Analysis of CEE-15 countries has recorded increased enquiries for Small Business Units and Last Mile Logistics space, which is connected with the significant development of the e-commerce sector

The total stock of SBU (Small Business Units) / LML (Last Mile Logistics) space in the CEE-15 countries accounts for over 3 million sq m, but the development of this market is not evenly spread in this region. The largest amount of space is located in Poland (circa about 2 million sq m), reveals a new report by Colliers: „ExCEEding Borders Small Business Units & Last Mile Logistics Sector in CEE-15”.

Kevin Turpin, Regional Director of Capital Markets, CEE at Colliers comments: “Occupier demand from the I&L sector in the CEE-15 region over the past few years has been strong and driven mainly by the 3PL, retail and distribution sectors, followed by the light production, automotive and FMCG industries. During the pandemic, we experienced higher tenants’ interest from the e-commerce sector and logistics operators offering their services to retailers and internet trading companies. The increase in enquiries for SBU/LML space is also a consequence of this trend”.

SBU/LML market across the CEE-15 countries is at a different stage of development

There are no typical SBU/LML schemes at all in Albania or Bosnia and Herzegovina. In that case, specific tenants in this sector lease smaller modules in big-box or smaller I&L schemes of lower standards. Some projects are also built with a concept similar to modern SBU/LML schemes, but for private use. The largest amount of space is located in Poland (ca. 2 million sq m). The country with the biggest share in SBU/LML space of its total I&L stock is Bulgaria, where this type of scheme accounts for 59% of the total supply.

Rents level for SBU and LML space

In CEE-15 there are ca. 500,000 sq m of SBU/LML space under construction. The majority of that volume is currently being built in Poland (310,000 sq m). Typically, rents and service charges are significantly higher than in standard buildings, but SBU and LML spaces make up for this with excellent locations and excellent adaptation to needs. All of these factors result in higher construction costs. In most of the CEE-15 countries headline rental rates for this type of space stretch range between EUR 4.0 up to EUR 10.00 per sq m/month but, in the Czech Republic and Estonia, they can even reach levels of EUR 12 per sq m/month.

Investment into the I&L sector topped the CEE-6 market volumes in 2021

The significant changes or disruption to consumer behaviour, the production of goods and global supply chains, caused by the pandemic and the war in Ukraine, have all led to I&L becoming one of the most sought-after property classes, not only globally, but also across the CEE region. I&L investment transactions accounted for ca. 25% of all volumes on average in the CEE-6 countries over the past 5 years. Investment into the sector also secured the top spot in 2021 with 37% of volumes. European capital (including CEE) just about leads investment activity with 33%, ahead of Asia Pacific capital with 31%, since 2017.

The impact of the war in Ukraine

The war in Ukraine has affected individual CEE-15 countries differently. In some of them, the impact of the war on the I&L market is already noticeable, while some have not yet noticed any significant impact on this market segment. However, all countries are experiencing rising fuel prices, higher construction material prices, lower availability, and a partial breakdown of supply chains, all of which are affecting the condition of the I&L market across this region. Prolonged construction timelines for new I&L schemes or the halting of newly started and planned schemes may slow down growth in of I&L space in future quarters, compared to the current period.

Land availability

There is a lack of available land across the CEE region, particularly in the most sought-after locations. Some of the more active I&L developers have been busy in the past number of years securing lands (lank bank) for future development. Other plots, especially those within or close to major cities, can often meet high competition from residential developers who can often pay more per square metre.

“Currently, the I&L sector is performing well which is why we do not expect any significant changes in this trend in the near future. There is a chance that we will experience some slowdown in I&L market growth until the construction markets and supply chains stabilise and supply chains resume some level of normality. This slowdown however is likely to be short-term rather than long-term”, concludes Kevin.

Related news

Innovation in retail trade, 2020

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Amikor a megszámlálhatatlan megszámlálhatóvá válik

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >The number of Hungarian dishes has increased to one hundred with the terpertős pogácsa and Vecsés sauerkraut

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

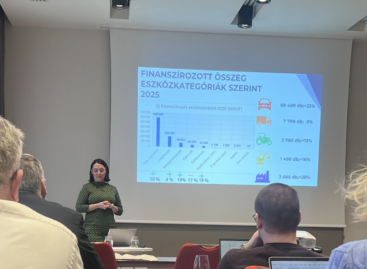

Read more >The leasing market was able to grow last year in a stable environment

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >