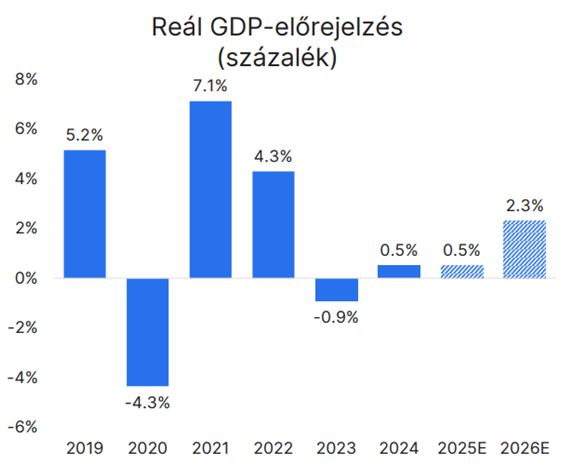

The Hungarian economy may finally start growing next year

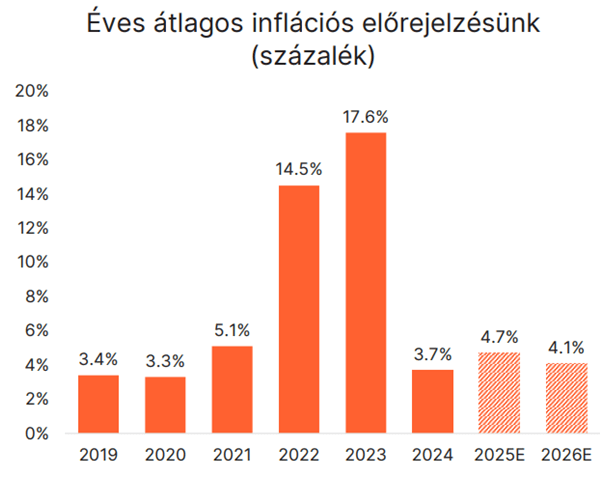

After this year’s stagnation, the Hungarian economy may return to growth next year, with exports and investments expected to pick up, bringing GDP expansion of 2.3% in 2026. The margin cap and the relatively strong forint exchange rate are likely to cool inflation, while agricultural producer prices may fuel it. Inflation could reach 4.7% this year and 4.1% next year. Although the forint is currently slightly overvalued, the differential between international and domestic interest rates helps maintain its stability. One euro could stand at 405 forints at the end of this year, and 410 forints at the end of 2026.

The Hungarian economy could finally pick up in 2026. A trade agreement between the European Union and the United States, as well as the expected recovery of the German economy, may provide a more favorable external environment. Falling uncertainty and growing demand for Hungarian exports could bring the long-awaited turnaround in investment. As a result, GDP could expand by 2.3% in 2026. For 2025, however, performance is still stagnating. Erste analysts now expect at most 0.5% GDP growth for this year, down from the 2% forecast at the beginning of the year. Currently, household consumption is the only factor supporting the economy, while investment and exports are dragging growth.

Thanks to the margin cap and the relatively strong forint exchange rate, inflation slowed in the first half of the year, and short-term risks have also become more balanced. At the same time, rising global food and commodity prices, coupled with domestic farmers’ losses from frost and drought, are pushing agricultural producer prices higher. Along with persistently high household inflation expectations, this increases upward risks in the longer term. Inflation may end this year at 4.7%, down from the 5.5% forecast earlier, and could slow further to 4.1% in 2026. However, the likely phasing out of the margin cap in 2026 adds uncertainty, suggesting inflation may only return to the central bank’s target range from 2027.

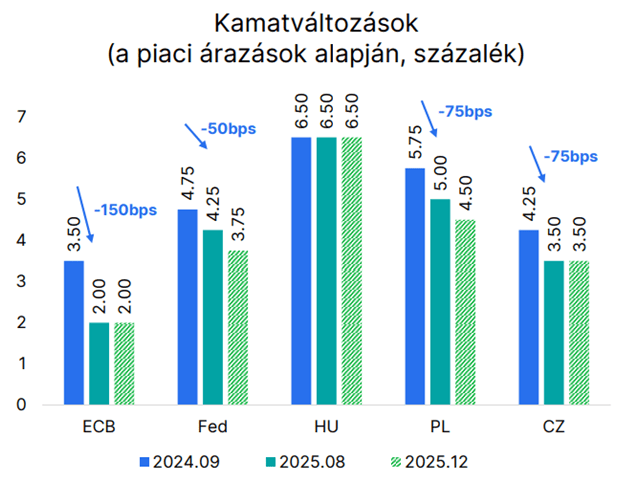

Monetary policy will continue to focus on stability, with the central bank monitoring inflation risks and global market developments. Depending on the international interest rate outlook, the base rate could decline further this year, though high inflation expectations remain a concern for the MNB.

With the forint recently trading below 400 to the euro, the currency is currently slightly overvalued. However, the forint is supported by easing trade conflicts, a current account surplus, and a widening interest rate differential between international and domestic levels, which could keep the Hungarian currency more stable than previously expected. In the medium term, though, the inflation differential may still keep the forint on a slow depreciation path against the euro. The EUR/HUF rate could reach 405 by the end of 2025 and 410 by the end of 2026.

Related news

Fidelity: What awaits China in the Year of the Horse?

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Stagflation and structural erosion in transportation: the profit recession of the Hungarian SME transportation sector has been going on for nine quarters

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Nestlé to sell remaining ice-cream assets but commits to Froneri venture

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Lidl guarantees fairer prices for cocoa farmers

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >