MBH quick analysis: Retail produced strong numbers in April

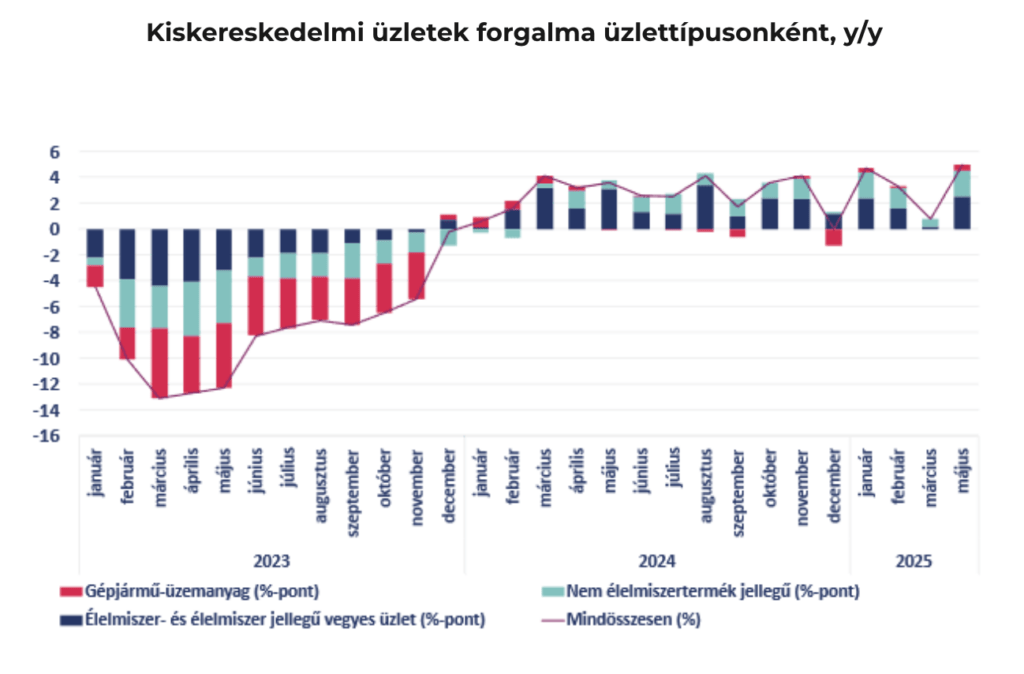

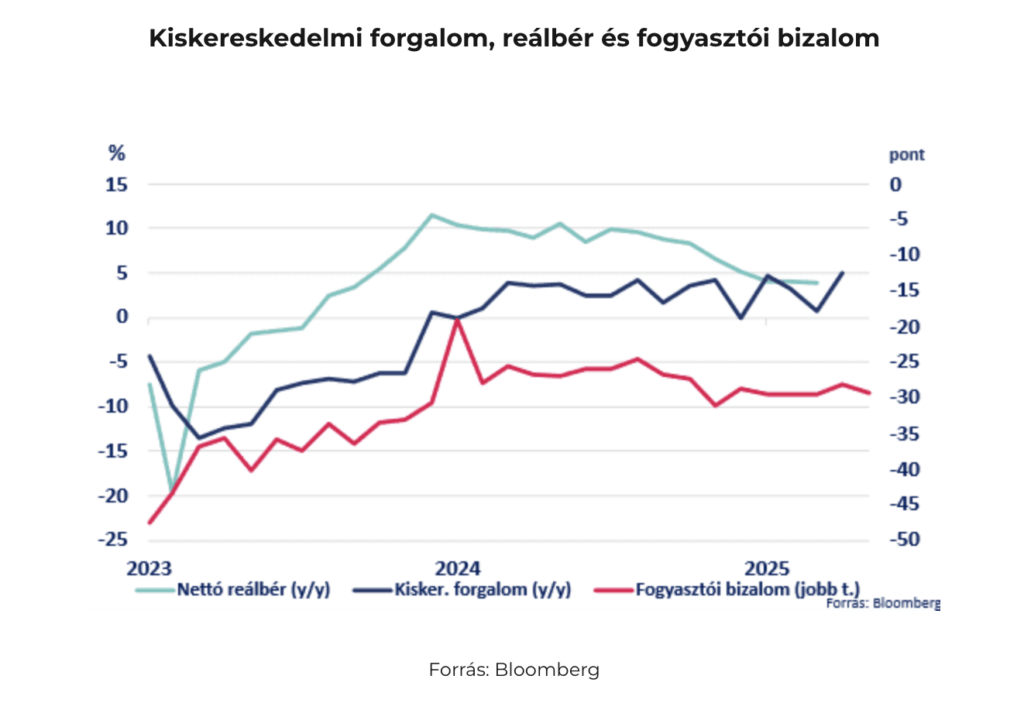

Retail sales rose by 5.0% year-on-year in April, surpassing the pace observed over the past year. On a monthly basis, growth was 2.0%, and the retail turnover is increasingly exceeding the fixed base. Looking at recent trends, we see a clear upward trajectory, which we expect to continue throughout the year—meaning consumption could increasingly drive economic growth. Based on the low base from last year (now revised even lower), further expansion is likely in the coming months, although not necessarily at the current pace. The first four months saw growth across a broad range of retail segments, with the non-food category contributing most significantly (+5.1%).

Retail sector performance:

- According to seasonally and calendar-adjusted April data, retail sales volume increased by 2.0% compared to the previous month. Among the main categories, food and fuel sales rose, while the non-food segment saw a slight decline. The current figure is 3.3% above the monthly average for 2021, and based on the upward trend, volumes are expected to further exceed the fixed base over the remainder of the year.

- On a year-on-year basis, the 5.0% increase exceeded the pace observed over the past year. All three subcategories contributed to the dynamic annual growth, with non-food products driving the increase (+4.0%), particularly mail order and online retail (+9.1%), and mixed industrial goods stores (+8.3%). Excluding fuel, annual growth stood at 5.2%.

- As expected, April delivered strong figures, partly due to the Easter holiday and indirectly due to the margin cap regulation. The margin cap’s effect is considered indirect, as mixed food retail (subject to the cap) increased by only 0.9% month-on-month, while specialist food stores grew by 2.5%. This suggests that income saved due to regulated prices may have been spent in other stores. It’s also worth noting that during festive periods over the past 18 months, specialist stores have generally outperformed mixed retail month-on-month.

- In the second half of May, the scope of products under the margin cap expanded. Based on data from March and April, its full impact is expected to be reflected in the June data. While some short-term positive effects may occur, the longer (and broader) the measure remains in effect, the greater the damage to the retail sector—one of the highest value-added industries—manifesting in delayed wage increases, layoffs, and postponed investments.

- Mail order and online retail volumes grew by 9.1% year-on-year in April, while the month-on-month increase was 2.1%. Its current share of total retail turnover is 8.4% (representing a 0.1 percentage point decrease month-on-month).

- In the first four months of the year, retail expanded by 3.4% (excluding fuel: +3.8%), driven by a strong January and the robust April. Growth was broad-based across store types, with non-food segments contributing most (+5.1%).

- In H2 2024, the rate of store closures returned sharply to pre-COVID levels: 1,217 stores closed, marking a 1.3% drop (excluding gas stations). The negative peak was in H1 2023, driven by falling demand due to inflation and surging energy costs—4,497 stores closed during that period. From there, the trend gradually improved. In total, 4,714 stores shut down in 2023, the second-highest in the past 5 years. The significantly lower H2 figure may signal the end of the accelerated consolidation caused by past shocks, and semiannual closure rates may stabilize at 1–2%, though only full-year data will confirm this. However, continued enforcement of the margin cap poses a renewed risk of rising closures.

Key trends in retail:

- Following an April increase, the GKI business confidence index dropped by 2 points in May, returning to early-year levels, with the retail sub-index showing a similar trend. While the employment indicator remained unchanged, the price-setting indicator for retail fell again in May—most sharply in the retail sector—likely due to reduced pricing flexibility caused by the margin cap.

- The GKI consumer confidence index also fell in May, returning to Q1 levels. Consumer confidence has not improved significantly in over a year and remains lower than the same time last year. The previous month’s rise in the index was partly attributed to the one-time effect of the margin cap, whose positive impact now appears unsustainable. The June index is likely to reflect the late-May expansion of the margin cap product range. Price changes also play a role in consumer sentiment: food prices rose by 5.4%, while fuel prices dropped by 7.1% in April (compared to March, food prices fell by 1.3%, fuel prices by 1.4%), yet inflation perception among households remains much higher than actual data.

- The DG ECFIN EU27 economic sentiment index rose slightly in May (to 95.2), but dropped by nearly two points in Hungary (to 93.6). The EU27 consumer confidence index improved by 1.5 points (-16.0), while Hungary’s index decreased slightly, within the margin of error.

- In March, real wages increased by 3.5% year-on-year. Gross earnings continue to grow above inflation, albeit at a slower pace than in previous years, even though inflation remains outside the tolerance band. Rising real wages are expected to support further consumption growth.

- April data shows a decline in employment levels compared to March, with the three-month average reaching a two-year low. Despite the drop in employment, unemployment only rose slightly, meaning the economically active population (i.e. potential labor force) also declined. Even with economic growth in H2, job creation may be slow, as companies did not lay off workers en masse during the downturn. Thus, hiring is unlikely to accelerate significantly once recovery begins.

Related news

Inflation has dropped significantly, a cycle of interest rate cuts may begin, while gold soars

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Home Start loan: MBH Bank has raised the stakes

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Festival buzz at the 60th anniversary EuroShop trade fair

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Historic price reduction at ALDI

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >A stable compass in the Hungarian FMCG sector for 20 years

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >