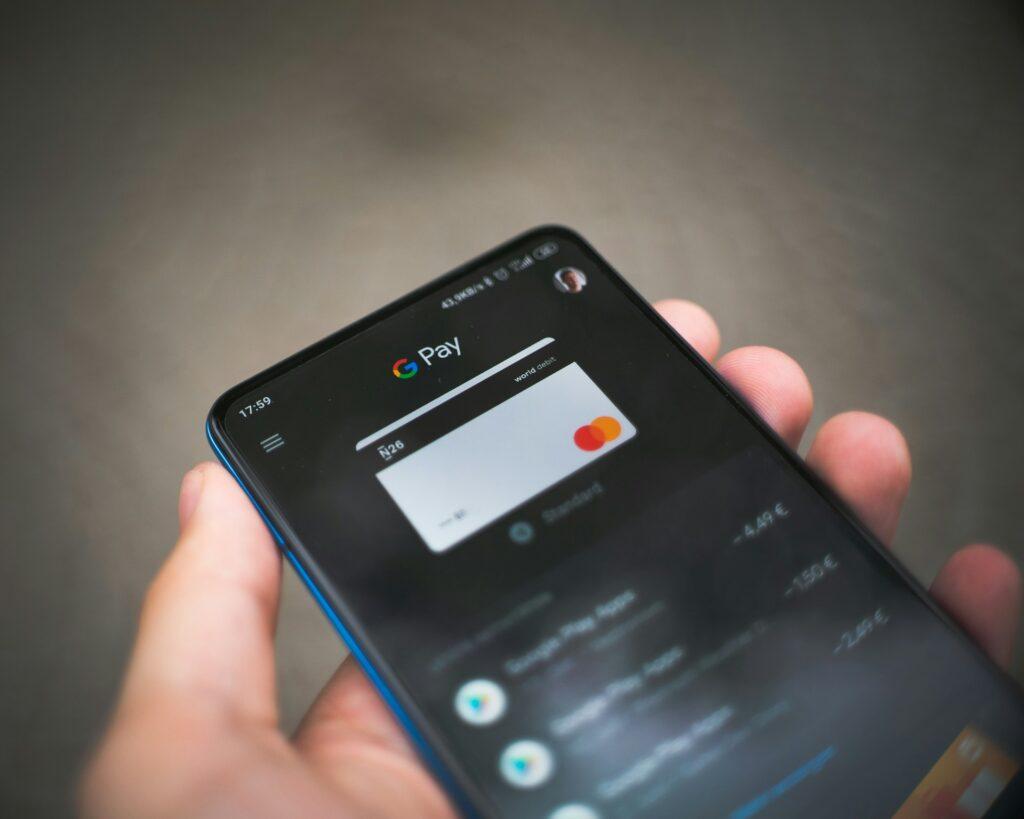

The security of smartphone payment is equal to that of a bank card

The majority of people in their twenties consider smartphone or smart watch payments with digitized cards to be just as safe as traditional bank card transactions, according to the results of the latest K&H youth index. Compared to two years earlier, more people think that bank cards are more secure than cards from fintech companies. They also set the “direction” for physical bank cards.

Nyugdíjba mehetnek a bankkártyák a fiatalok többsége szerint

The majority of young people consider electronic payment solutions to be fundamentally safe. Thus, their spending also contributed to the fact that in the first quarter, according to the data of the central bank, the number of bank card purchases increased by 11.5 percent on an annual basis, and in terms of value, the expansion was 10.7 percent.

Card vs. app

According to the K&H youth index survey, in the second quarter of this year, 72 percent of members of the 19-29 age group believe that paying with a smartphone or smart watch digitized card is just as safe as a simple – physical – bank card solution. This roughly corresponds to the result of the 2022 research. At the same time, many people – 70 percent of respondents – are of the opinion that cards issued by banks are safer to use than cards from fintech companies.

Related news

Cybersecurity, digital payment – new episodes added to the K&H Vigyázz, KáPé! vlog

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >How to spend Valentine’s Day around here

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

EY Businessman of the Year: Tibor Veres is the grand prize winner, six special awards were also given out

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >The government is supporting dairy farmers with a new measure

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >