K&H: financial security? the picture is very mixed

26 percent of middle-aged Hungarians have an income of 589 thousand forints, which is enough money to live without problems, but they do not have enough to save – this is revealed, among other things, by the latest results of the K&H Sure Future survey. Those who also live without problems, but are already able to put aside regularly, reported an income of 719 thousand forints. The other extreme is represented by those who have to do without to live, because their income of 229 thousand forints is not enough.

Middle-aged Hungarians continue to have a very mixed view of their subjective financial situation, according to the K&H Sure Future survey, which examined this issue among 30-59 year-olds in the second quarter.

How much does it take to save?

According to the latest results of the household income survey, 2 percent of respondents have an income of 229 thousand forints, which is so low that they are forced to do without in order to survive. The next two categories are those who face financial problems from month to month, they make up 8 percent of the respondents, and 16 percent are those who are just barely getting by on their income – the average monthly net source of living for these two categories is 426 thousand forints.

26 percent of respondents said that with a monthly income of 589 thousand forints, they do not have everyday financial problems, but the amount is not enough to save. The largest part of respondents, 36 percent, sees that they can get by well on the average monthly amount of 674 thousand forints, and can even put some aside occasionally. The 12 percent in the most favorable situation reported an average of 719 thousand forints, which is enough for regular savings. The average monthly income among middle-aged people was thus around 573 thousand forints in the latest measurement.

Related news

GDP growth in OECD member countries slowed to 0.3 percent in the last quarter of last year

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

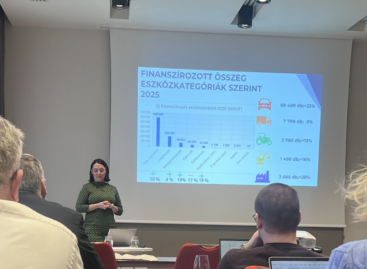

The leasing market was able to grow last year in a stable environment

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >