The leasing market is performing well, but companies remain cautious

The number of new leasing contracts increased last year, but the performance showed significant differences between the individual segments: the financing of passenger and light commercial vehicles continued to strengthen, while the decrease in the volume of industry set back the market for production assets. According to the Secretary General of the Hungarian Leasing Association, László Kőszegi, the role of subsidized financing programs remains decisive, but the narrowing of funds has affected the volume of contracts. The high interest rate environment and the caution of the corporate sector have influenced the development of the leasing market, uncertainty remains high, and the willingness to invest is low.

Although the number of new leasing contracts increased among the members of the Hungarian Leasing Association in 2024 compared to the previous year, the performance varied by segment: while some areas showed outstanding growth, others stagnated. In the fourth quarter, the value of placements reached HUF 969.77 billion, which represents a 6.6 percent increase compared to the same period of the previous year.

Although the number of new leasing contracts increased among the members of the Hungarian Leasing Association in 2024 compared to the previous year, the performance varied by segment: while some areas showed outstanding growth, others stagnated. In the fourth quarter, the value of placements reached HUF 969.77 billion, which represents a 6.6 percent increase compared to the same period of the previous year.

The number of contracted units was 84,282, which represents a 16.5 percent increase compared to 2023. The total outsourced portfolio increased to HUF 2,374 billion, which is a 10.9 percent increase compared to the previous year. At the same time, the number of units in the portfolio decreased to 318,993, which is 7 percent lower than the 2023 value.

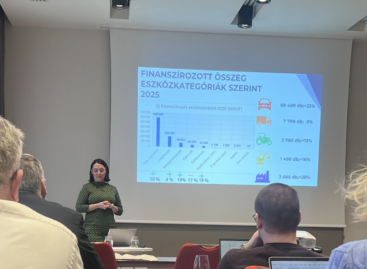

Based on the distribution of financed amounts, 62 percent of leasing service providers’ clients are SMEs, 18 percent are large companies, while the proportion of private individuals is only 8.6 percent. The remaining 11.4 percent is provided by state-owned and other non-residential enterprises.

According to the data of the Hungarian Leasing Association, 80 percent of the financed amount went to new and 20 percent to used assets. The most popular construction was closed-end financial leasing, which accounted for 52.6 percent of all contracts, while 33.1 percent of the portfolio was open-end financial leasing. Loans represented 3.4 percent of the market, and operational leasing 10.9 percent.

The interest rate environment showed a mixed picture: the 1- and 3-month BUBOR trend, which is decisive for variable interest rates, decreased until the beginning of October, and then stabilized at 6.5 percent. In contrast, in the case of fixed-interest transactions, which are more important for the market, the indicative 3- and 4-year BIRS indicator exceeded the values at the beginning of the year by the end of the year, said László Kőszegi, Secretary General of the Leasing Association.

e

Related news

The leasing market was able to grow last year in a stable environment

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Companies are waiting, calculating and delivering – new room for manoeuvre on the fleet market

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

No matter how much you save, food and gadgets always take the money

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >