Primary producers may be excluded from VAT refunds

Although the government would start refunding food VAT for pensioners this year, several experts warn that primary producers and their customers could be left out of the system – writes Infostart.

Pensioners often purchase vegetables, fruit, and dairy products from them – but these producers are exempt from subject VAT, so they cannot collect refundable tax.

Pensioners often purchase vegetables, fruit, and dairy products from them – but these producers are exempt from subject VAT, so they cannot collect refundable tax.

According to pension expert András Farkas, this system could distort purchasing habits, while Katalin Neubauer, Secretary General of the Hungarian National Trade Association, fears that pensioners will turn away from primary producers in the countryside, so that perishable goods could remain with them, which could lead to serious losses.

Experts would rather consider a general pension increase or a refund based on subject law to be fairer.

Related news

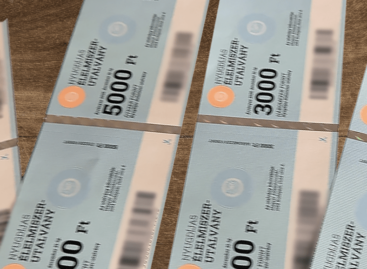

Delivery of pensioner food vouchers has been completed

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >More than one and a half million pensioners have received the 30,000-forint food voucher so far

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

MOHU: 5,200 return points are in operation, but 47 larger settlements still do not have RE points – public “enema” machines may be introduced

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Change in Rossmann Hungary’s leadership: Kornél Németh decided to move towards new challenges in 2026

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >