The GKI business climate index stagnated in March

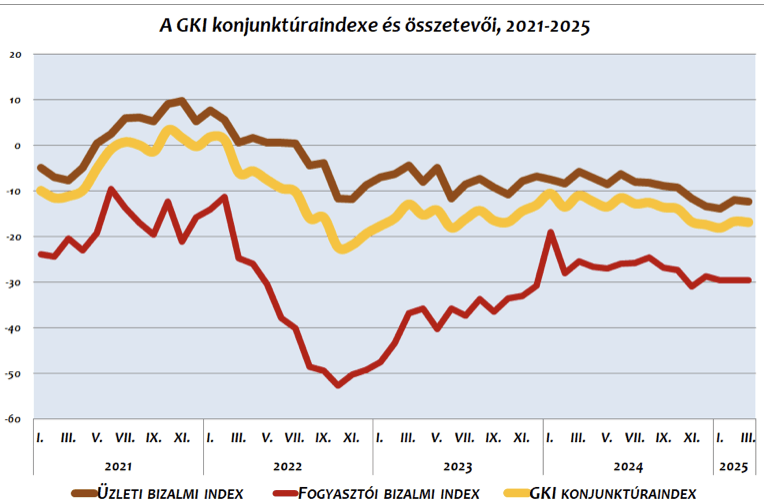

According to a survey conducted by GKI Economic Research Co. – with support from the EU – there was no meaningful change in consumer or business expectations in March compared to February: the GKI economic sentiment index practically stagnated. Companies’ employment intentions slightly worsened, while overall expectations regarding future sales prices decreased significantly.

Business expectations gradually deteriorated throughout 2024, hitting their lowest point in January, followed by a slight improvement in February. The GKI business confidence index showed no significant change in March compared to February. Behind the stagnating overall picture lies a 2- and 3-point decrease in the industrial and construction confidence indices, as well as a 2-point increase in the trade and service sector indices. Currently, the construction sector is the least, while business services are the most optimistic.

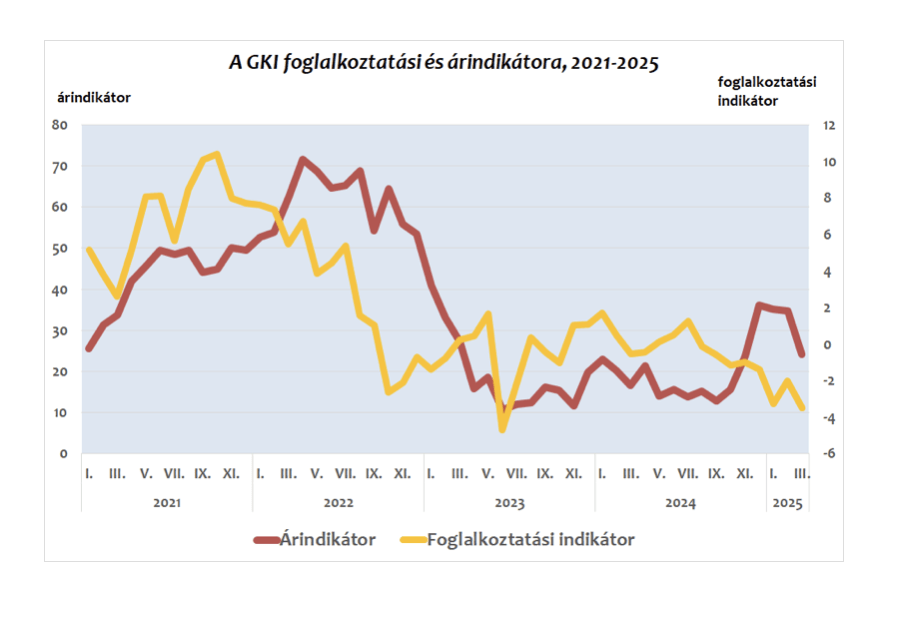

The employment indicator, which reflects companies’ aggregated willingness to hire, declined slightly in March compared to the previous month. Employment intentions worsened slightly in all four sectors. Over the next three months, 9% of businesses plan to expand their workforce, while 11% plan to reduce it.

There was no significant change in the perception of the predictability of the business environment in March.

The price indicator, which summarizes pricing intentions in the business sector into a single figure, dropped significantly in the third month of this year compared to the previous survey. Price increase intentions declined across all four sectors, especially in construction. Over the next three months, 27% of companies plan to raise prices (down from 45% in February), while 10% intend to lower them (up from 5% in February).

The GKI consumer confidence index has shown little movement over the past four months and remained unchanged in March compared to February. In the first month of spring, households perceived a slight improvement in their financial situation over the past 12 months and in their outlook for the next 12 months. However, they considered the country’s economic outlook unchanged, and their assessment of their ability to purchase high-value consumer goods slightly worsened. Inflation expectations slightly declined, while expectations for unemployment remained unchanged from February.

Related news

How does the forint exchange rate affect consumer prices?

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >KSH: In January 2026, industrial producer prices were on average 2.9 percent lower than a year earlier and 0.9 percent higher than the previous month

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >The GKI business climate index rose in February

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

MBH Analysis Center: The Hungarian economy may accelerate again in 2026, but the Iranian war carries serious risks

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Focus on the domestic fishing sector at SIRHA Budapest

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Together for the future: dm supports projects that also offer opportunities for volunteer work with 50 million forints

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >