From January, all invoices will be visible to NAV

Until now, it has been sufficient to upload invoicing information between domestic companies (taxable persons), such as customer data, tax numbers and items, electronically on the dedicated page of the National Tax and Customs Administration (NAV). From 1 January 2021, however, an invoice issued to a retailer, ie to an individual, will also be subject to reporting. Moreover, cross-border settlements, such as sales to the European Union and third countries, must be reported in this way. This step will significantly expand the range of taxpayers using the Online Invoice system.

Related news

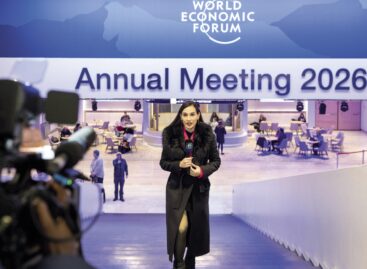

The keys to corporate growth in 2026: AI, acquisitions and rapid transformation

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Davos 2026: the risk premium has appeared on store shelves

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

MOHU: 5,200 return points are in operation, but 47 larger settlements still do not have RE points – public “enema” machines may be introduced

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >KSH: in the fourth quarter of last year, investment performance was 1.3 percent lower than a year earlier

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >