Supply Disruptions Add to Inflation, Undermine Recovery in Europe

With supply constraints likely to persist, the challenge for policymakers is to support recovery without allowing high inflation to become entrenched.

When countries asked people to stay at home to control COVID-19, consumers cut spending on services and bought more manufactured goods instead. The reopening of economies boosted manufacturing output, but renewed lockdowns and shortages of intermediate inputs from chemicals to microchips caused the factory recovery to stall. Prices of core consumer goods rose rapidly as delivery times reached record highs—sparking a debate about inflation and the course of monetary policy.

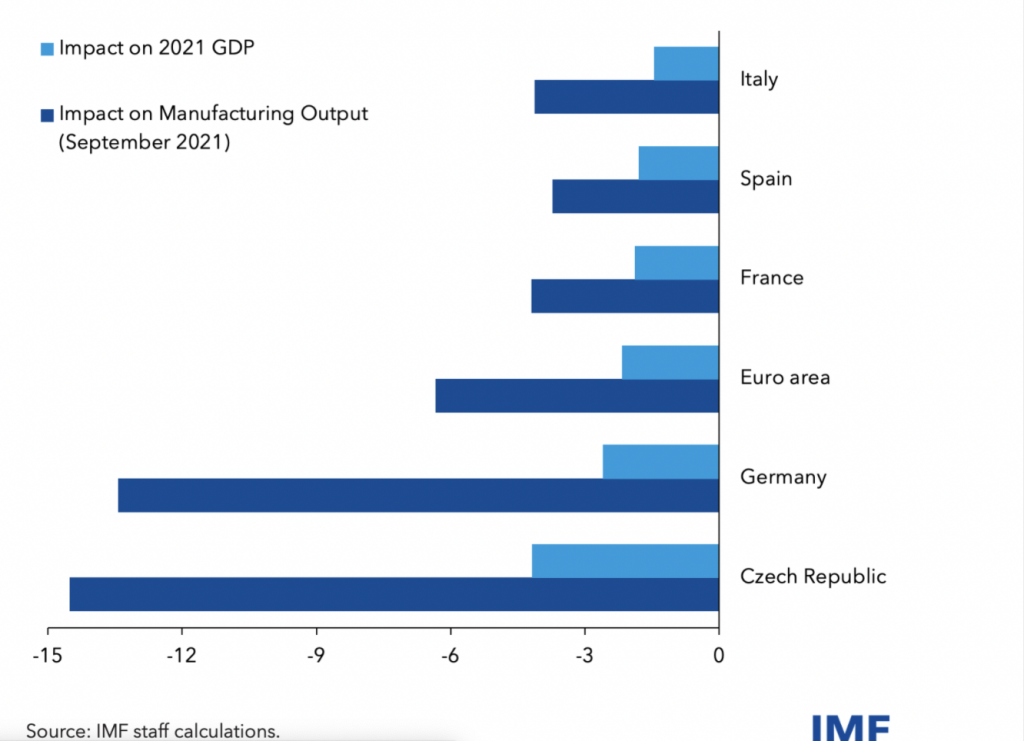

In a new paper, we estimate that euro-area manufacturing output in the fall of 2021 would have been about 6 percent higher without the constraints on supply. Based on the historical correlation between manufacturing and overall output, we assess that gross domestic product would have been about 2 percent higher—equivalent to about one year’s worth of growth in normal pre-pandemic times for many European economies.

The drag on output was largest in countries where manufacturing firms operate at the downstream end of global value chains and are reliant on highly differentiated intermediate inputs. Key examples include countries with large automotive sectors, such as Germany and the Czech Republic, where manufacturing output would have been as much as 14 percent higher.

Supply constraints also played a significant part in fueling producer price inflation in the euro area—but so did strong demand. The manufacturing component of producer price inflation was about 10 percentage points higher relative to pre-pandemic times in the first three quarters of 2021. We estimate that supply shocks can explain about half of the increase in the inflation of manufactured goods prices. The rest is mostly explained by increased demand.

Supply disruptions had less of an impact on core consumer prices (inflation excluding energy and food prices). This measure of inflation was only about 0.5 percentage points higher over the same period because of supply constraints for manufactured goods than it would otherwise have been. This smaller effect is not surprising because goods make up less than half of the consumption basket. The prices of services, which account for more than half, are less sensitive than those of goods to manufacturing supply shocks.

Related news

ZEW: Economic expectations worsened in Germany and the euro area in February

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Forced paths: trends and decisions in 2026

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >NGM-VOSZ cooperation agreement for digital commerce security

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >