Cashierless smart shops in Germany: slow start followed by rapid growth

Germany has started late to adopt cashierless grocery formats, yet 600 smart stores have emerged in just six years. The Smart Store 24/7 segment is expanding, particularly in rural areas, farm retail, and travel hubs. A study by the Baden-Württemberg Cooperative State University (DHBW) explores the landscape and future of unmanned stores. Will this trend reshape German food retail or remain a niche solution?

This article is available for reading in Trade magazin 2025/5.

Sebastian Rennack

international retail analyst

Aletos Retail

The German grocery sector is often perceived as a late adopter of retail technology, particularly in a European context. However, a new study from DHBW Heilbronn provides an extensive overview of the rapid development of cashierless smart stores in Germany, revealing that the market has already grown to approximately 600 locations within just six years. While many European markets are still testing similar concepts, Germany’s expansion in this segment suggests that autonomous retail solutions are not merely a passing trend but an emerging format with long-term potential.

The white paper, led by Prof. Dr. Stephan Rüschen, Professor of Food Retailing at Baden-Württemberg Cooperative State University (DHBW) Heilbronn, defines cashierless smart stores through five key characteristics: they are unmanned, operate 24/7, have a small footprint, rely on cashless payments, and require mandatory registration via an app or access card. While these features provide a general framework, not all stores adhere to every criterion. Some hybrid models incorporate partial staff presence, while others still offer alternative payment methods.

Germany’s first modern unmanned store, operated by Tante M, opened in July 2019. Since then, various retailers have introduced their own autonomous formats, covering different applications such as neighborhood convenience stores, travel retail, vending solutions, and fresh food vending.

Key smart store concepts in Germany

Several distinct cashierless store formats have emerged in Germany, each catering to different consumer needs and retail environments.

The challenges of Grab & Go: Limited expansion despite technological appeal

Grab & Go stores represent one of the more well-known concepts, allowing customers to pick their items and leave, with automated payment handled via an app. Rewe Pick & Go, Żabka Nano in Grünheide, Netto Pick & Go, Hoody in Hamburg, and Teo locations in Marburg and Darmstadt all fall into this category. Rewe and Netto’s versions also allow payments at traditional cash desks and self-checkouts, reflecting the fact that fully autonomous models have yet to gain widespread acceptance. Most of these stores are located in Germany’s largest cities and high-traffic transport hubs. Despite its technological appeal, the Grab & Go model faces several hurdles in the German market. Many consumers remain unfamiliar with the concept and find it unsettling. App registration requirements and delayed post-purchase billing introduce friction into the shopping process. Additionally, the study highlights that shoppers prefer having an employee on-site as a point of contact. Given these challenges, no major expansion of the format is expected in the near future, and the concept remains in a test phase.

Self-Checkout and RFID-based Stores: The Leading Model

Self-checkout or RFID-based stores represent the most widespread smart store model. Customers scan and pay for their items through self-service kiosks or mobile apps. Tante ENSO, which operates 63 locations primarily in Northern Germany, focuses on rural areas and situates its stores within existing buildings rather than in standalone containers. Tante M, with 61 locations in the south, follows a similar model and operates almost exclusively through franchise agreements. German supermarket operator Tegut’s Teo concept has 40 active locations across central Germany. Originally launched as standalone container-based stores, Teo has expanded into franchising since mid-2024. These three market-leading formats typically carry between 1,000 and 3,000 SKUs, offering a broad assortment designed for full-basket proximity shopping.

Other innovative formats include Rewe’s Nahkauf Box and Rewe To Go 24/7, which operate under the Rewe Nah & Gut network, as well as Edeka’s hybrid 24/7 pilot stores. The ‘Dorfladenbox’ model, designed for rural communities, facilitates direct sales from regional producers, enabling farm-to-consumer distribution.

Robotics-based smart stores: Automated fulfillment for a new shopping experience

Robotics-based and similar box stores operate on an entirely different principle. Instead of allowing customers to pick their own items, a robotic system retrieves products based on digital kiosk orders. The largest operators in this space include Non-Stop-Shop with 25 locations, VPS Roberta with seven locations, Smark with six locations, and Latebird with five locations.

Automated vending: An evolution of traditional vending machines

Automated vending stores, while not entirely new, have also gained momentum within the Smart Store 24/7 landscape. These vending machine clusters offer a selection of snacks, beverages, and essential grocery items. The largest operators, based on Google Maps listings, include Herr Anton with 36 locations, Kiosk 24 with 15, PM Express 24 with 14, 24sieben with 11, and BK-World with eight locations, mainly situated at Tesla charging hubs.

The Emmerich 24/7 smart store showcases the potential of automated retail in rural Germany with local products and a seamless payment process.

Rural and farm retail leading the way

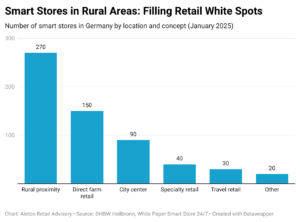

Germany’s 600 Smart Store 24/7 locations are spread across five key retail environments. The largest share, with around 270 stores, is found in rural areas, where operators such as Tante M and Teo provide access to essential groceries in communities too small to support full-scale supermarkets. These stores range from 100 to 300 square meters in size and stock between 1,000 and 3,000 SKUs, balancing standard grocery items with selected local products.

Direct farm retail accounts for approximately 150 stores, leveraging models such as Dorfladenbox (‘village store box’) and Ackerpay (‘Farmpay’) to enable local farmers to sell directly to consumers. Some of these solutions function as marketplaces, consolidating products from multiple regional manufacturers.

Specialty retail, which includes automated butcher shops, bakeries, and florists, has also begun to integrate smart retail solutions. These stores often incorporate RFID-based inventory management to track ultra-fresh product expiration dates.

The travel retail segment has seen significant expansion, with around 90 stores opening at gas stations, train stations, and EV charging hubs. Operators such as Rewe Ready, PM Express 24, and BK-World Tesla lounges are tapping into changing mobility trends.

Urban locations, while less common, are home to approximately 30 smart stores, mainly consisting of small-scale walk-in formats and vending machine clusters.

Challenges and future outlook

Consumer skepticism and regulations slow growth, while farm retail and hybrid models drive opportunity

Despite the rapid expansion of Germany’s Smart Store 24/7 sector, several challenges remain. Consumer adoption is mixed, with concerns about payment transparency and the lack of human interaction. Many customers still feel uneasy shopping in fully autonomous environments. Regulatory uncertainty further complicates growth, as only the federal states of Hesse and Mecklenburg-Vorpommern currently allow unmanned stores to operate on Sundays. The scalability of Grab & Go formats remains questionable, particularly within larger supermarkets or discount retailers. Competition among rural and specialty retail operators is also intensifying, with companies such as Tante M and Tante ENSO rapidly expanding their footprints.

However, opportunities for growth persist. Direct farm-to-consumer retail is flourishing, supported by low-cost, app-based solutions that make smart store technology accessible to small producers. Gas stations and EV charging hubs are emerging as important retail destinations, aligning with shifts in mobility and energy infrastructure. Hybrid models that combine staffed and autonomous elements may ultimately prove to be the most viable format, offering a balance between efficiency and human service.

Germany’s reputation as a slow adopter of cashierless retail solutions is being challenged by the steady expansion of Smart Stores 24/7. With 600 locations already in operation, the scale of unmanned retail in Germany may come as a surprise to many European industry observers. While significant hurdles remain, particularly in urban markets and consumer acceptance, the sustained growth of unmanned convenience stores in rural areas, direct farm retail, and travel hubs suggests that smart retail solutions will continue shaping the future of German grocery retail.

Related news

Every second German drinks plant-based

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >From the shopfloor: What the Mere format reveals about retail concentration

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Spring whirlwind at the 60th anniversary EuroShop trade fair

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >