The state is experimenting with the wealthy on an untrodden path

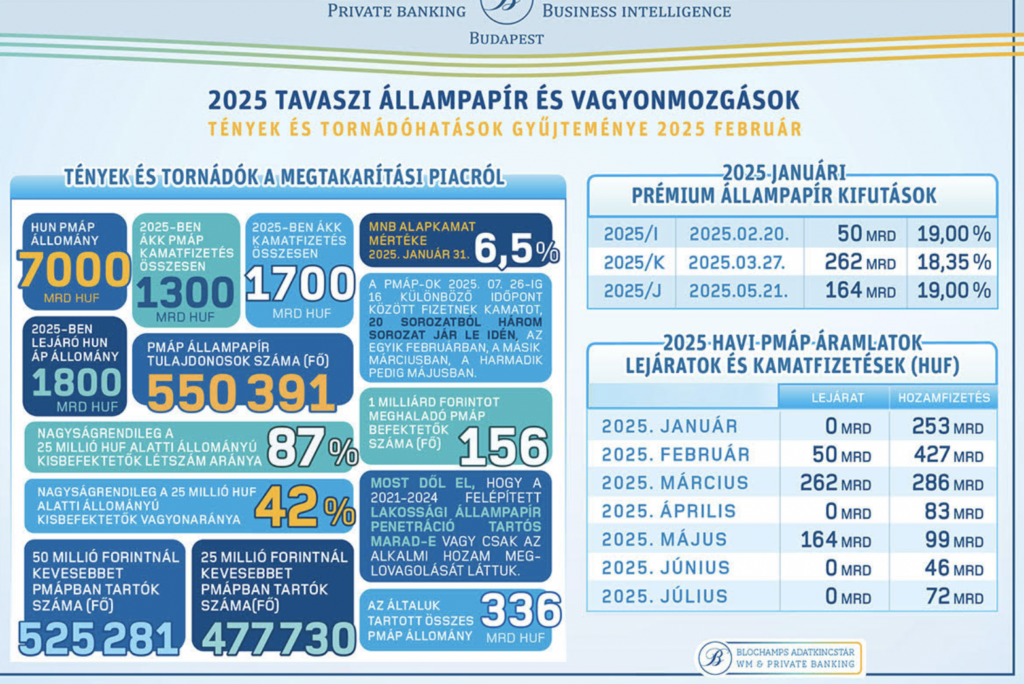

The Hungarian state is embarking on an interesting experiment when the most popular savings, Premium Hungarian Government Bonds (PMÁP), do not offer a meaningful yield alternative to the owners – believes István Karagich. The managing director of Blochamps Capital, a Hungarian private banking market analysis company, reminds us that the February interest rate cut ended on Monday, within the framework of which, in just under a week, in addition to the nearly 50 billion forints of the 2023/I series that have expired, approximately 400 billion forints of the average 18 percent interest payment after subsequent maturities will arrive in the government bond accounts, so that customers holding approximately 2,200 billion forints in the affected series will think several times after the interest payment whether it is worth keeping their paper, which pays an interest of 3.95-5.2 percent, depending on the series, only until next February.

The issue is not with the average, small-amount savers; nearly 65 percent of PMÁP holders, more than 350,000 people, have government securities assets of less than 10 million forints. In their case, no significant shift away from government securities is expected – simply because for them the money in the free accounts held at the Hungarian State Treasury functions as a safety reserve, not as a yield-optimizing tool. But these clients only have access to 18 percent of the PMÁP portfolio. What is more important is how private banking clients decide on investments. According to Blochamps’ previous calculations, only 1.45 percent of clients have government securities assets of more than 100 million forints, but this narrow group owns nearly 24 percent of the entire PMÁP portfolio, and the richest 5 percent will pocket three-quarters of the PMÁP payments this year.

The question is therefore whether the wealthiest will still have their money in government securities even without an extra yield premium? It will be important for the group concerned whether the state will offer any meaningful alternative to the inflation-tracking government securities that are already paying a modest interest rate next year. In this regard, it seems extremely interesting that the State Debt Management Center has decided to close the sale of the current series of Bonus Hungarian Government Securities, which currently offers the best alternative and whose interest rate is tied to the average yield of government securities formed at the 3-month discount treasury bill auctions every quarter, on February 25, and in the new series available from Wednesday, it will pay a uniformly 25 basis points lower interest premium of 1.25 percent for both 3- and 5-year maturities (leaving the option for the additional yield to jump by 1 percentage point to 2.25 percent in the 4th and 5th years of the five-year construction). Thus, only those who wake up early can enjoy the higher yield of the paper with an interest rate of 7.5 percent in the coming weeks.

According to István Karagich, it would be too early for the experts of the State Debt Management Center to draw conclusions based on the favorable results of the government bond redemption data in January. It is true that the majority of the payments at that time – according to reports, two-thirds – remained in the treasury accounts, and some of them were transferred to other government bonds, but according to Blochamps Capital’s assessment, this can be attributed to waiting for the time being: on the one hand, the wealthy were waiting for the money coming from later maturities, and on the other hand, the weak exchange rate of the forint did not encourage them to make any significant wealth transformations.

Related news

Retail accounts: banks are already warming up for summer fee increases

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Society identifies with the krőzus tax for a reason, but reality demands a more sensible implementation

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Home Start loan: MBH Bank has raised the stakes

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

The Hungarian Food Book is 50 years old

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >ZEW: Economic expectations worsened in Germany and the euro area in February

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >