MBH Bank: improving economic prospects, expanding investments, but temporarily rising inflation expected in 2025

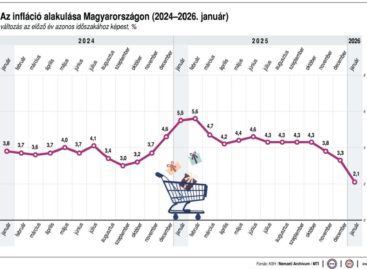

Real wage growth, stabilizing investments and further recovery in consumption are expected in 2025, thanks to which the outlook for economic performance is more favorable compared to 2024, it was revealed at the press event of MBH Bank presenting its latest macroeconomic forecasts. According to the latest forecast of the MBH Analysis Center, economic growth could reach 4 percent by the last quarter of this year, while full-year GDP growth could be around 2.6 percent. The economic trajectory is also supported by the slowly improving external market environment, but the economy continues to be characterized by strong inflationary pressure.

Industrial investments starting up could give a boost to growth

The forecasts for the Hungarian economy for 2025 are more favorable compared to last year, which is primarily due to the recovery in domestic demand due to the expected increase in consumption. This year, investments are expected to stabilize, in connection with the fact that more than 1,400 billion forints of funds may be channeled into the economy through the Sándor Demján program in the form of preferential investment credit, leasing and capital programs, as well as partially non-refundable subsidies.

“The increase in real wages, the increase in family tax relief, payments and maturities on government securities, and the labor loan may all further increase internal demand, so that economic growth may reach up to 4 percent by the end of this year. However, we have revised our forecast for annual GDP growth to 2.6 percent due to the only slowly improving foreign market economy and the slower acceleration of large automotive industry investments,”

– said Zoltán Árokszállási, Director of the MBH Analysis Center.

An important development is that the chances of the Russian-Ukrainian war ending in the foreseeable future have recently increased. This could have a significant positive impact on economic growth through lower energy prices, improved investor sentiment, and thus a stabilization of the forint exchange rate.

Related news

January inflation data paves the way for February interest rate cut

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Spring whirlwind at the 60th anniversary EuroShop trade fair

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >The economic sentiment index deteriorated in the euro area and the EU in February, but improved in Hungary

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >