MBH Analysis Center: The rate of store closures has decreased to pre-Covid levels

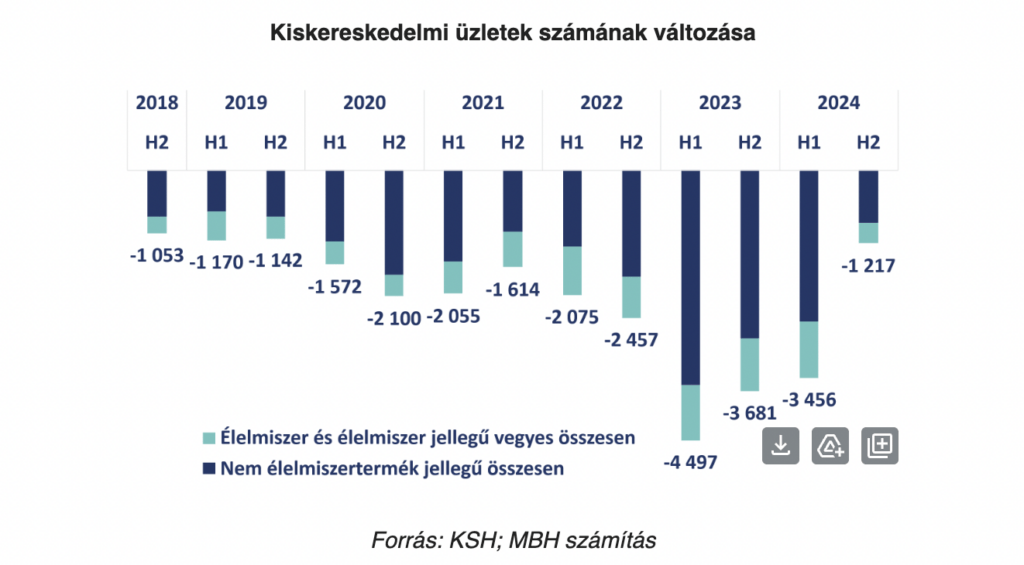

There was a significant slowdown in the closure of retail stores in the second half of last year: a third of stores closed compared to the first half. The number of general stores with a manufactured goods type seems to be stabilizing, but vegetable stores may still be at risk. In retail, a more intense wave of closures began due to the inflation shock of 2023 and the soaring energy prices, but this trend has now subsided to pre-covid levels.

Based on the latest data on the number of retail stores for the second half of 2024, the six-month rate of store closures suddenly dropped to the level usual in pre-covid years: 1,217 stores closed, which represents a decrease of 1.3% (excluding gas stations). The first half of 2023 is considered a negative peak due to the decreasing demand caused by inflation and the simultaneously rising overhead costs. At that time, 4,497 stores closed, and from there a slow improvement began, i.e. the number of closing stores decreased. Since the number of closed stores was much higher in the first half of last year, the total value for the entire last year is 4,714, which is the second highest number in the past 5 years. The significantly lower half-year figure compared to previous years may indicate the end of the accelerated concentration caused by the aforementioned shocks, the half-year decrease may return to between 1-2%, but this can only be said for sure with this year’s data.

In terms of the type of stores, it is clear that more than half (52.7%) of the units closed last year were book, computer and other industrial goods, as well as textile, clothing and footwear specialty stores. The biggest improvement was seen in general stores with manufactured goods, as while 29% of them closed in 2023, only one and a half percent closed last year. A similar improvement is seen in music and video stores, but their number is very low (70), and only one in three has been able to stay afloat in the past decade and a half. The situation has worsened in the case of fruit and vegetable stores: the closure rate of 7% in 2023 increased to 10.3% last year. In their case, the biggest difficulty may still be retaining price-sensitive consumers, who may prefer discount stores and supermarkets in search of more favorable prices.

The rise of supermarkets and discount stores has long been a characteristic phenomenon in the retail sector: since 2005, the total floor area of food and non-food stores has increased by 1.3%, i.e. it has remained essentially unchanged, while at the same time the number of stores has decreased by 40.5%, so the average floor area has increased by 70.7%, i.e. the winners of the concentration that has been going on for years are the larger floor areas, typically discount and supermarket chains.

Related news

MBH Analysis Center: The Hungarian economy may accelerate again in 2026, but the Iranian war carries serious risks

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >MBH Analysis Center: Hungarian tourism is soaring – further growth is expected in the hotel market

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >MBH: store closures drop to pre-Covid level

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

The 2026 Marketing Diamond Awards have been presented

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >FAO food price index rises again in February after five months

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >MBH quick analysis: The snow situation shaped store traffic in January

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >