Shoppers’ favorite FMCG brands – YouGov Brand Footprint 2025

The analysis is based on the CRP (Consumer Reach Points) metric, which combines population size, brand penetration (i.e. how many households bought the brand at least once), and purchase frequency. The 2025 edition analyzes more than 30,000 FMCG brands across 56 countries, covering 73% of the global population. The European ranking includes data from 21 countries – including Hungary – while the Hungarian list reflects the actual purchasing behavior of local households. The research only considers barcoded FMCG products bought for in-home consumption – giving an accurate picture of which brands truly made it into shopping baskets, and how often.

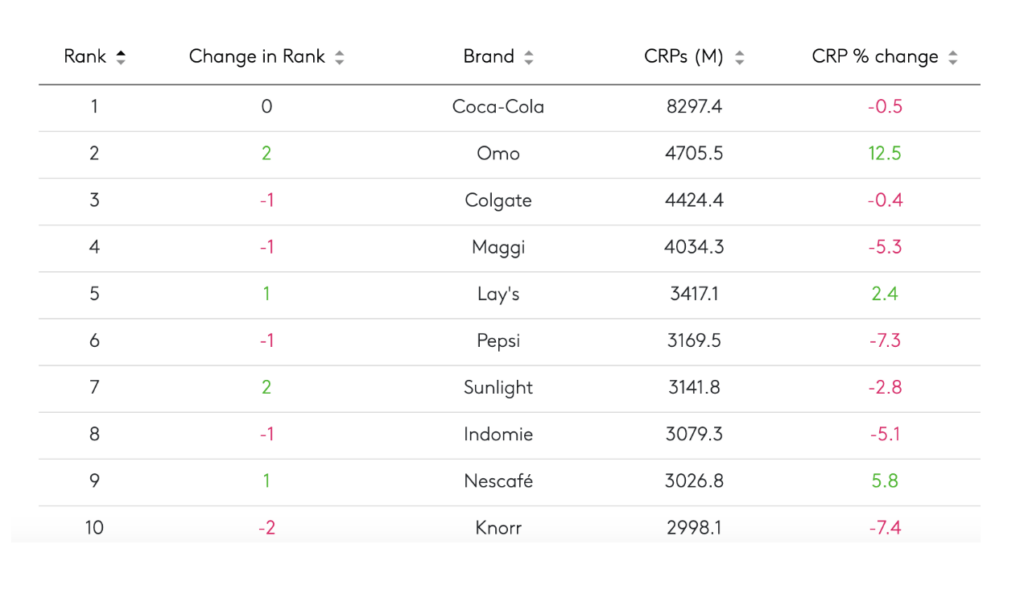

Global favorites: Coca-Cola remains on top

Coca-Cola remains the world’s most chosen FMCG brand with 8.3 billion CRPs, despite a slight 0.5% decline. Omo, the laundry detergent brand, entered the top three with a 12.5% increase, while Colgate dropped to third place. Four food brands are featured in the top ten: Maggi (4th), Lay’s (5th), Pepsi (6th), and Indomie (8th). However, Pepsi and Indomie both faced notable declines of around 7%, while Lay’s and Nescafé (9th) saw modest growth.

In the mid-table, primarily snack and beverage brands stood out – such as Oreo (17th), Doritos (20th), Milo (21st), Mountain Dew (23rd), and Kinder (27th) – mostly showing flat or slightly positive CRP trends. Among the lower-ranked food brands, Kraft (42nd), Haribo (43rd), Pringles (47th), and Barilla (48th) deserve mention: most improved their position modestly compared to last year.

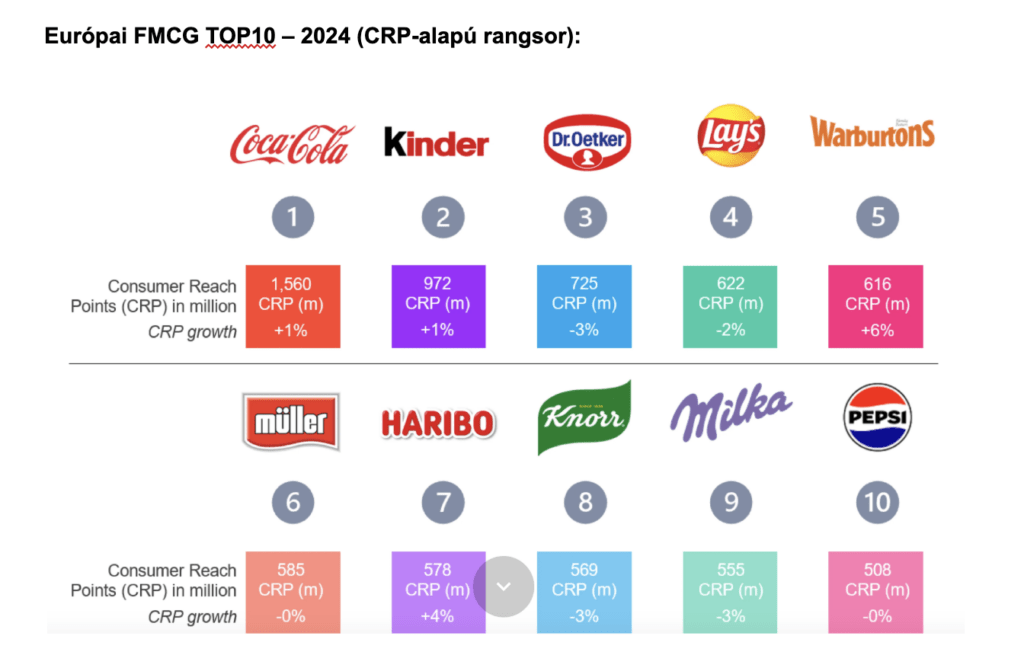

Europe’s top FMCG brands

Coca-Cola also tops the European ranking in 2024 with 1.56 billion CRPs, marking a 1% increase. Kinder comes second with 972 million CRPs, followed by Dr. Oetker in third. Other notable names in the top ten include Lay’s, Warburtons (+6%), Müller, and Haribo, which climbed to 7th with a 4% gain. Knorr, Milka, and Pepsi complete the list. The consistency at the top shows how trust, availability, and everyday relevance drive consumer choices – from breakfast staples to snacks and cooking ingredients.

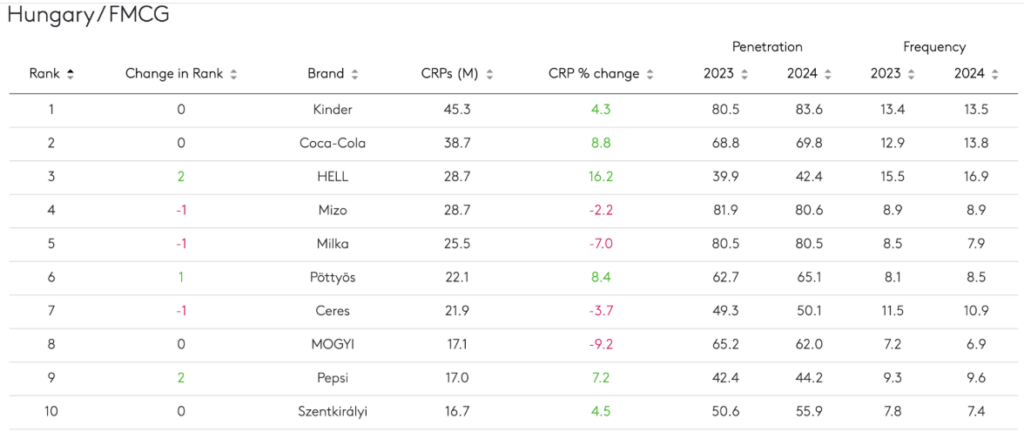

HELL, Apenta and Zewa among Hungary’s fastest risers

Kinder and Coca-Cola remain the most chosen FMCG brands in Hungary with consistently strong CRP figures and high household penetration. However, the highest CRP growth was recorded by HELL energy drink (+16.2%), Apenta (+21%), and Zewa (+18.5%). These brands not only increased in purchase frequency but also expanded their reach – with Apenta reaching nearly 47% penetration, up more than 3 points year-over-year. Pöttyös and Jogobella also performed well, both growing by more than 8%. Only Mizo and Milka saw a decline in the top ten: Mizo dropped by 2.2% and Milka by 7%.

In the mid-range, stable yet underperforming brands include Mogyi, Ceres, and Sport – the latter fell two spots and saw an 8.7% drop in CRPs. Conversely, Pepsi improved by two places with a 7.2% CRP gain. In terms of penetration, Kinder (83.6%) and Mizo (80.6%) remain highly present in Hungarian homes, with Hell (42.4%) catching up quickly. The most vulnerable brands this year were Mogyi (-9.2%) and Milka (-7%), both facing declines in frequency and presence in the basket.

Top-performing food brands in Hungary

In the Hungarian food brand category, Kinder took the top spot, overtaking last year’s leader Milka, which suffered a 7% decline. Ceres held on to third place with minor changes in frequency, remaining a stable player. Detki made the biggest leap, moving up six spots with a 17.1% increase in CRPs. Other strong performers include Pick (+14.2%), Balaton (+8.9%), and Cerbona (+14.2%). Meanwhile, well-known names like Lucullus (-10.4%) and Chio (-12.4%) faced double-digit declines.

Further down the list, Gyermelyi held its 17th place with nearly 5% CRP growth. However, Univer and Koronás Sugar lost ground (-2 and -7 positions, respectively), with the latter dropping 14%. Vita emerged as a promising brand, improving by two places and 9.3% in CRPs – one of the strongest gains in the lower ranks. Knorr, on the other hand, fell by six places and lost 13%, a significant setback for a traditionally strong player.

Beverages: classics and challengers

Coca-Cola continues to lead the beverage segment in Hungary, increasing its CRPs by 8.8% and maintaining a high frequency score of 13.8. HELL retained its second place with a 10.7% gain, while Xixo posted the largest growth (+23.9%), overtaking several established brands. Apenta also had a strong year with a 21% increase and climbed one spot. At the lower end, Top Joy (-11.8%) and Nescafé (-11.2%) experienced significant declines, the latter underperforming in both food and beverage categories.

Both Szentkirályi and the Nestlé–Szentkirályi–Kékkúti mineral water brands performed well: the former ranked 4th among beverages, the latter 19th in food. The beer segment saw growth from Soproni and Dreher, while Gösser surged by 13.3%, climbing from the bottom of the list. In contrast, Márka and Sió stagnated or declined slightly. The data suggests that brands offering innovative flavors or campaigns targeting younger audiences had a competitive edge in 2024.

Hungarian awards debut in September

For the first time, Hungary’s top-performing brands will be honored at a dedicated awards ceremony: the YouGov Shopper Awards will be presented on 25 September 2025, during the Business Days conference. In addition to revealing detailed rankings and research findings, the event will spotlight those brands that managed to grow amid economic pressure, shifting consumer expectations, and promotional overload.

Related news

An experience beyond scent

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Less meat might be consumed in German-speaking countries

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Lidl guarantees fairer prices for cocoa farmers

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >