Despite the increase in average wages, saving has become the privilege of the richest

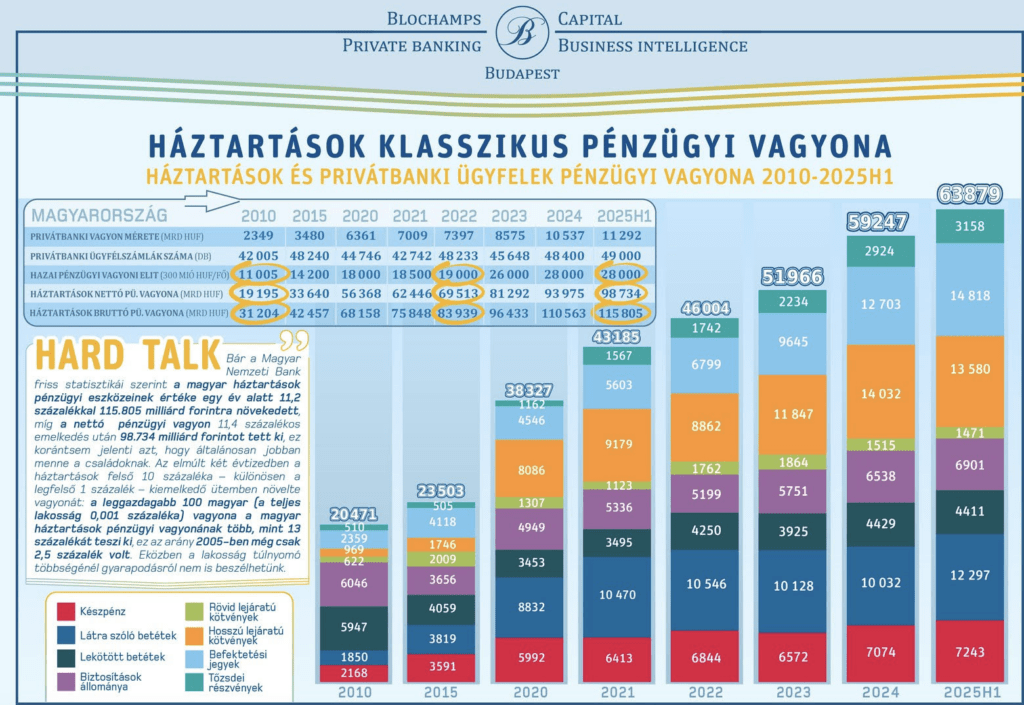

Blochamps Capital’s previous forecast is echoed in the latest data from the MNB and the Central Bank: wealth concentration in Hungary is at an extraordinary level. According to István Karagich, head of the private banking analysis firm, the financial growth is only apparently widespread; according to central bank data, 72 percent of financial wealth in Hungary is owned by 10 percent of people, while half of the population has a total share of only 5 percent.

Although wealth concentration has become a global phenomenon in recent years, the latest Savings Report from the Hungarian National Bank (MNB) confirms Blochamps Capital’s previous forecast that wealth concentration is intense in Hungary – even compared to other countries. According to the latest data from the central bank, 72 percent of the financial wealth of Hungarian households is concentrated in the top decile of the population – in Slovakia this ratio is below 70 percent, in Germany around 60 percent. In Hungary, the bottom half of society in terms of net worth owns only 5 percent of financial wealth, while in Slovakia, for example, this ratio is 12 percent, and in Austria, 8 percent.

Although wealth concentration has become a global phenomenon in recent years, the latest Savings Report from the Hungarian National Bank (MNB) confirms Blochamps Capital’s previous forecast that wealth concentration is intense in Hungary – even compared to other countries. According to the latest data from the central bank, 72 percent of the financial wealth of Hungarian households is concentrated in the top decile of the population – in Slovakia this ratio is below 70 percent, in Germany around 60 percent. In Hungary, the bottom half of society in terms of net worth owns only 5 percent of financial wealth, while in Slovakia, for example, this ratio is 12 percent, and in Austria, 8 percent.

Blochamps experts have previously warned that the news about the impressive growth in savings can be misleading, because most of the growth is concentrated in a narrow elite. “Looking behind the numbers, it is clear that even among the rich representing the top wealth decile, only the wealth of the richest 1 percent, a few tens of thousands of people, is really growing,” emphasized István Karagich, CEO of Blochamps Capital.

According to the Household Living Standards Survey of the Central Statistical Office (KSH), the richest 20 percent now have an income 4.8 times higher than the lowest income quintile – this value was only 4.2 in 2021, i.e. this is yet another clear evidence of the intensification of social stratification long indicated by Blochamps.

The richest 100 Hungarians (0.001% of the population) now own more than 13 percent of household financial assets, while this ratio was only 2.5 percent in 2005.

The vast majority of domestic savings therefore continues to accumulate among the wealthy, while more than a third of households do not have any substantial financial reserves. It is sobering to see – despite the fact that massive real wage growth in recent years is trying to offset the negative income effects of the 2023 inflation surge – that the proportion of households whose financial wealth does not reach the value of their monthly consumption has increased in all income deciles compared to 2020! In the poorest three deciles, this proportion has again risen to over 40 percent, and even up to and including the sixth decile, the proportion of those who have less savings than is necessary to cover their monthly expenses is over 30 percent! What again indicates the excessive concentration of wealth is the fact that nine out of ten Hungarians would not withdraw from their current savings for even half a year – the vast majority of society has therefore remained financially vulnerable. For them, the long-term saving opportunity has probably been lost forever.

According to a survey by the Central Statistical Office (KSH), 31.7 percent of the population is affected by at least three types of financial or social deprivation. These include, for example, not being able to pay for unexpected expenses, not being able to afford a week’s vacation, or not having basic digital or transportation means. Financial vulnerability is therefore not only a lack of wealth, but also a lag in quality of life.

Blochamps also pointed out that the methodology of official statistics itself overestimates household wealth, since the central bank also records difficult-to-realize business assets as part of financial wealth. István Karagich reminds us that the so-called “other ownership interests” account for nearly 30 percent of household financial wealth, but their market value is uncertain and their liquidation is limited. Moreover, the expert reminds us, wealth concentration can be caught up here too: the upper class is likely to have companies that truly represent value, while the corporate wealth of people with weaker financial opportunities is largely concentrated in (forced) enterprises that provide a living for the entrepreneur himself, in which case there is no realistic, marketable company value.

Wealth concentration will continue to increase in the coming years, claims the Blochamps expert based on their forecast. According to István Karagich, wealth is expected to increase by 65 percent in the richest private banking clientele between 2025 and 2028, while their research predicts a 50 percent increase in the affluent (premium) saver segment. This predicts that even within the top wealth decile, the narrow super-rich layer will accumulate the vast majority of excess wealth. The trend therefore promises a further widening of the wealth gap: the richest few percent of society are getting richer at an outstanding rate, while the wealthy middle classes are experiencing significantly more moderate growth.

Related news

KSH: industrial production in January fell by 2.5 percent compared to the same period of the previous year, and increased by 1.5 percent compared to the previous month

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >OTP Deputy CEO: After a strong year, they are successfully progressing with the strategy

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >MKIK seeks partnerships with businesses and government

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Sentix: investor sentiment in the eurozone deteriorated in March

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Home or parcel machine? It’s been revealed how Hungarians order and what they fear most about delivery

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Frost, cost shock, generational change: the pálinka sector is cornered on several fronts at once

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >