The Hungarian M&A market is gaining momentum

Despite the geopolitical uncertainties, the domestic transaction market remained active, according to EY’s recent report evaluating corporate mergers and acquisitions (M&A). Although the number of transactions decreased, their estimated value increased in 2023 compared to the previous year in Hungary. Last year, the most attractive investment target was the technology sector, while this year the manufacturing industry gained momentum in the first six months, and in June the largest transaction in the history of the Hungarian economy took place.

During the previous year, 111 transactions were made public in Hungary, with a total value of 6.4 billion dollars. The number of deals decreased last year, but their combined value increased by almost 10 percent compared to the 137 announcements in 2022 that resulted in a total of $5.9 billion. In the first six months of 2024, a total of 43 acquisitions were concluded and made public, including the largest and most complex transaction of the past decades, the repurchase of the airport.

During the previous year, 111 transactions were made public in Hungary, with a total value of 6.4 billion dollars. The number of deals decreased last year, but their combined value increased by almost 10 percent compared to the 137 announcements in 2022 that resulted in a total of $5.9 billion. In the first six months of 2024, a total of 43 acquisitions were concluded and made public, including the largest and most complex transaction of the past decades, the repurchase of the airport.

“According to our expectations, the domestic economy demonstrated strength, and investors were able to remain active despite the turbulent geopolitical conditions. Several high-volume transactions were realized on the Hungarian market, among others thanks to the activities of DayOne, Portfolion and 4iG. Takeovers and acquisitions therefore continue to play a key role in enhancing the competitiveness of domestic companies”

– dr. Péter Vaszari, partner in EY’s Strategic and Transactional Consulting area.

The proportion of transactions to our country rose to 41 percent last year. The number of investments also shows an increasing trend – in 2022, barely 22 percent of the deals, 29 percent in 2023, and already 35 percent of all deals in the first half of 2024. At the same time, the number of domestic transactions is decreasing year by year; last year, these transactions accounted for only 30 percent of all cases made public. In the previous year, domestic companies invested most often in Poland, Serbia and Slovenia. Among the companies investing in this country, the United States, the Netherlands, as well as Austria and Germany are at the forefront.

“The proportion of financial investors in Hungary increased significantly this year. We expect that more and more similar transactions will take place on the market in the coming period. This trend is supported by the nearly 1,000 excellently performing medium-sized companies, which can be an attractive target for either financial or strategic investors.”

– pointed out Márton Paulovits, director of EY’s area dealing with corporate takeovers and acquisitions.

Related news

EY Businessman of the Year: Tibor Veres is the grand prize winner, six special awards were also given out

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >The keys to corporate growth in 2026: AI, acquisitions and rapid transformation

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

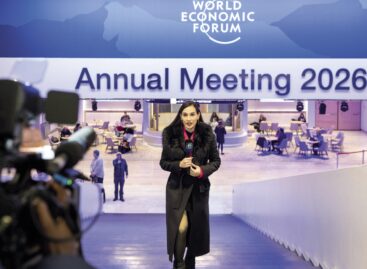

Read more >Davos 2026: the risk premium has appeared on store shelves

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Festival buzz at the 60th anniversary EuroShop trade fair

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >A stable compass in the Hungarian FMCG sector for 20 years

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >