How will the world economy develop in 2025?

The global economy will continue to face major challenges in 2025, with Donald Trump’s protectionist policies, trade tensions between China and the US, and the slow growth of the euro area affecting Hungary.

This article is available for reading in Trade magazin 2025/2-3.

China: lasting challenges

In 2024 China’s GDP growth was around 4.9%, more or less meeting the government target of 5%. However, this growth was mainly driven by a muscular export performance, while funding strains for indebted municipalities, a deepening housing crisis – which has led to many families losing their savings – and persistent youth unemployment remain serious concerns for the country. While recent stimulus measures such as interest rate cuts, reserve ratio cuts and a CNY 10tn public bailout to settle municipal debt packages may partly mitigate these effects, rising trade tensions with the US – including Donald Trump’s expected tariffs on high Chinese imports – pose significant obstacles to economic growth.

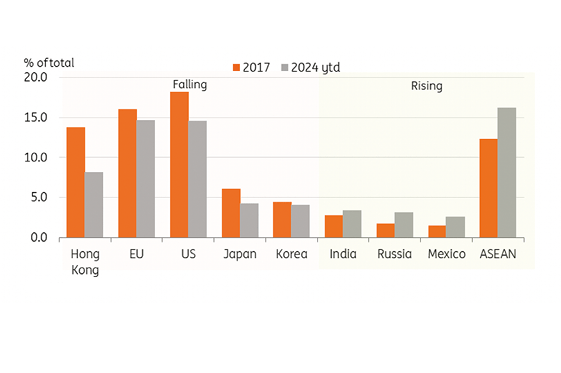

While traditional markets (e.g. the US and EU) have seen a decline due to the first trade war and geopolitical changes, the importance of ASEAN and other emerging markets has increased

US: what will Trump bring?

The US economy ended 2024 on a strong footing, thanks to more robust growth than expected: economic growth was at 2.7% in 2024 (up from the previous forecast of 2.6%) and is expected to be 2% in 2025 (up from the previous forecast of 1.7%). Growth was also backed by rising wages, higher savings and positive consumer sentiment. Business investment, particularly in machinery, infrastructure and factory construction have also played a big role in growth, helped by the government’s industrial policy measures. Inflation also appears to be moderating, with the Fed’s 2% target expected to be reached in the 4th quarter of 2025. However, geopolitical tensions and the Trump administration’s protectionist measures carry serious risks, including new tariffs on imports and a rise in economic nationalism. This could disrupt economies around the world and disappoint Wall Street. Donald Trump has stated firmly: he will cut consumer prices and regulatory burdens, but it isn’t yet clear how he will achieve this.

European trade as a whole must prepare for Trump’s tariffs

Could Germany make a return?

Europe’s largest economy, Germany, is increasingly lagging behind. In recent years there has been little measurable economic growth and 2025 promises stagnation. Germany’s real GDP has been stagnant since the 4th quarter of 2019, while the euro area has expanded by 5% and the US by 11% over the same period. According to Goldman Sachs analysis, Germany’s GDP growth is expected to be just 0.3% in 2025, below the euro area (0.8%) and the UK (1.2%). The reasons are clear: in recent years China has turned from a key export market into a major competitor, and it has also gained market share in sectors such as car manufacturing, where Germany has been squeezed by rising costs. On the positive side, the German industry is undergoing a transformation, with companies shifting from lower value-added production to higher value-added products.

A split of the world economy into Western and Eastern blocs could cause damage on a scale that would exceed the economic impact of the 2008 global financial crisis and pandemic

EU: so many uncertainties

In 2025 the European economy continues to face numerous crises, which will hold back economic growth. The EU has been underperforming economically since 2019 if compared to other industrialised countries such as the US. GDP growth in the EU-27 remained lower than the G7 average between 2019 and 2024, partly due to weak economic dynamics in Germany, which have a big influence on the EU as a whole. Geopolitical tensions are making the trade and investment situation worse. Supply chain disruptions entail production losses, while import independence is expensive

and resource-intensive. Uncertainty curbs investment, which weakens the EU’s economic potential in the long term. The good news is that there are also positive prospects. Strong growth in the US economy could boost demand for the EU, while lowering inflation could facilitate interest rate cuts by the European Central Bank (ECB), stimulating investment and consumption. In the euro area inflation is gradually approaching the medium-term target of 2%.

Hungary: consumption is finally growing

Analysts at Erste Bank forecast a 2% economic growth in 2025, supported by an expansion in household consumption and a partial recovery in investment. Hungary’s labour market was under pressure in 2024, with the level of unemployment rising to 4.6% and selective layoffs expected. However, from the 2nd quarter of 2025 the economic recovery could reduce unemployment. Wages continue to grow dynamically, with average gross and net wages rising by 13.9% in the first eight months of 2024. Owing to the real wage growth, high household savings and a reduction in consumer caution are expected, which could also contribute to a pick-up in domestic demand. In 2025 a normalisation of the interest rate environment, targeted loan programmes and the implementation of delayed public investment could also have a positive impact on economic performance. However, rising food prices, volatility in the forint exchange rate and tax increases pose significant risks. Inflation could average around 3.7% in 2025. //

Domestic retail and consumption trends

According to data on the 4th quarter of 2024 from the VOSZ Barometer, the structure of domestic consumption underwent significant transformation. Consumers are increasingly turning to services, while retail sales have come to a halt. Although inflation is more moderate now, its effects can still be felt: almost 70% of businesses still factor higher prices into their pricing, limiting the recovery of household finances and the growth of purchasing power. Investment is low: only 11% of businesses were planning new development at the end of 2024. //

Related news

Less meat might be consumed in German-speaking countries

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Every second German drinks plant-based

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Innovations, success stories and awards on the same stage

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Farewell day at the 60th anniversary EuroShop trade fair

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >NAV: Women’s Day inspections begin

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >