Here is NAV’s 2025 audit plan – new forms of audit, new areas in focus

The NAV 2025 audit plan has been published, in which, similarly to the previous year, the differentiated, risk-based approach is given a prominent role. NAV is further refining the process of selecting for an audit by using the vast data assets at its disposal and artificial intelligence, and based on this, it selects the type of audit according to the taxpayers’ willingness to comply with the law, which can be the new data reconciliation procedure, or the supporting procedure, compliance inspection, or tax or customs audit, which have been used frequently in previous years. NAV continues to support cooperative taxpayers who strive to fulfill their tax obligations, while at the same time cracking down mercilessly and immediately on those who engage in fraudulent activities. We will explain the details with the help of Jalsovszky Law Firm.

Taxpayers who are the engine of the national economy: transfer pricing and tax benefits

Similar to previous years, this year too, the audit of taxpayers with the highest tax performance will be of paramount importance, especially in relation to tax benefits, the correct determination of items increasing and decreasing the corporate tax base, the correct fulfillment of the rehabilitation contribution obligation, and the settlement of tax-free payments.

Affiliated enterprises will not escape this year either in relation to the examination of prices applied in transactions between themselves.

Continuations and novelties

The 2025 audit plan contains numerous continuity elements compared to previous years. Thus, companies that have been operating on member loans for several years, businesses that have been continuously rolling over deductible VAT for years, businesses that have shown a significant increase in turnover within one year of their establishment, as well as (used) vehicle dealers, asset protection activities, traders of IT and telecommunications products, internet content providers, fruit and vegetable traders, or those engaged in construction activities can certainly expect a tax audit.

However, compared to previous years, a new feature is that from 2025, operators of foreign and domestic e-commerce platforms, as well as sellers on these platforms, and those engaged in product import activities will also be targeted by the Tax Authority.

Related news

MKIK seeks partnerships with businesses and government

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Eurozone economic growth accelerated in February

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

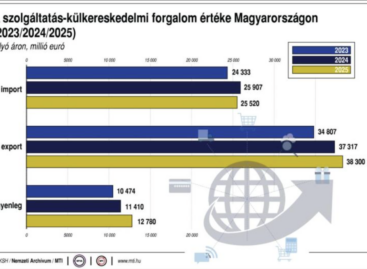

Read more >KSH: The foreign trade surplus in services was 3.1 billion euros in the fourth quarter of last year

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Emotions, stories, authenticity – these were the deciding factors in 2025

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Dreher prepared messages from fathers for Women’s Day

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >IVSZ and WiTH are looking for female role models in the digital profession again this year

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >