Price stability is still far away – a price index of 4.3% is expected this year

In May 2025, Hungary’s Central Statistical Office (KSH) reported a 4.4% increase in the consumer price index, indicating that despite governmental interventions, inflation is once again on the rise. While this is within previous analyst (and GKI) forecasts—which predicted around 4.5% inflation for this year—it significantly exceeds the government’s earlier projection of 3.2%.

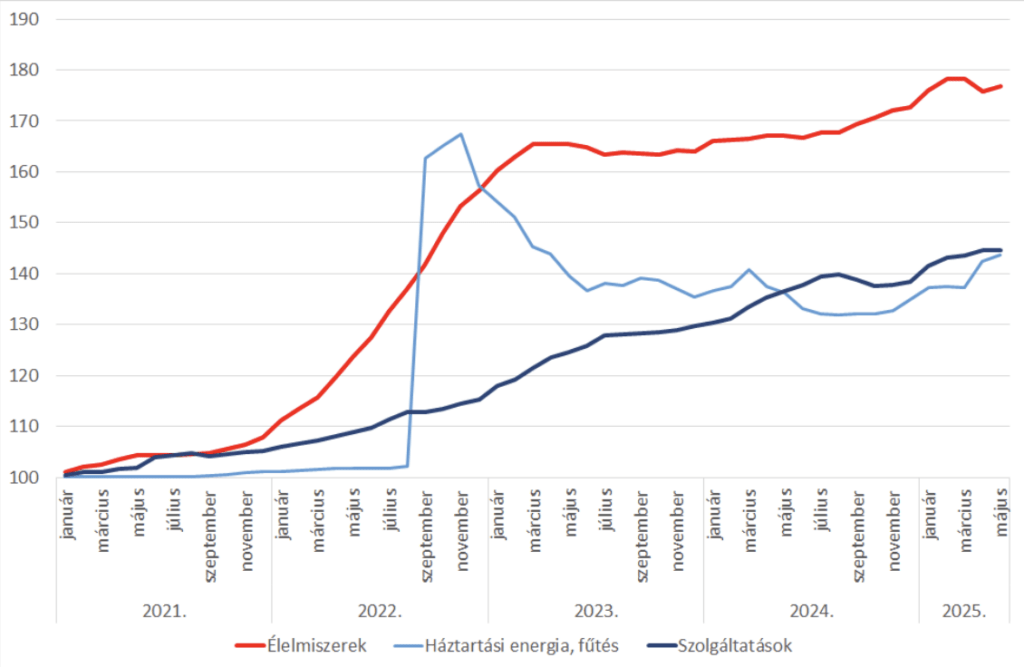

Monthly changes in prices of food, household energy, and services

(December 2020 = 100)

Source: GKI calculations based on KSH data

Looking at the long-term price trends, the first major surge in food prices occurred by January 2023, followed by a 7.5 percentage point increase until September 2024—less than the overall price index’s rise of 9.7 points. Another 7.6-point increase happened in the next eight months. Altogether, food prices have risen nearly 77% since December 2020. Services prices have grown steadily since early 2021, with a total increase of 44.6%. For household energy, the KSH (based on its own methods) recorded a drop after the September 2022 spike, lasting until October 2024. Since then, increased consumption has pushed prices up again (+11.7 points over 9 months). Despite continued subsidies, household energy is now 43.6% more expensive than in December 2020. Prices for other goods, fuels, and alcoholic beverages and tobacco have increased similarly (+46.4% and +50.3%). Clothing and durable goods saw below-average inflation (22.6–23.5%).

The drivers of inflation are varied. Key contributors include rising agricultural producer prices, spiking energy costs (e.g., Hungarian producers pay about 20–30% more for electricity than their EU counterparts), increased regulated fees, packaging material costs (exacerbated by the rise in EPR fees), and notably, rising labor costs and the retail surtax levied on international supermarket chains. Additionally, warehousing costs have increased, and imported goods have become more expensive due to the weaker forint–euro exchange rate. These rising costs are passed on to consumers as there is less room for retailers to absorb them.

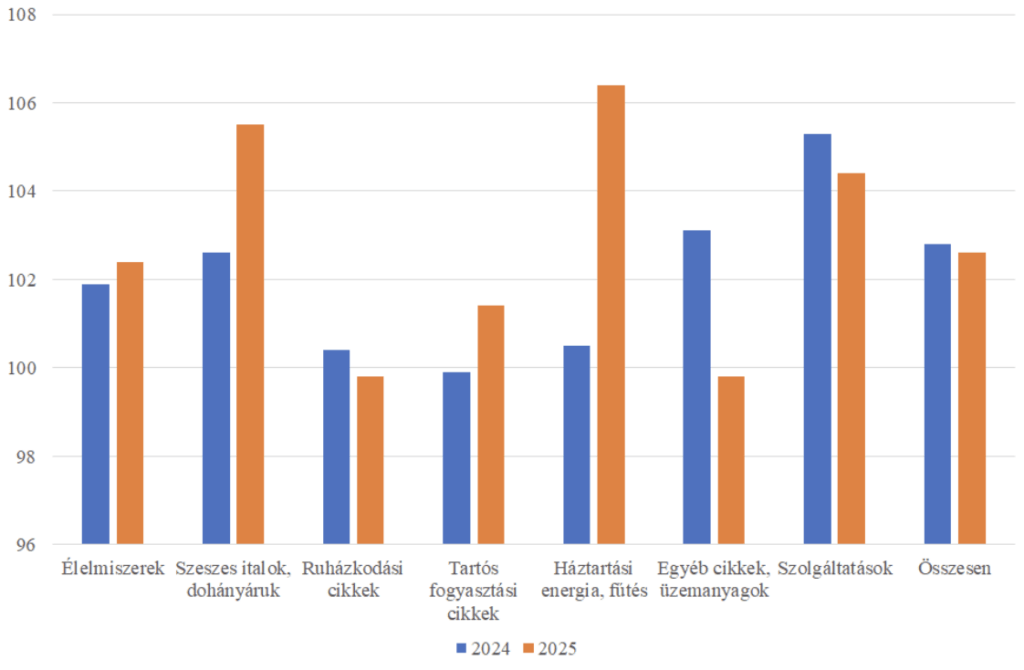

It is also worth comparing the inflation trends between last year and this year. From January to May, prices rose by 2.8% in 2024 and by 2.6% in 2025 compared to the previous December, indicating a slight slowdown. Food prices rose by 1.9% in 2024 and by 2.4% this year; for services, the figures were 5.3% and 4.4%, respectively. Household energy prices increased by 0.5% in 2024 but jumped by 6.4% this year. Alcohol and tobacco prices also rose faster than average (2.6% in 2024 vs. 5.5% in 2025). Meanwhile, the KSH recorded price drops for clothing, durable goods, and fuels.

Consumer price index by main categories, January–May 2024 vs. January–May 2025 (previous December = 100)

Source: GKI calculations based on KSH data

In conclusion, the acceleration of inflation is largely driven by the alcohol and tobacco category (12% weight in CPI) and household energy, with services also contributing. It is also notable that food inflation has not stopped, despite a brief decline in April. As previously pointed out, the food retail sector typically transmits supplier price hikes only partially, with the underlying cause being rising costs. Within this, the most impactful factors are higher energy prices due to cross-subsidization that maintains utility price caps and rising labor costs outpacing productivity growth.

Related news

At K&H AI implementation is coupled with knowledge development

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

MOHU: 5,200 return points are in operation, but 47 larger settlements still do not have RE points – public “enema” machines may be introduced

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >GDP growth in OECD member countries slowed to 0.3 percent in the last quarter of last year

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Change in Rossmann Hungary’s leadership: Kornél Németh decided to move towards new challenges in 2026

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >