GKI analysis: Hungarian industrial production decreased further

The volume of Hungarian industrial production declined for the second consecutive year: by 5.5% in 2023 and by 4% in 2024. Sales decreased both on the domestic and export markets. Industrial GDP also fell: in 2023, total industry contracted by 4.4%, and manufacturing by 3.7%, while in 2024 these figures were 3% and 4.4%, respectively. In Hungary, the combination of European trends and poorly structured industrial development led to a 13.3% drop in vehicle production and a 22.4% decline in battery production in 2024, mainly due to reduced demand from European factories. These two subsectors were the primary contributors to the industry’s overall weakness.

In the first quarter of 2025, industrial production decreased by 4.4%. Export sales, accounting for 63% of total sales, stagnated, while domestic sales, representing 37%, dropped by 3%. Out of thirteen manufacturing subsectors, production declined in nine, with the most significant drop—25%—in the manufacture of electrical equipment. The largest subsector, vehicle manufacturing, saw a 3.8% decrease. Only the manufacture of computers, electronics, and optical products showed meaningful growth.

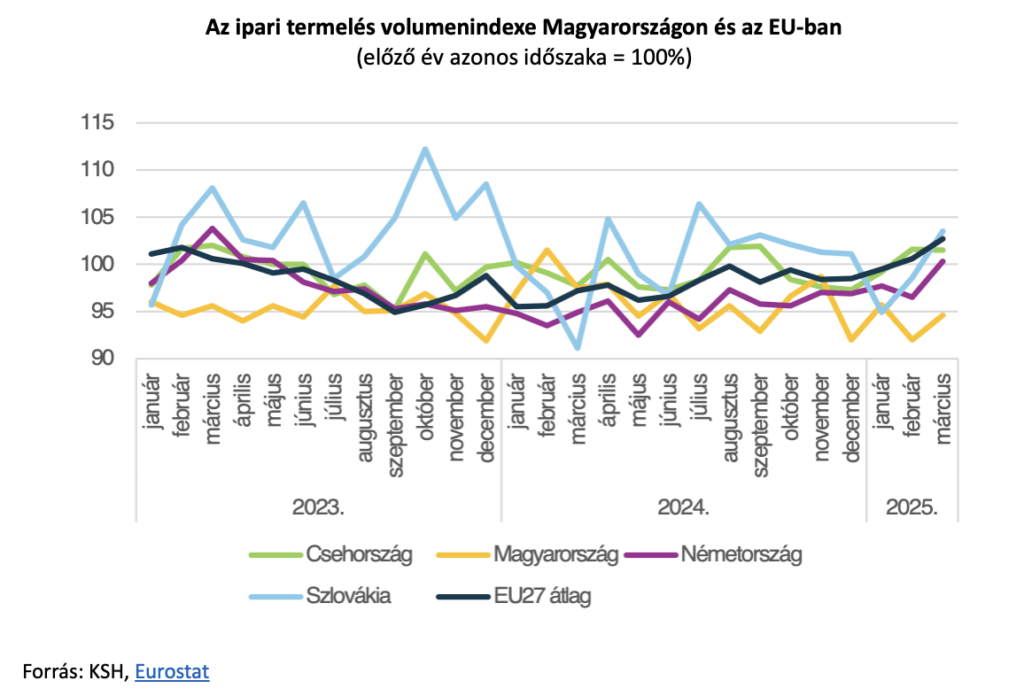

Since early 2023, Hungary’s industrial output volume—except for a few months—has been persistently below the EU-27 average. By the end of Q1 2025, industrial production in the EU as a whole, as well as in Germany, the Czech Republic, and Slovakia (all with significant automotive industries), had entered a growth path, whereas Hungary’s production continued to decline.

The outlook remains rather bleak. Although European industry is slowly recovering from the inflationary shock of the COVID and energy crises, a full “revival” of the automotive sector will take much longer. Tariffs imposed by President Trump—especially the 25% duty on cars—could stall the recovery in the EU unless an agreement is reached with the US. The uncertainty surrounding these tariffs (Trump is threatening a 50% tariff on EU goods, while the International Trade Court has deemed several newly imposed tariffs illegal, although the 25% automotive duty is not among them) has created an unpredictable business environment, delaying investments and production growth. This has a particularly negative impact on sectors like logistics and energy.

In Hungary, business expectations remain pessimistic, and the order backlog is significantly smaller than it was this time last year. Moreover, the sources of industrial growth also look weak. In 2024, employment in the industrial sector declined by 1.5%, and in manufacturing by 1.8%. According to GKI’s business surveys, industrial respondents expect further layoffs. While this could potentially boost productivity, that would require investments. However, manufacturing investments dropped by 4.7% in 2023 and by 14.2% in 2024. Additionally, the focus is not on capacity expansion: in the GKI surveys, most companies cited equipment replacement as their main investment goal. So far, there are no signs of capacity-enhancing or product innovation-driven developments. This points to a continued decline—or at best, stagnation—in Hungarian industry.

No significant improvement is expected in Hungarian industrial performance during the first half of 2025. When conditions gradually improve on key export markets, the current decline may come to a halt, and the utilisation of underused capacities could allow for modest growth. Further improvement could result from the ramp-up of major investments such as the CATL and BMW plants in Debrecen, or BYD’s expansion in Szeged. However, their output also depends on better European market conditions. Overall, it is expected that a slow recovery in industrial production could begin in the second half of the year.

Related news

KSH: In January 2026, industrial producer prices were on average 2.9 percent lower than a year earlier and 0.9 percent higher than the previous month

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >The GKI business climate index rose in February

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Farewell day at the 60th anniversary EuroShop trade fair

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >