Tesco faces uncertain future in Central Europe

Tesco’s business in Central Europe faces significant challenges. In its home market the British market leader can successfully defend market share as well as increase profits, thanks to its loyalty program and a strong value orientation. Regulatory actions and stepped-up competition, however, might lead to a further deterioration of Tesco’s position in the emerging markets of Europe.

In the UK Tesco’s strategy of offering exclusive loyalty discounts and matching prices of basic items with rival Aldi has enabled the retailer to defend its market share. According to Kantar Worldpanel data for Great Britain, Tesco increased its market share last year by 0.3 percentage points to 27.6% of the FMCG market. Aldi and Lidl’s combined share gain of 0.4 percentage points over the same period, according to bank analysts, came at the expense of rivals Asda and Morrisons, that lost a combined 0.7 percentage points. Both Asda and Morrisons are burdened by high debt levels following private equity takeovers.

At the same time preliminary adjusted operating profit for the retailer’s total retail business for the fiscal year to February 2024 rose 11.0% to 2.76 bn British pounds (GBP), above the expected range of 2.6 to 2.7 bn GBP. For the current financial year Tesco is optimistic and expects adjusted operating profits of at least 2.8 bn GBP.

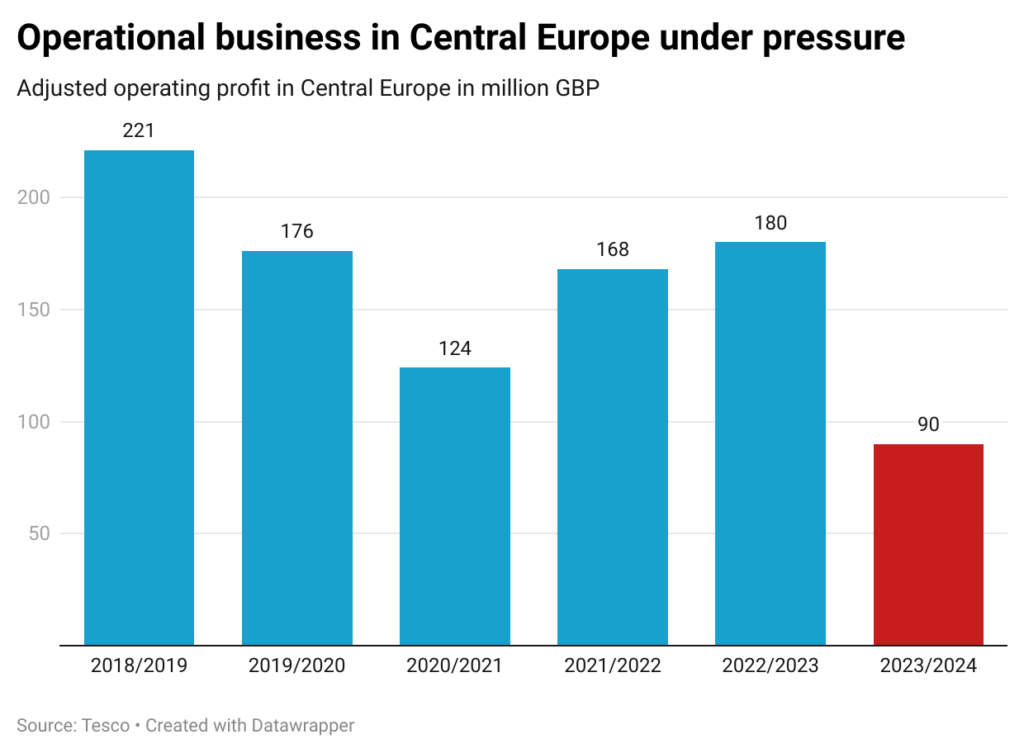

It is a remarkable achievement for Tesco to increase its market share while making more money in its home market. In the CE region, however, market share and profitability are on a decline. In Central Europe, which includes Tesco’s operations in the Czech Republic, Slovakia and Hungary, adjusted operating profit halved to 90 million British pounds at constant exchange rates. In an earnings call Tesco CFO Imran Nawaz said that the current environment in the emerging markets ‘continued to be challenging’ but the retailer saw encouraging volume developments, amongst others due to investment in the retailer’s value proposition. Tesco launched its exclusive Clubcard prices and a low price guarantee in CE in summer 2022, following their introduction in the UK in 2019.

The same strategy, Clubcard prices and a low-price guarantee, have helped Tesco to achieve ‘broadly flat’ sales year-on-year across Central Europe over the reporting period. Considering inflation rates this might even be good news. March data for the last 12 months shows food inflation in Czechia and Hungary at the lowest in the European Union. In the Czech Republic the indicator came to minus 5.9% year over year and in Hungary to minus 2.1%. Also Slovakia with 0.6% higher food prices still ranks notably lower than the average for the Euro area that came to 1.5%.

Tesco is well established in Central Europe. All three markets of presence are relatively mature with the leading retailers opening only a few new stores each year.

In the Czech Republic a study of Mendel University in cooperation with the Office for the Protection of Competition ÚOHS attributed 75% of grocery market share to the six largest retailers. According to the latest available balance sheet data for the 2022/2023 business year, Tesco ranked fifth among the top retailers in terms of sales, down just one place compared to the year 2017. But while pre-tax profits in 2017/2018 reached 1.6 bn Czech crowns (CZK, 61 million euros) or 3.5% of net sales, a year ago they had deteriorated to 151 million (6 million euros) or 0.3% of net sales.

In Slovakia Tesco, still the market leader in 2017, had fallen to third-largest retailer behind Lidl and local hero Coop Slovensko by the end of 2022. Net profit in the comparable periods has almost halved from 94 million euros (6.5% net profit margin) to 57 million euros (3.5% net profit margin). The outlook for the near future is bleak. Polish discount market leader Biedronka announced plans to enter Slovakia still this year. When this happens, a price war between the new challenger and the Slovakian market leader Lidl seems inevitable, putting pressure on the whole market. Encroaching discounters and the resulting erosion of profits already in 2020 had led Tesco to sell its business in Poland.

In Hungary Lidl and Spar both have overtaken Tesco as former top retailer since 2017. Helpfully for Tesco, the ‘Plaza Ban’ regulation, which was amended in 2018, restricts the entry of other competitors such as discounters Lidl and Aldi into Tesco’s existing catchment areas. The law requires government approval for new store openings and even minor store refurbishments for gross floor retail areas of more than 400 sqm. In Hungary the British retailer was able to maintain its profitability levels, achieving a net profit of 19.6 bn Hungarian forint (HUF, 50 million euros) in 2022, compared to 17.5 bn HUF (57 million euros) in 2017. However, regulatory measures have already massively reduced profitability in 2023, as Tesco’s results show. With an increase in the rate of the special retail tax from the beginning of this year we could see a further downward trend in results.

Related news

Tesco sets out store expansion plans in 2026 including five former Amazon Fresh sites

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

ZEW: Economic expectations worsened in Germany and the euro area in February

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >