliver weak figures: in June, industrial production volume was 4.9% below the level of a year earlier. Based on seasonally and working-day adjusted data, industrial output was 1.2% lower than in May 2025. In the first half of the year, output fell cumulatively by 3.9% year-on-year. The main reason for the weak performance is insufficient external demand, which particularly affects the largest subsectors, namely vehicle manufacturing and the production of electrical equipment (battery manufacturing).

The German economic stimulus package could have a positive impact on the sector, and the end of the Russia–Ukraine war could also support the situation of industry and reduce uncertainty. The effects of the still weak foreign market environment may be partly offset and industrial output could improve from the end of 2025 – but more likely from 2026 – with the launch of factories built in recent years in the automotive and battery segments, although they will only reach full capacity after several years. Overall, however, we expect industrial performance to decline on an annual average in 2025.

Main trends in industry:

- In June 2025, industrial production volume was 4.9% lower than a year earlier (working-day adjusted data matched the unadjusted figure).

- Based on seasonally and working-day adjusted data, industrial output was 1.2% lower than in May 2025.

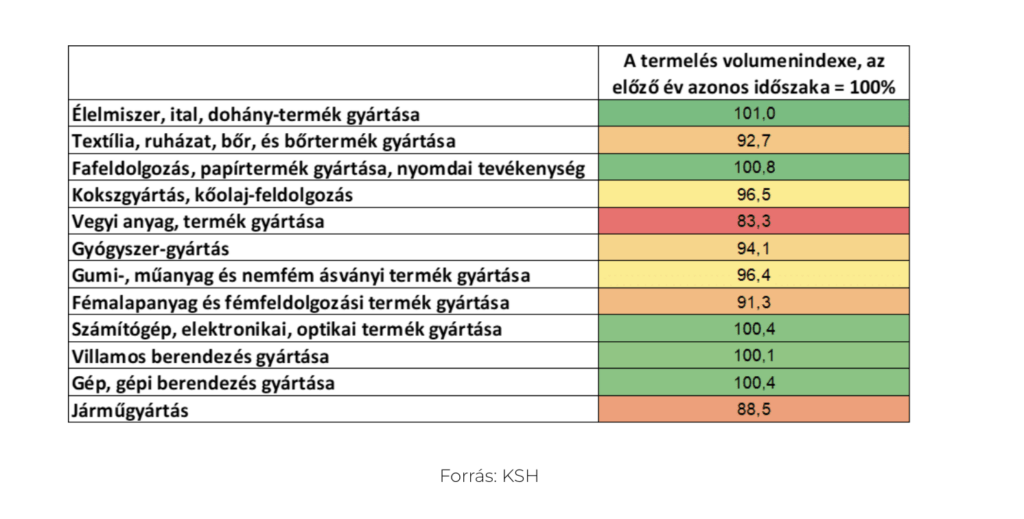

- Most manufacturing subsectors saw a decline in production, with the sharpest drop in the manufacture of chemicals and chemical products. The largest subsector, vehicle manufacturing, which accounts for 26% of manufacturing output, fell by 11.5% compared to the same month last year, while the manufacture of electrical equipment, which has a 9.6% share, rose by 0.1% year-on-year.

- Order and export data point to unfavourable trends:

- Total new orders in manufacturing fell by 15.6% compared to June 2024.

- New domestic orders fell by 8%, while new export orders dropped by 16.8% year-on-year.

- Total order backlog at the end of June was 8.0% lower than a year earlier.

- In the first half of the year compared to the same period last year:

- industrial production fell by 3.9%.

- Production fell in eleven out of thirteen manufacturing subsectors, with the largest decline – 14.7% – in the manufacture of electrical equipment.

Short-term outlook for the whole sector and key subsectors

- In 2025, industry is expected to decline on an annual average, with growth only likely next year. One reason for the sector’s weak performance is poor export market conditions (both the German and Austrian economies contracted last year), in addition to the slowdown in the transition to electric mobility. It remains to be seen how the European market will react to the new tariff situation, whereby the general tariff rate has increased to 15%, while the tariff for the automotive sector has decreased from 25% to 15%.

- From the end of 2025, but more significantly from 2026, industrial output could be supported by the commissioning of major manufacturing developments, such as the BMW and CATL plants, while the construction and potential trial operation of BYD will also support growth. However, foreign market prospects may only improve marginally in 2025; the German economy is expected to achieve modest growth thanks to the stimulus package announced this year, which will have a tangible positive impact on industrial production next year.

Vehicle manufacturing:

- Data pointing to recovery are not particularly encouraging, due to several factors: declining global demand, volatility in energy prices, geopolitical tensions, and the tariff war – all causing businesses to place new orders more cautiously.

- In addition, Europe’s car manufacturers are not in a strong position, with significant overcapacity – i.e. producing more cars than can be sold.

- According to ACEA data, car sales in the EU fell by 1.9% in the first half of the year compared to the same period last year. In effect, the EU car market has been stagnant for two years, and still absorbs significantly fewer cars than before 2020. In the first half of 2025, the market share of battery-electric vehicles (BEVs) reached 15.6%, up from 12.5% in 2024. The most popular hybrid-electric vehicles dominate 34.8% of the market. Plug-in hybrids have also gained momentum, with a share of 8.4%, up from 6.9% a year earlier. Traditional powertrains suffered a sharp decline: the market share of petrol cars fell to 28.4% from 35.4% a year earlier, while diesels dropped to 9.4% in the first half of the year.

- The Hungarian market grew by 4.3% year-on-year in the first half, contrary to the EU decline. Sales of battery-electric vehicles increased by 12.2%, hybrid-electrics by 18%, while plug-in hybrids fell by 2%. Petrol car sales dropped by 18.1%, while diesel sales grew by 5.5% in the first half of the year.

Manufacture of electrical equipment:

- The current decline in battery production is caused by falling demand, which affects domestic production, but this is likely to be a temporary problem. To see growth in this subsector this year, there would need to be an improvement in the general European environment. Signs of this are emerging, such as announced spending plans in Germany. The impact of significant capacity expansions (CATL in Debrecen, BYD in Szeged, etc.) cannot yet be felt, as weak European economic conditions and the slowdown in the transition to electric mobility are currently reducing orders in this subsector.

Manufacture of computers, electronics and optical products:

- In this subsector, export sales dominate, so the weak European economic climate has a generally negative impact on the subsector and domestic output.

Manufacture of food, beverages and tobacco products:

- This subsector is tied to the domestic market and is therefore less dependent on external demand; it depends more on internal demand.

Prepared by: Flóra Horti