GKI: Companies’ price increase intentions have noticeably decreased this year, but cost pressure is still present

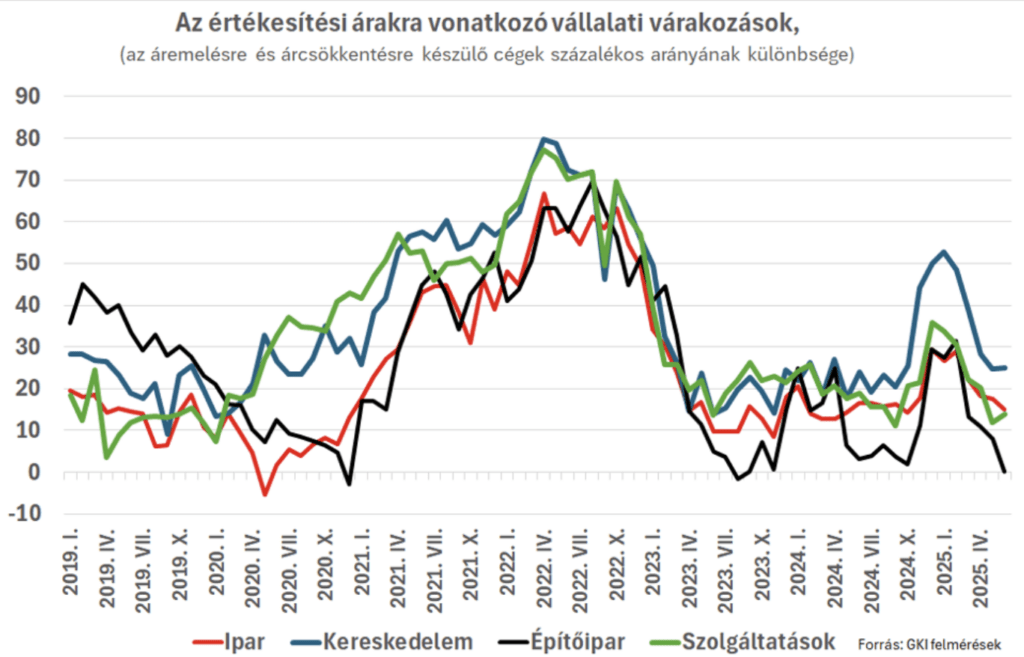

In the past part of 2025, price increase intentions have weakened almost continuously and noticeably in several sectors of the Hungarian business sector. By June 2025, these expectations had fallen to their lowest point in eight months. At the same time, price increase intentions remained close to their long-term average in all sectors, with the exception of the construction industry. This means that inflation is expected to remain stable in the short term.

GKI Economic Research Ltd. has been conducting monthly surveys in the business world for decades, following the methodology of the European Commission. These surveys are conducted in the fields of industry, construction, trade and business services. These surveys, among other things, also map companies’ pricing expectations. Since strong inflationary processes gained a foothold in the Hungarian economy in 2022-23, and then the rate of price increases decreased significantly in 2024, the question rightly arises: what do companies’ expectations currently show? What future vision do companies’ pricing plans reveal to us? The government’s interest and aspiration is clear: to bring down inflation as quickly as possible or at least keep it under control. But can the corporate sector be a partner in this?

What do the data from previous years show?

In recent years, the Hungarian economy has been hit by several external shocks. The first of these was the Covid-19 pandemic, which – in the short term – set the pricing practices of individual sectors on a different trajectory. The outbreak of the crisis immediately increased price expectations in trade and services, while it increased industrial and especially construction prices later. The low point of industrial price expectations came in June 2020, and that of the construction industry only in January 2021. Until the awareness of the energy crisis that emerged as a result of Russian aggression against Ukraine, price increase intentions in all four sectors steadily strengthened – this was also supported by the rapid rebound after the decline caused by the pandemic. However, the surge in energy prices brought a turning point in pricing plans, significantly increasing the price increase intentions of the agricultural sector. From mid-2022, following the first shock, price expectations began to fall. A quiet period followed between mid-2023 and late 2024, with pricing intentions showing no clear direction. In late autumn 2024, price increase expectations increased slightly, presumably due to the increasingly uncertain economic environment. This was most pronounced in trade, but less markedly in the other three sectors. In the first half of 2025, however, price increase intentions decreased almost continuously. In the case of the construction industry, the demand constraint became decisive, and the delay and cancellation of state investments, the low point in housing construction, and the decline in renovations justify more cautious price increase intentions than before. Trade price increase expectations rose the most in 2024, so their decrease is a natural correction, and government measures also pushed expectations downward. Business services did not perform well in the first half of the year either, and the reduction in price increase intentions is not surprising here either. The industry does not sell a significant part of its products domestically, and foreign market demand is quite volatile – this also affects pricing plans.

Related news

KSH: industrial production in January fell by 2.5 percent compared to the same period of the previous year, and increased by 1.5 percent compared to the previous month

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >OTP Deputy CEO: After a strong year, they are successfully progressing with the strategy

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >MKIK seeks partnerships with businesses and government

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Schwarz Group Gets Approval For Acquisition Of La Cocoș In Romania

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >The 2026 Marketing Diamond Awards have been presented

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >FAO food price index rises again in February after five months

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >