Magazine: Digitalization in banking: fast, safe, convenient

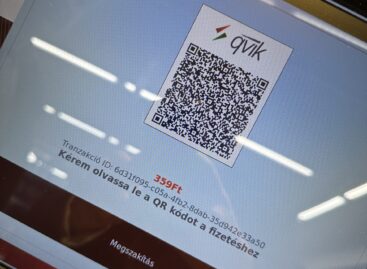

Budapest Bank, MKB, K&H Bank and OTP shared their experiences in the Instant Payment System with Trade magazin. All four banks agreed that the operation of the instant payment system (IPS) is smooth and reliable ever since the start and the new payment facility has been received positively by clients. Transactions in the weekend and over working hours have become standard.

Katalin Schuster

digital business and sales development

manager

Budapest Bank

Katalin Schuster, digital business and sales development manager, Budapest Bank reminded that there is considerable room for improvement in terms of digitalisation of the banking sector. She underlined the high rating of their own mobile app in stores and added that Budapest Bank keeps adding new e-service features and have been the first in the sector to develop an invoicing program for microenterprises.

Just a few clicks

Zsolt Levente Szabó

director of digital products

MKB Bank

Zsolt Levente Szabó, director of digital products, MKB Bank pointed out that they started to implement the agile methodology in the organisation, through which they want to speed up their delivery capabilities, adding that this year has been extremely successful and that MKB’s digital transformation efforts have been realised at a pace faster than expected.

The pandemic has brought about the increase in clients’ demand for digital banking

Safe, fast, online

András Kuhárszki

digital bank development director

OTP Bank

The IPS fits well into OTP Bank’s strategy that encourages clients to prefer safe and fast online payment methods. Even if the majority still insists on ready cash, tens of thousands of users started to use our digital channels during the lockdown, András Kuhárszky, digital banking development director, OTP Bank told. The bank furthers contact-free payment methods and has recently implemented a number of innovations.

Almost telepathy

András Árva

marketing manager/retail banking

K&H Bank

According to András Árva, marketing manager/retail banking, K&H Bank also perceives an increase in the number of clients across all age brackets having become digitally active. A new service enables clients to monitor their investment and credit portfolio per phone and take out different insurances in the K&H mobile bank. K&H has developed its paper-free online and remote procedures and pioneers in automating cash transactions. //

Related news

The place of Hungarian products in stores is in danger

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Instant payments have taken over, with most transfers arriving within seconds.

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >K&H: career lab in reality: young leaders are not afraid of responsibility

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Festival buzz at the 60th anniversary EuroShop trade fair

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >A stable compass in the Hungarian FMCG sector for 20 years

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >