GKI Analysis: The financial sector is starved but efficient

As part of our productivity analysis series, following the manufacturing, construction, retail, and ICT sectors, we now examine the financial and insurance sector. In 2023, this sector accounted for an average of 4.6% of GDP across the EU, ranging from 2.7% in Slovakia to 4.1% in Hungary and 5.1% in Poland.

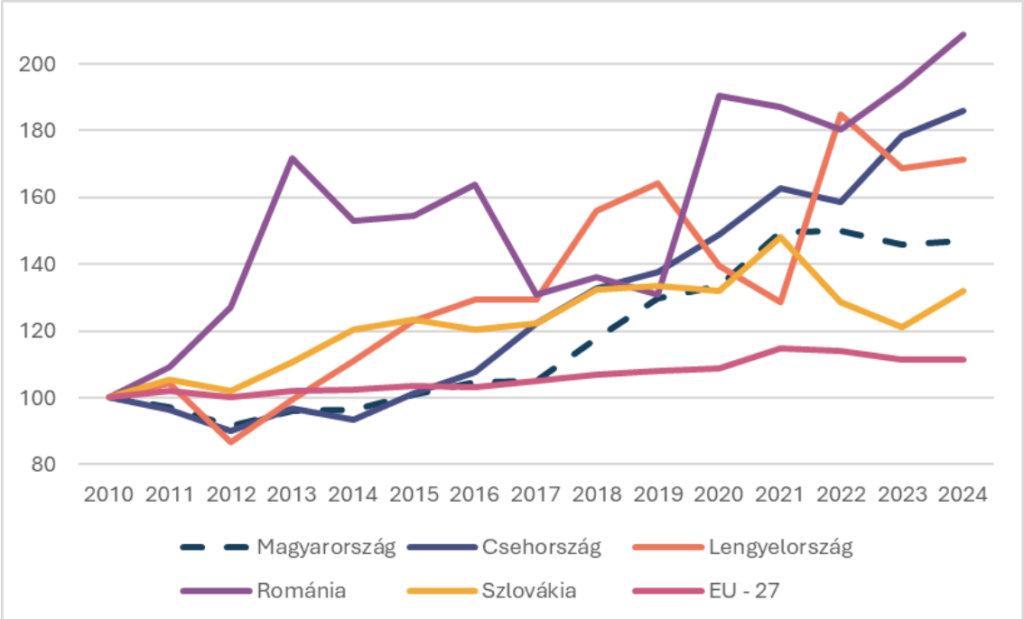

Labor productivity in the financial and insurance sector increased by 11% in the EU between 2010 and 2024, but countries in the CEE region significantly outperformed this. Slovakia, with the lowest growth in the region, reached 32% last year, while Hungary achieved 47%. The leaders in the region were Poland (71%), Czechia (86%), and Romania (109%).

Labor productivity in the financial and insurance sector in the V4 countries, Romania, and the EU-27, 2010–2024 (2010=100%)

Source: Eurostat

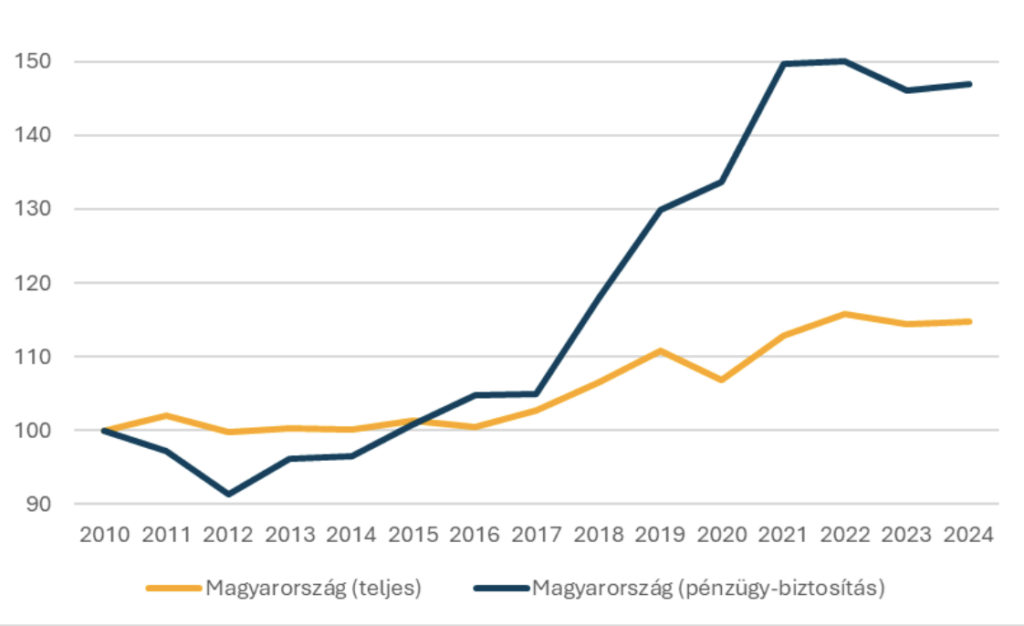

In Hungary, productivity in this sector declined in the early 2010s and only surpassed 2010 levels around 2016–2017. A dynamic growth period followed, with the indicator improving by more than 40 percentage points by 2021. This progress stalled afterward, with a slight decline observed since then. Sector-specific extra taxes played a significant role in this stagnation by diverting funds from development. Nonetheless, thanks to previous gains, the 47% productivity growth in the financial sector significantly exceeds the national average of 15%, thus pulling up overall productivity—counterbalancing, for instance, the 8% growth in manufacturing.

Labor productivity growth in the national economy vs. the domestic financial and insurance sector, 2010–2024 (2010=100%)

Source: Eurostat

The banking and insurance sector underwent strong digitalization after 2010. The spread of mobile apps, the expansion and quality improvement of online services, and the reduction of physical branches decreased the need for on-site staff. However, administrative demands kept rising, resulting in more new hires than the headcount saved. Overall, employment in the sector grew from 103,000 to 112,000 (+8.7%) between 2010 and 2024, compared to a 20% national employment growth. Therefore, while the national economy expanded extensively, the financial and insurance sector achieved almost exclusively intensive growth.

This was facilitated by the virtual elimination of household foreign currency loans, removing exchange rate risk and defaults. Improved customer service and risk evaluation also reduced other losses. Today, insurance contracts are nearly all inflation-indexed, preserving real revenue and improving insurers’ operational efficiency. However, non-bank-owned leasing companies and other financial enterprises—key players in microfinancing—lack such flexibility. Their one-sided income structure and reliance on subsidies mean that sector-specific taxes directly reduce their lending capacity, threaten their viability, and lower their efficiency.

Over the past 15 years, the financial and insurance sector has shown remarkable productivity growth through digitalization, operational efficiency, and improved risk management, significantly contributing to national economic performance. In Hungary, the sector’s productivity growth (47%) was more than triple the national average (15%).

Although tax burdens have increased recently (e.g., bank tax, transaction duty, extra profit tax, insurance tax, and newly introduced “voluntary” price cuts), which reduced corporate profitability, productivity has still improved. However, the combination of short-term productivity growth and declining profits may hinder long-term expansion of the sector, leading to counterproductive outcomes for both the market and the state.

Related news

How does the forint exchange rate affect consumer prices?

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >KSH: In January 2026, industrial producer prices were on average 2.9 percent lower than a year earlier and 0.9 percent higher than the previous month

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >The GKI business climate index rose in February

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

(HU) Átadták a SIRHA Budapest 2026 Innovációs Termékverseny díjait

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >How does the forint exchange rate affect consumer prices?

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >HELL CITY has arrived, led by Michele Morrone

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >