The GKI business climate index decreased in May

According to a survey conducted by GKI Economic Research Co. – supported by the EU – both consumers and businesses became slightly more pessimistic in May compared to April. The business sector’s willingness to hire declined somewhat relative to the previous survey, while the combined expectation for the development of sales prices fell to a seven-month low. Perceptions of the predictability of the business environment remained unchanged.

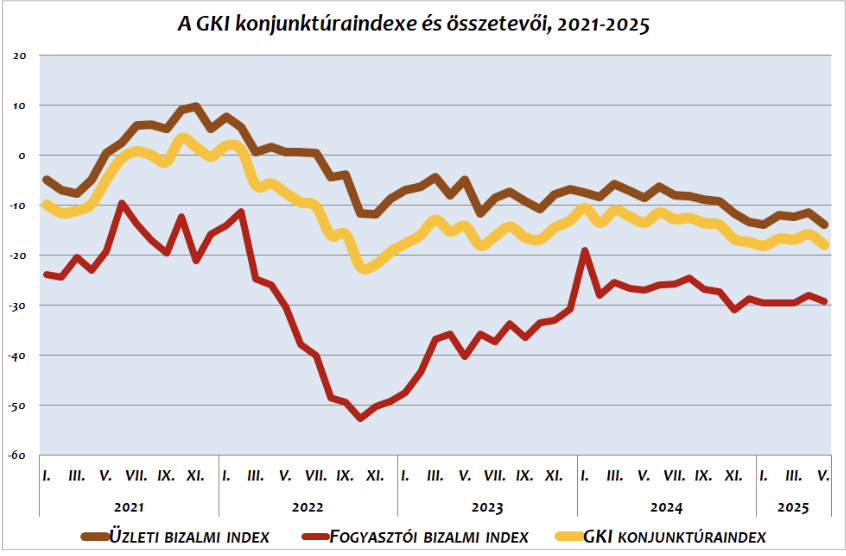

Business prospects hit rock bottom in January this year, followed by a slight upward trend through April. This positive development stalled in May, as the GKI business confidence index dropped by over 2 points compared to the previous survey, returning to its early-year level. Confidence indices in all four surveyed sectors fell by 2–3 points compared to April. The construction sector remains the least optimistic, while business services are still the most confident.

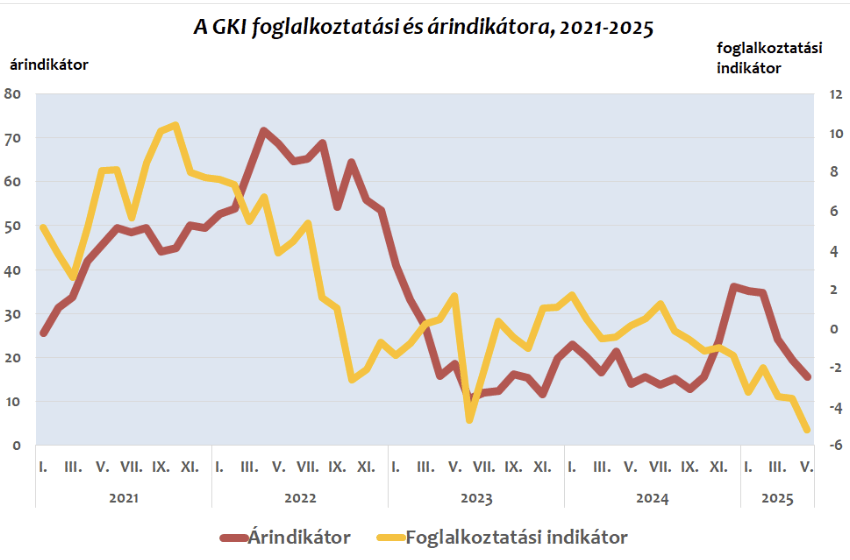

The employment indicator reflecting companies’ overall staffing expectations slightly decreased in May compared to the previous month. There was no significant change in industry or trade, but construction and business services reported somewhat less favorable outlooks. Over the next three months, 9% of companies plan to expand their workforce, while 12% foresee a reduction.

Perceptions of the predictability of the business environment barely changed in May, with the most negative assessment coming from the construction sector.

May marks the fifth consecutive month in which the price indicator – summarizing price-setting plans in a single figure – decreased compared to the previous month, falling to a seven-month low. Price increase intentions declined across all four sectors, most significantly among business service providers. In the next three months, 20% of companies intend to raise prices, while 8% are planning reductions. A month earlier, these figures stood at 26% and 8%, respectively.

The GKI consumer confidence index started the year at a relatively low level, then rose slightly in April. In May, the index took a negative turn, essentially returning to its January–March level. Households reported a slight improvement in their financial situation over the past 12 months, but had moderately worse expectations for the coming year. Their outlook for the country’s economic situation over the next 12 months improved slightly in May compared to April. However, perceptions of their ability to spend on major consumer goods worsened somewhat. Inflation expectations decreased, and fears of unemployment also eased slightly.

Related news

KSH: In January 2026, industrial producer prices were on average 2.9 percent lower than a year earlier and 0.9 percent higher than the previous month

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >The GKI business climate index rose in February

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >GDP growth in OECD member countries slowed to 0.3 percent in the last quarter of last year

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Festival buzz at the 60th anniversary EuroShop trade fair

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >