GKI analysis: Hungarians will receive more than a trillion forints

In recent months, the Premium Hungarian Government Bond (PMÁP) has become one of the most dominant investment instruments in the retail savings market. In a high-inflation environment, investor confidence remains strong, as evidenced by the outstanding interest payments of government bonds and the relatively low redemption rates. Márton Nagy, Minister of National Economy, has repeatedly emphasized the importance of government bonds in Hungary’s savings strategy, highlighting that these bonds offer a safe and inflation-proof investment opportunity for the population. The latest analysis by GKI Economic Research examines PMÁP’s role and expected trends based on recent data.

Impact of Interest Payments on Households

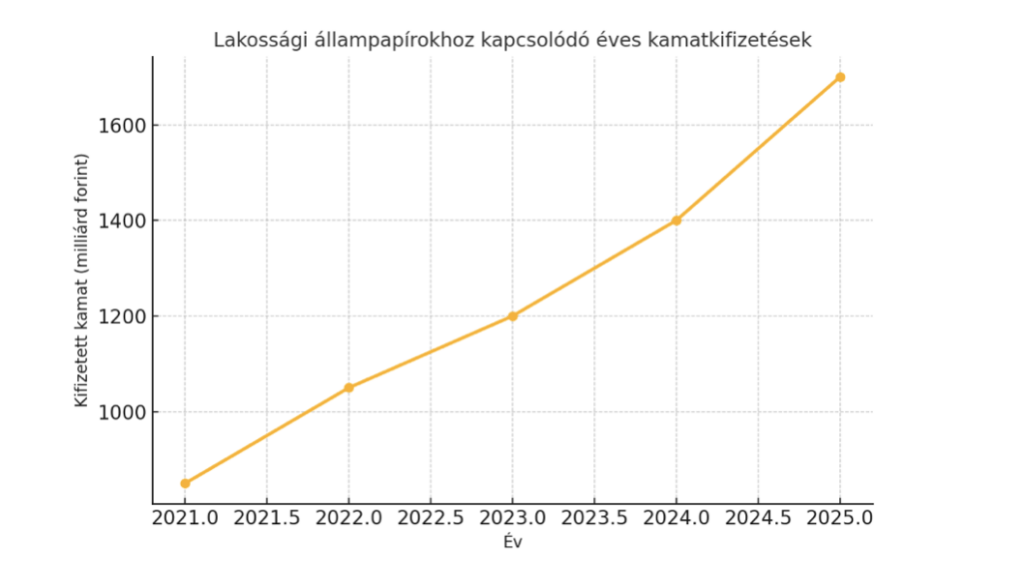

According to the Ministry of National Economy, in 2025, the state will pay 1,700 billion forints in interest to retail investors, of which 1,300 billion forints are linked to PMÁP. This directly affects the financial situation of hundreds of thousands of households and significantly impacts household consumption and savings strategies.

The chart below illustrates the annual development of interest payments in the retail government bond market:

Interest Payments on Retail Government Bonds (Billion HUF)

PMÁP Redemption Trends – Investor Confidence Remains Strong.

Although interest payments are substantial, data shows that most investors retain their bonds. In the first 3–5 days after interest payment, the redemption rate is around 20%, and even after two weeks, it does not exceed 30%. This indicates that PMÁP continues to function as a long-term investment vehicle among the population.

Analysis:

- The 2033/I series has the highest redemption rate, suggesting that investors are more likely to sell longer-term PMÁP bonds.

- The 2028/I and 2027/K series show lower redemption rates, indicating that due to their favorable interest rates, investors prefer to hold these bonds for a longer period.

- The higher redemption rates of older series suggest that newer government bonds offer better conditions, prompting investors to reallocate their savings.

This confirms that the Hungarian population continues to trust government

Related news

Fidelity: What awaits China in the Year of the Horse?

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Nestlé to sell remaining ice-cream assets but commits to Froneri venture

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >40 secure jobs, sustainable solutions – new BURGER KING® in Csepel

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >