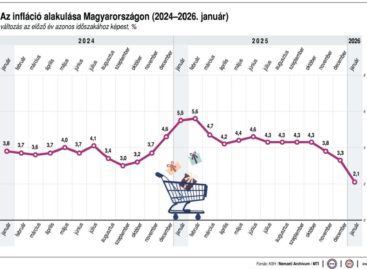

MBH Bank: Following January’s inflation data, we are raising our inflation forecast for this year to 4.6%

Following a 4.6% year-on-year price increase in December, consumer prices in Hungary rose by an average of 5.5% in January 2025. The figure exceeded both our expectations (4.9%) and the market consensus (4.8%). Compared to the previous month, prices increased by 1.5%, compared to our expectation of 0.8%. Annual core inflation rose even faster than the headline figure, from 4.7% to 5.8% in January. Core inflation reached a level last seen a year ago, indicating an unexpectedly strong surge in inflationary pressures.

Based on the monthly price changes, the main food group, which accounts for over 30% of the consumer basket, increased by 1.9%, following a 0.4% increase in the previous month, which was higher than our expectations. Fuel prices increased by 2.7% in January, which was roughly in line with our expectations. The main other articles group, which also includes vehicle fuels and has a weight of 19%, saw a 1.5% price increase after a 0.9% increase in December. Household energy prices rose by 1.7%, and alcoholic beverages and tobacco products were 1.5% more expensive. Clothing items fell by 2.9% due to end-of-season price cuts, which was roughly expected.

What is the real, big negative surprise is that the price of services has increased significantly: in one month, we had to pay 2.2% more for services. Durable consumer goods have increased by 0.7%, which is also a relatively rapid increase in price, and may have been high due to the weakening of the forint.

Outlook

Today’s inflation data is a serious negative surprise. First of all, it is the increase in the price of services that has become unexpectedly strong: we last saw a similar price increase at the beginning of 2023, in the midst of the inflation shock at that time. Thanks to the increase in the price of services, core inflation has also jumped amazingly. At the same time, the increase in the price of food has also been stronger than we expected. The structure of inflation therefore looks very unfavorable, and practically means that the indicator will be permanently and significantly above the MNB’s inflation target band throughout this year.

The important question for the next few months will be to what level the monthly inflation rate can fall back in the coming months after the January data release containing serious price increases at the beginning of the year. Service providers can no longer really point to last year’s average inflation. At the same time, it is conceivable that economic actors have simply become accustomed to significant price increases in recent years, and even though this is less justified in the current situation, they will still implement significant increases. In parallel, the population’s inflation expectations are also rising, while the wave of forint weakening that lasted from early autumn to early January has also appeared in price increases on the one hand, and on the other hand, it is also worsening population expectations. All this creates a rather dangerous situation, which does not justify the MNB relaxing monetary conditions. Overall, given today’s data, our inflation forecast of 4.1% for this year cannot be maintained, we are increasing it to 4.6% (the data refers to the annual average).

Related news

KSH: in January, consumer prices exceeded the values of the same month of the previous year by an average of 2.1 percent

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

The Store of the Future opens again at the SIRHA Budapest exhibition! (Part 1)

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >