GKI analysis: Productivity in trade has grown 6 times faster since 2010 than in manufacturing

In the third part of our series examining labor productivity in national economic sectors, we take trade after manufacturing and construction. In 2023, trade accounted for an average of 11.3% of GDP in the EU and 10.3% in Hungary. In the case of the V3, this ratio is higher, led by Poland (14.3%).

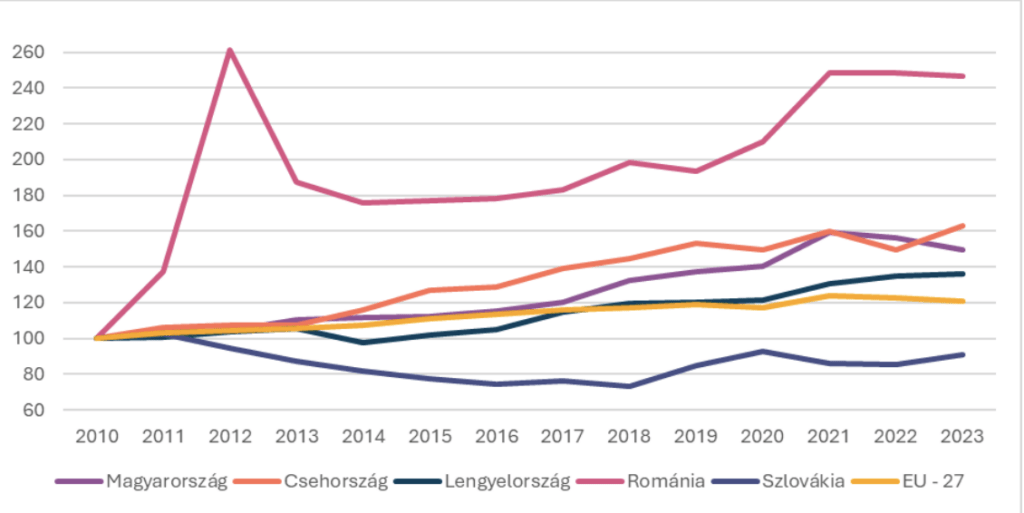

Based on the growth of labor productivity in trade, Romania came in first place in our region: the Romanian figure peaked in 2012 (+160%), then fell until 2014 (+below 80%), but by the 2020s they reached a consistent level of over 240%. The Czech and Hungarian figures are also impressive: the growth was between 50-65%. Poland was also above the EU average (+20%) (almost 40%). In the case of Slovaks, labor productivity fell until 2018, and only by 2023 did it manage to reach 90% of the 2010 value.

Labor productivity in trade of the V4 countries and Romania, as well as EU-27 countries, 2010-2023 (2010=100%)

Source: Eurostat

The improvement in labor productivity in trade by 2023 compared to 2010 (+50%) is outstanding compared to the overall data for the country (+15%) or the manufacturing indicator (+8%). The development peaked in 2020 mainly due to the restrictions caused by the coronavirus pandemic, as at that time there was great pressure on retail to significantly increase home delivery. This required more employees for larger chains, but at the same time their productivity (value added per person) exceeded the average. The energy price explosion, rising other costs, and the shrinking purchasing power that also appeared in trade reduced the added value of trade, while the number of employees also increased (to 504 thousand people, +14% compared to 2010). The end result was a slight decline in productivity. The wave of store closures that has been going on since 2010 (nearly 44 thousand stores have closed, which represents a 31% decrease) also increased productivity, as stores with typically small floor areas and high labor costs closed, while the lost purchasing power appeared in larger chains. This was also boosted by the price freeze, which caused significant losses for smaller stores (as their customers were forced to move to the units of larger chains that offered lower prices).

Related news

The economic sentiment index deteriorated in the euro area and the EU in February, but improved in Hungary

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >At K&H AI implementation is coupled with knowledge development

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Historic price reduction at ALDI

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >