Credit Market: More than half of the Hungarians do not compare the offers

The Hungarians’ trust in crediting shows a rising trend in the recent period; nearly two-third of the population accepts or even considers the good credit scheme as an option – Cofidis Credit Monitor’s survey reveals.  Nevertheless, two of the three people believed that the loans contain hidden costs, which arise only after the conclusion of the contract. This is probably related to the fact that although the majority of the population is particularly cost-sensitive, the financial awareness is not typical of the Hungarians at all: less than half of them would take the trouble to compare the market offers at least online.

Nevertheless, two of the three people believed that the loans contain hidden costs, which arise only after the conclusion of the contract. This is probably related to the fact that although the majority of the population is particularly cost-sensitive, the financial awareness is not typical of the Hungarians at all: less than half of them would take the trouble to compare the market offers at least online.

Related news

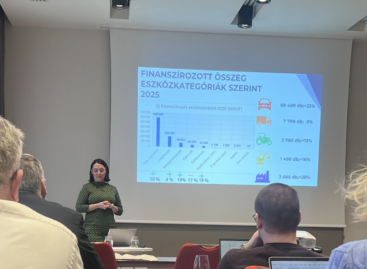

MFB Director: Interest-free loans worth HUF 39 billion will help businesses develop energy efficiency

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Hungarians almost exclusively take out home loans and personal loans

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Amikor a megszámlálhatatlan megszámlálhatóvá válik

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >