The Hungarian economy is facing increasingly strong headwinds

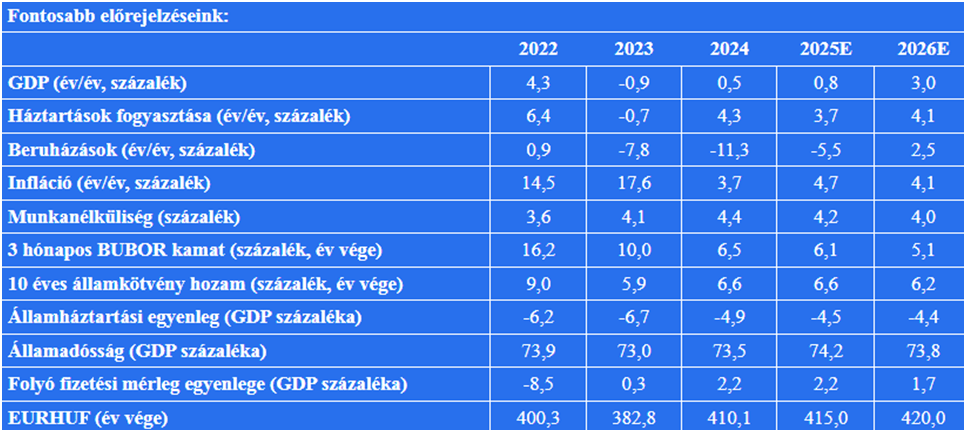

Despite the uptick in household consumption, Hungary’s economic growth is expected to reach no more than 0.8% this year due to the unfavourable external environment. Meanwhile, declining global oil prices and slowing wage outflows are helping to ease inflation, which may average 4.7% in 2025. The EUR/HUF exchange rate has stabilized between 400 and 405, but the forint may weaken further by year-end, potentially reaching 415 per euro.

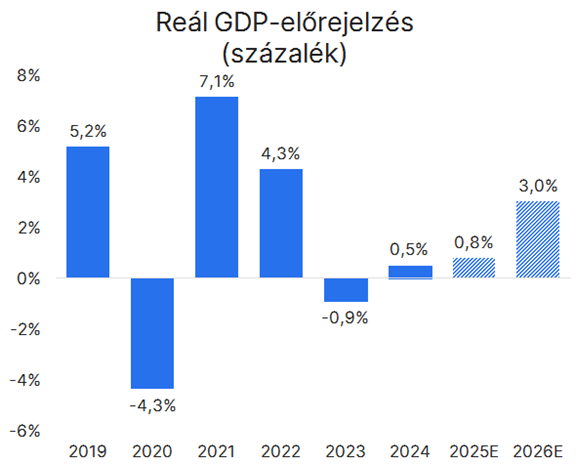

Hungary’s economy may grow far less than previously expected this year. Due in part to the lingering effects of the trade war linked to former U.S. President Donald Trump, the external environment remains uncertain. The weak performance of Germany—a key export market for Hungary—continues to hamper industrial exports and investments. Domestic growth is now mainly supported by household consumption recovery, which alone is insufficient for a more robust turnaround. Erste analysts have downgraded their GDP growth forecast for 2025 from 2% to a maximum of 0.8%, a figure that would still require significant economic momentum in the second half of the year. A positive shift may come in 2026, provided that the trade war is resolved and the German economy rebounds significantly.

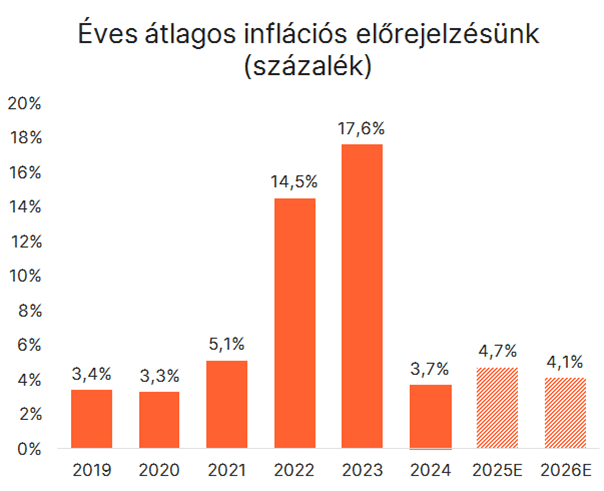

Following a sharp increase early in the year, inflation declined again in the spring. However, administrative price restrictions such as the profit margin cap proved to be no magic bullet. The global price of oil, a relatively stable forint, and slowing wage outflows are currently exerting downward pressure on domestic prices. Inflation, originally forecast at 5.5% for this year, may instead be limited to 4.7%. In 2026, inflation could slow further to 4.1%. However, the anticipated phase-out of the profit margin cap—likely in 2026—introduces uncertainty, as it exerts delayed price pressure on the affected sectors and market players.

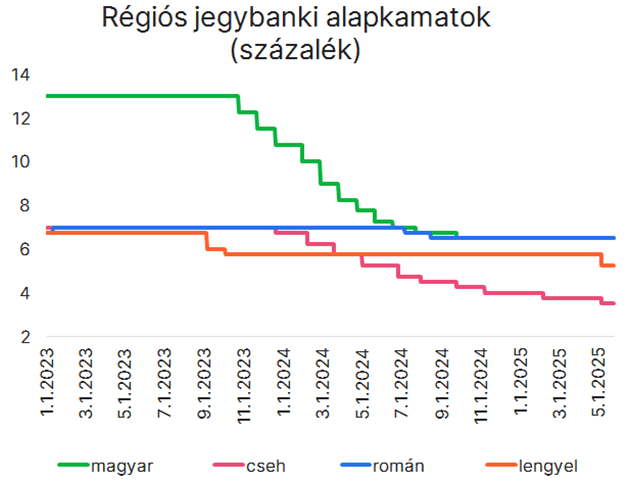

Due to economic uncertainty, monetary policy remains focused on maintaining stability. However, interest rate policies by international central banks may later open the door for cautious base rate cuts. Inflationary risks complicate decisions, and it remains highly uncertain when policymakers might begin to ease the key interest rate again.

After weakening in early April, the forint rebounded as the trade conflict eased and has since stabilized in the 400–405 range against the euro. Hopes of further de-escalation in trade tensions and a current account surplus could help support the Hungarian currency. However, persistent inflation differentials continue to place devaluation pressure on the forint. The EUR/HUF exchange rate may reach 415 by the end of 2025 and 420 by the end of 2026.

Related news

The impact of the forint exchange rate on GDP growth

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

The Store of the Future opens again at the SIRHA Budapest exhibition! (Part 1)

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >The impact of the forint exchange rate on GDP growth

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Cheese-cocoa-peach jam: these are the most popular cookie flavors

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >