The forint may remain relatively strong, even permanently

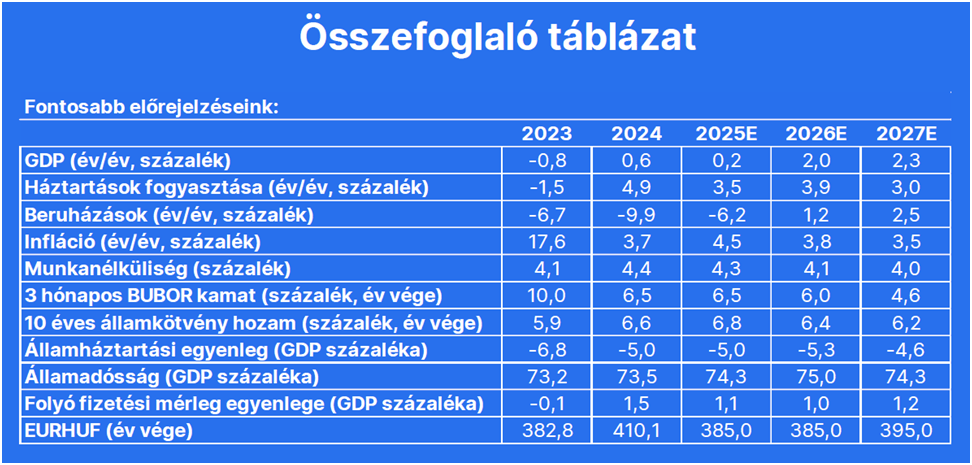

After this year’s 0.2 percent, the Hungarian economy could expand by 2 percent next year. The possible elimination of the margin stop could temporarily increase the rate of currency depreciation, but due to the tight monetary conditions, overall average inflation can be expected to slow down in 2026. The expected further increase in the difference between domestic and foreign interest rates provides strong support for the domestic currency. One euro could be around 385 forints this year and at the end of next year.

According to Erste analysts, the Hungarian economy could expand by 2 percent next year after the expected 0.2 percent GDP growth this year, or essentially stagnation. Thanks to the expected increase in real wages and the government’s welfare measures, household consumption will continue to support the domestic economy – its extent and supporting role may even strengthen. Although the prospects for industry are only slowly improving, and the return on previous large investments is also delayed, the uncertainty caused by the tariff war has eased somewhat thanks to the agreement reached between the European Union and the United States. This, together with the expected recovery of the German economy, could once again increase demand for Hungarian export products, which could slowly bring about the long-awaited investment turnaround.

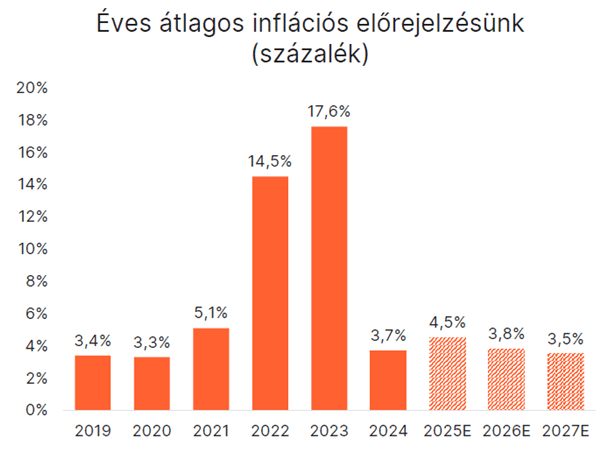

Inflation could be 3.8 percent next year after the 4.5 percent expected for 2025. Currently, the margin freeze, the forint exchange rate stabilizing at a relatively strong level, and the decline in producer prices are slowing the pace of currency depreciation, but at the same time, market services continue to become relatively expensive, and the population’s inflation expectations are also stuck at a high level. It remains uncertain when the government will remove the margin freeze. If this happens next year, due to the expected one-off effect, the pace of monetary deterioration will not remain permanently within the central bank’s target range in 2026 either – this can be expected from 2027 at the earliest.

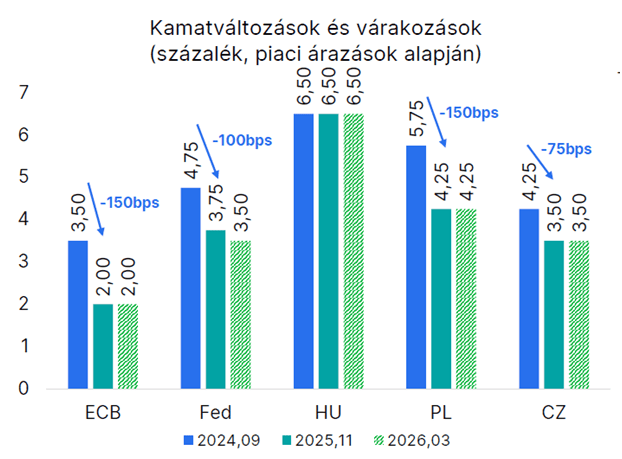

While major central banks and some regional institutions have already decided to lower interest rates, the Hungarian National Bank (MNB) continues to strive to maintain stability in its monetary policy. The Hungarian central bank is apparently concerned about higher inflation expectations and a possible increase in the pace of monetary deterioration after the elimination of the margin stop. The MNB continues to consider the inflation target to be sustainably achievable by ensuring strict monetary conditions and a positive real interest rate. Based on all this, Erste analysts believe that there may be a chance to reduce interest rates towards the end of 2026.

Primarily due to the expected further increase in the difference between domestic and international interest rates, after this year’s nominal appreciation of approximately 7 percent, the forint may remain strong in the long term. The exchange rate is supported by the easing of tariff war tensions and the current account balance – somewhat narrower than previously expected, but stable – while in the medium term the inflation differential keeps the Hungarian currency under continuous depreciation pressure against the euro. The euro/forint exchange rate may fluctuate around 385 forints this year and at the end of 2026.

Related news

Fidelity: What awaits China in the Year of the Horse?

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

40 secure jobs, sustainable solutions – new BURGER KING® in Csepel

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >