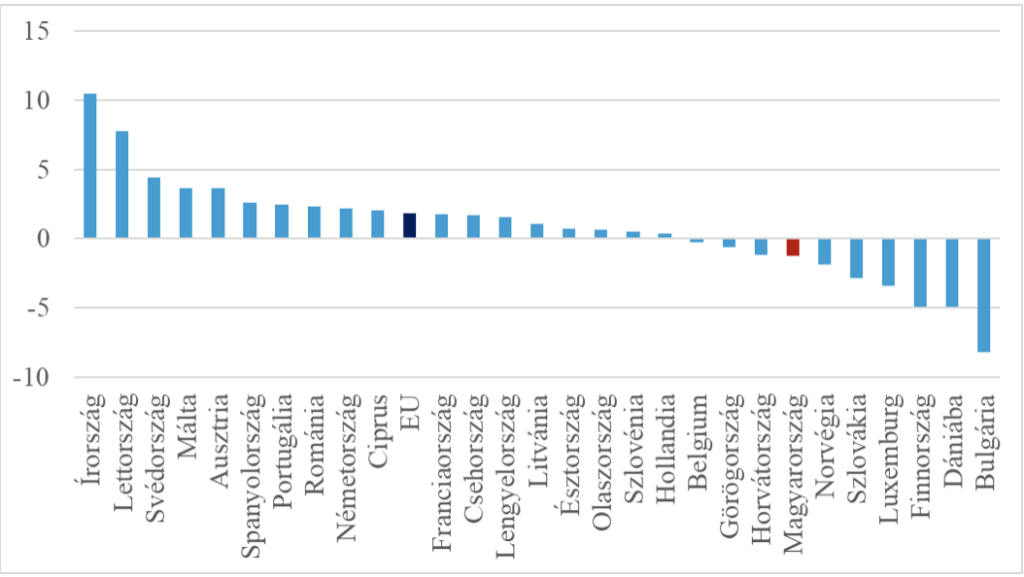

Industrial production is still declining in Hungary, but is already increasing in the EU

In July 2025, industrial production in the EU increased by 1.8% compared to July 2024. In Germany, industry managed to grow for the first time this year in May, with an annual increase of 2.2% recorded in July. This is a positive signal for Hungarian industry as well, since the two countries share similar demand markets, and many Hungarian companies are significant suppliers to German factories. Meanwhile, Hungary’s industrial output fell by 1.3% in July – the 7th largest decline among EU member states.

Change in industrial production in selected EU countries (July 2025 vs. July 2024, %)

Source: Eurostat

In the first eight months of 2025, industrial output volume was 7.3% lower (seasonally and calendar-adjusted: -2.3%) than in the same period a year earlier. Exports, which account for 64% of total sales, fell by 1.3%, while domestic sales – representing 36% – declined by 5.3%. The steepest drops were recorded in coke production and oil refining (-20%), chemical industry (-14.4%), and textiles (-11.2%), while production also fell in mining (-8.5%) and electrical equipment manufacturing (-8.3%), which includes battery production. Out of 15 observed subsectors, output decreased in 9 and increased in 5, according to the Central Statistical Office (KSH). Within manufacturing, automotive production stagnated in July. Reports suggest reduced shifts and layoffs at domestic car factories, while the expected growth boost from new plants coming online this year will remain limited.

In the first seven months, production fell in 12 manufacturing subsectors. The electronics industry grew by 8.2%, improving the overall performance, while production also increased in the wood, paper, and printing industry (3.1%) and in electric power generation (1.9%).

According to GKI business surveys, weak demand remains the main cause of production decline. KSH data supports this: both domestic and export sales dropped in the first seven months of 2025 by 3.7% and 1.5%, respectively. Short-term prospects are still unfavorable: as of July 2025, order volumes in the sectors monitored by KSH were 7% lower than a year earlier. Growth is also constrained from the input side. While labor shortages used to be cited as the main barrier to growth in GKI business surveys, this factor has recently become less relevant; where it persists, it is more a qualitative than quantitative issue. Employment in industry fell by 1.5% in 2024 and by a further 3% in the first three quarters of 2025.

A similar situation exists regarding technical capacities. Manufacturing investments dropped by 17.4% in the first half of 2025, although major projects (BMW, BYD, CATL factory constructions, etc.) are still in progress and could give the sector a boost once operational. In June, the second phase of the CATL project was suspended indefinitely, and given the current economic environment, other – mainly automotive-related – investments may also be delayed. According to the GKI business survey, most operating companies did not even carry out major “maintenance-type” investments, let alone development projects aimed at market expansion or production growth. Most respondents indicated that their only investment goal was to replace worn-out equipment. This means that Hungarian industry may struggle to take advantage of a later upswing, and dynamic growth is unlikely in the near term. However, some reserves remain: average capacity utilization was last near the 80% threshold in the summer of 2022 and has since stayed below that level. The question is how and how quickly these underutilized capacities can be mobilized.

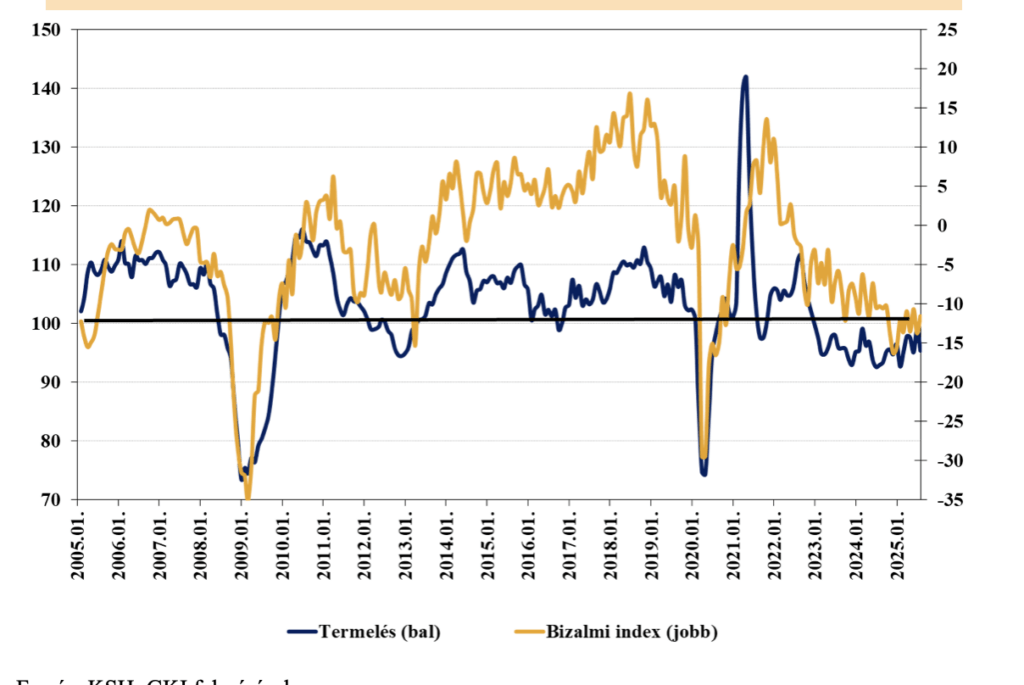

Manufacturing output (same month of previous year = 100) and industrial confidence index

Source: KSH, GKI surveys

There are signs of recovery in our key export markets, and following the new U.S.–EU tariff agreement, business confidence is also improving. The recovery has begun, though its pace remains slow. It seems clear that without growth in the EU economy, Hungarian industry cannot return to a growth path, as two-thirds of its output is sold abroad, while domestic demand – even with artificial stimulus – cannot rise enough to compensate. Thus, new factories entering production toward the end of the year may bring some momentum, easing the decline seen in the first half. Based on gross output data and business sentiment indicators, however, industrial growth for the full year is unlikely, though the downturn may level off by year-end, with sustained growth potentially starting in 2026 amid improving external demand.

Related news

Related news

The Hungarian Food Book is 50 years old

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >