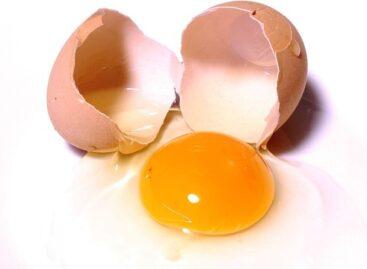

The VAT reduction on poultry and milk are accepted

🎧 Hallgasd a cikket:

The National Assembly approved the government's proposed tax package for next year on Tuesday.

According to the tax package, the Value Added Tax (VAT) on poultry meat, eggs, fresh milk will be reduced to 5 percent, while the VAT on internet services and restaurant nutrition will be reduced to 18 percent from year 2017. (MTI)

Related news

Egg packing house prices increased

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >

More related news >

Related news

A stable compass in the Hungarian FMCG sector for 20 years

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Half of employees do not support salary transparency

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >There is a slice for everyone

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >