The momentum of the Hungarian marketing industry is slowing: profits are falling, costs are rising

Domestic companies related to the marketing industry operate in a challenging market, but are basically stable. However, signs of weakening are already visible: sales revenues have developed well, but profits have started to decline, and costs have run wild – according to the Marketing Index, which measures the economic performance of the industry. According to the research, which processes the financial data of 33,000 enterprises, signs of concentration are clearly visible in almost all areas, the number of companies in the sector has decreased, the dominance of the capital is unavoidable, while 80 percent of revenue is concentrated in less than 20 percent of companies. Maintaining results from 2025 will be an increasingly greater challenge. There is no strong, positive trend reversal in the industry yet, so the key question is how market players adapt to this situation.

A missing summary of the performance and economic added value of the Hungarian marketing profession has been published: the Marketing Index was published this year, which processed a unique amount of data within the sector. It was prepared based on the financial reports of approximately 33 thousand marketing-related businesses processed until August 1, 2025.

The Marketing Index was first launched in 2020 and has been following the economic movements of the marketing profession year after year since then. Among other things, it reveals how the ratio of partnerships and sole proprietorships is developing, where sales revenue is concentrated, in which sector costs have increased the most, how well new entrants are able to gain a foothold in the market, how many people they employ, what their tax payment rates are, how many companies can be considered long-term leaders in the given sub-sectors, and how the age structure of companies is developing.

The indicator is calculated by experts from the Budapest Chamber of Commerce and Industry (BKIK), Positive Adamsky (PDKY) and OPTEN, based on stock market indices. The sectors were examined based on nine criteria: change in sales revenue, change in the number of companies, trend lines of personnel-related expenses, tax rate paid, average sales revenue per employee, change in EBIDTA ratio, change in indebtedness, shift in liquidity ratio, change in number of employees.

Sales revenue is growing, profits are thinning

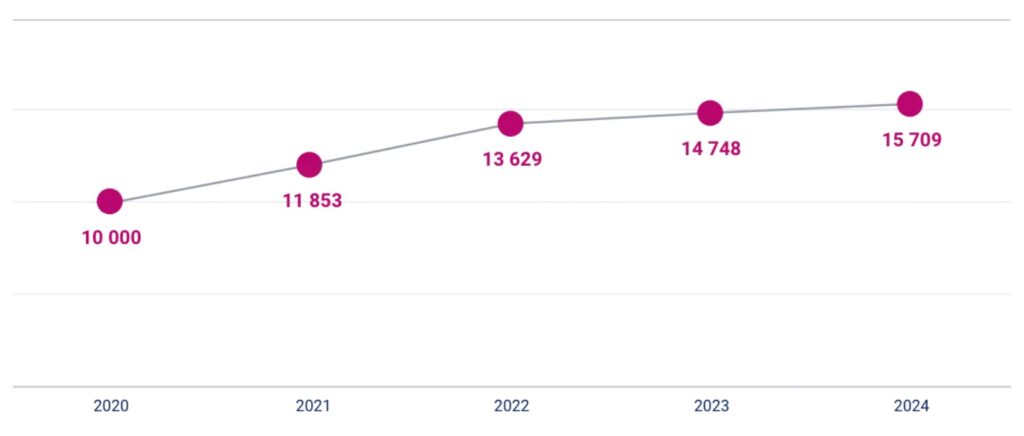

“From the latest data from the Marketing Index, we see that the market is full of challenges and struggles, but despite the experiences, it is fundamentally stable. The Index started from a base value of 10 thousand points in 2020 and reached 15,709 points in 2024. The continuous growth seen in the past five years is partly due to the low base of the starting year (2020). Examining the last three business years (2022, 2023, 2024) the growth curve, although still in positive territory, is significantly flatter. We also see that the profit as a percentage of sales has started to decline by 2024. On the cost side, the increase in wage costs and the related tax burden is exerting significant pressure on profitability. The duality of market concentration is also an interesting trend: while 80 percent of sales are realized by less than 20 percent of enterprises, the market remains highly fragmented. There are a large number of smaller companies and sole proprietorships, which strengthens the intensity of competition and the diversity of business models”

– said Hinora Bálint, CEO of Positive Adamsky (PDKY) group and President of the BKIK Marketing Department.

Advertising agencies are running out of steam

The Marketing Index consists of two components, one is narrowly defined marketing service activities, such as advertising agencies, media advertising, direct marketing, PR and market research. While the other includes additional marketing service activities such as event planning, media and press, digital production, audio and visual arts, and printing.

Among the areas examined by the Marketing Index, the advertising agency index has grown by more than 60 percent since 2020, but slowed down in 2024. The indicator stood at 16,145 points, which is 3.5 percent higher than the 2023 figure.

Related news

Company Trend 2025 – domestic businesses under strong pressure, in a negative trend

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >