Very cautious monetary policy is expected due to the deteriorating inflation trajectory

The MNB kept the key interest rate at 6.50% today, as expected. The two ends of the interest rate corridor remained at 5.50% and 7.50%. Preliminary expectations, rising inflation, and previous central bank comments (from Gyula Pleschinger and Barnabás Virág) made any other decision for today very unlikely.

The EUR/HUF exchange rate hovered around 401 in the half hour following the decision: apparently the interest rate decision itself had no effect on the forint exchange rate, as it developed as expected. However, due to the relatively strict comments of Deputy Governor Barnabás Virág (“the pricing practices of the service sector are not in line with the achievement of the inflation target”), the forint temporarily started to strengthen after the press conference starting at 3 o’clock. At around 3:30 p.m., the forint’s exchange rate against the euro approached the 400 level, but then began to weaken again, rising above 401 against the euro after 4 hours.

The EUR/HUF exchange rate hovered around 401 in the half hour following the decision: apparently the interest rate decision itself had no effect on the forint exchange rate, as it developed as expected. However, due to the relatively strict comments of Deputy Governor Barnabás Virág (“the pricing practices of the service sector are not in line with the achievement of the inflation target”), the forint temporarily started to strengthen after the press conference starting at 3 o’clock. At around 3:30 p.m., the forint’s exchange rate against the euro approached the 400 level, but then began to weaken again, rising above 401 against the euro after 4 hours.

Interest rate outlook

Today’s interest rate decision did not contain any major surprises, but Barnabás Virág made important signals regarding the outlook. He clearly indicated that if necessary, the MNB should raise interest rates. This suggests that if the risk perception deteriorates or the inflation picture worsens further, we should not expect a weakening of the forint exchange rate, but rather an increase in interest rates. However, this is not our base scenario for now: we see that a longer interest rate hike is likely, until the end of the year, when a cautious interest rate cut to 6.25% could be appropriate. However, for this to happen, it is absolutely necessary that the inflation picture does not deteriorate significantly further (i.e. the February and March data do not overwrite all of this and disinflation really starts), and that the Fed is able to reduce it below 4% overseas as well.

Related news

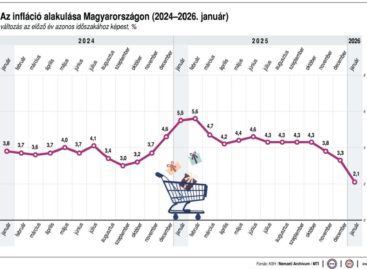

KSH: in January, consumer prices exceeded the values of the same month of the previous year by an average of 2.1 percent

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >January inflation data paves the way for February interest rate cut

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Spring whirlwind at the 60th anniversary EuroShop trade fair

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >