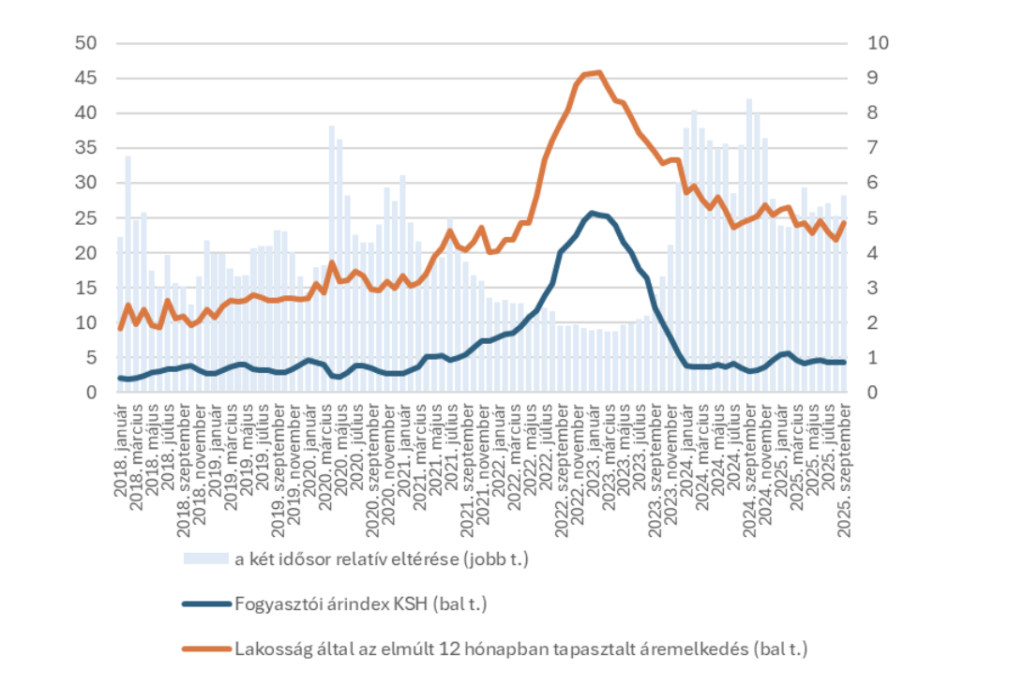

The index of price increases perceived by the population remains high

The consumer price index fell from a very high level in 2022-23 to below 5% by early 2024 and has only temporarily risen above this level for 2 months since then (the latest figure, September 2025, is 4.3%). The inflation sentiment index (which measures the price increase experienced by the population over the past 12 months) that fluctuated at a higher level decreased more slowly, so the relative difference between these two indicators remained high compared to pre-2022 levels.

Consumer price index and the rate of price increase experienced by the population over the past 12 months, January 2018 – September 2025 (%)

Source: GKI survey, KSH

Note: The relative difference shows how many times the difference is between the values of the two time series.

The population’s inflation perception differs significantly from the official inflation data. One reason for the difference between the two indicators is that individual households have different demand for goods and services, so the official consumer price index does not necessarily reflect the costs of each household. On the other hand, people tend to perceive inflation based on their own experiences. If the price of a particular frequently purchased product increases rapidly, but the prices of others remain stable, they perceive a higher inflation rate for the entire economy. Especially during crises or periods of uncertainty, fear of inflation is stronger. The population perceives high inflation even if the actual price increase is not that dramatic, but the effect of fear or pessimism strengthens the feeling of inflation. In addition, if people often hear about price increases, they tend to feel more inflation.

It can also be stated that among the individual social groups, graduates and those in the upper income decile have the smallest difference between inflation perception and official inflation data, while the largest difference is found for those with primary education and those in the lowest income decile, as well as those over 65. During the high inflation that characterized Hungary, the prices of basic necessities of life increased more than those of durable, less frequently purchased products, and this affected low-income people more, whose proportion increased precisely because of the high inflation. The less someone’s income, the more of it they spend on self-sustainability (food, utilities, housing), which are traditionally price-inelastic products (we buy them even if prices rise). A significant proportion of people under 30 live at home and typically do not shop for themselves, so their inflation expectations also differ from their parents. On the other hand, the elderly rarely spend on higher-value items (e.g. household appliances, cars), so their price changes do not affect them.

The difference in price level changes between the population and the Central Statistical Office jumped sharply between 2018 and 2025. In 2021 and before, the population perceived inflation to be 4-5 times higher than the consumer price index, but this fell below 2 times in most of 2022 and 2023, so the population overestimated the official inflation less. By 2024, however, this value quickly increased to more than 7 times, then returned to 5 times by the end of 2024 and has remained at this level ever since. Therefore, although according to the Central Statistical Office data, the increase in the consumer price index has slowed significantly and has permanently fallen below 5%, the population does not feel this.

Related news

KSH: in January, consumer prices exceeded the values of the same month of the previous year by an average of 2.1 percent

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >