German supermarkets draw even with discounters

After two years of inflation-induced market share losses, German supermarkets stabilize their market position. Food prices are deflating for the first time in ten years. Market leader Edeka ended the year with sales growth below the market average. The discount banner Netto Marken-Discount and the supermarkets run by independent merchants helped the cooperative to hold its ground.

Supermarkets and discounters compete head-to-head in Germany. According to the latest data from the GfK-CPS Consumer Panel Germany, both segments in Germany were able to increase their sales by 5% in March, the most recent month for which figures are available. In the first quarter of the year, the supermarket channel led by Edeka and Rewe was even able to grow slightly faster at 5.7% compared to the 5.4% growth of the discount channel.

The figures might point to a trend reversal, given the slowdown in inflation. According to Destatis, Germany’s Federal Statistical Office, food prices in March 2024 fell by 0.7% year-on-year. The deflationary result was underpinned in particular by a 20.1% year-on-year drop in the price of vegetables. According to the statisticians, this was the highest level of deflation since February 2015, when food prices fell by 0.2% year-on-year.

Over the past two years, discounters have been able to increase their market share in Germany. At the end of 2021, according to GfK-CPS, the discount channel accounted for 34.8% of the German FMCG market. By the end of 2023, their share had increased by 3.0 percentage points to 37.8%. Over the same period, supermarkets lost ground, down 0.8 percentage points from 29.4% to 28.6%. Lidl, Aldi & Co. did not necessarily gain exclusively at the expense of Edeka, Rewe and other supermarkets. The position of the specialized stores segment deteriorated significantly. Their share fell from 15.0% to 12.5%.

This development is mirrored by German grocery market leader Edeka, who has just announced its results for the past financial year. The group’s annual turnover in 2023 rose to 70.7 billion euros. The 6.7% increase is well below food inflation, which was 12.4% over the same period, according to Destatis. Accordingly, Edeka saw its market share fell slightly by 0.1 percentage points from 29.5% to 29.4% over the period. According to Edeka, one of the reasons for this is that supermarket customers have been able to shift their purchases more towards promotional discounts and private labels, an option less available at the discounters.

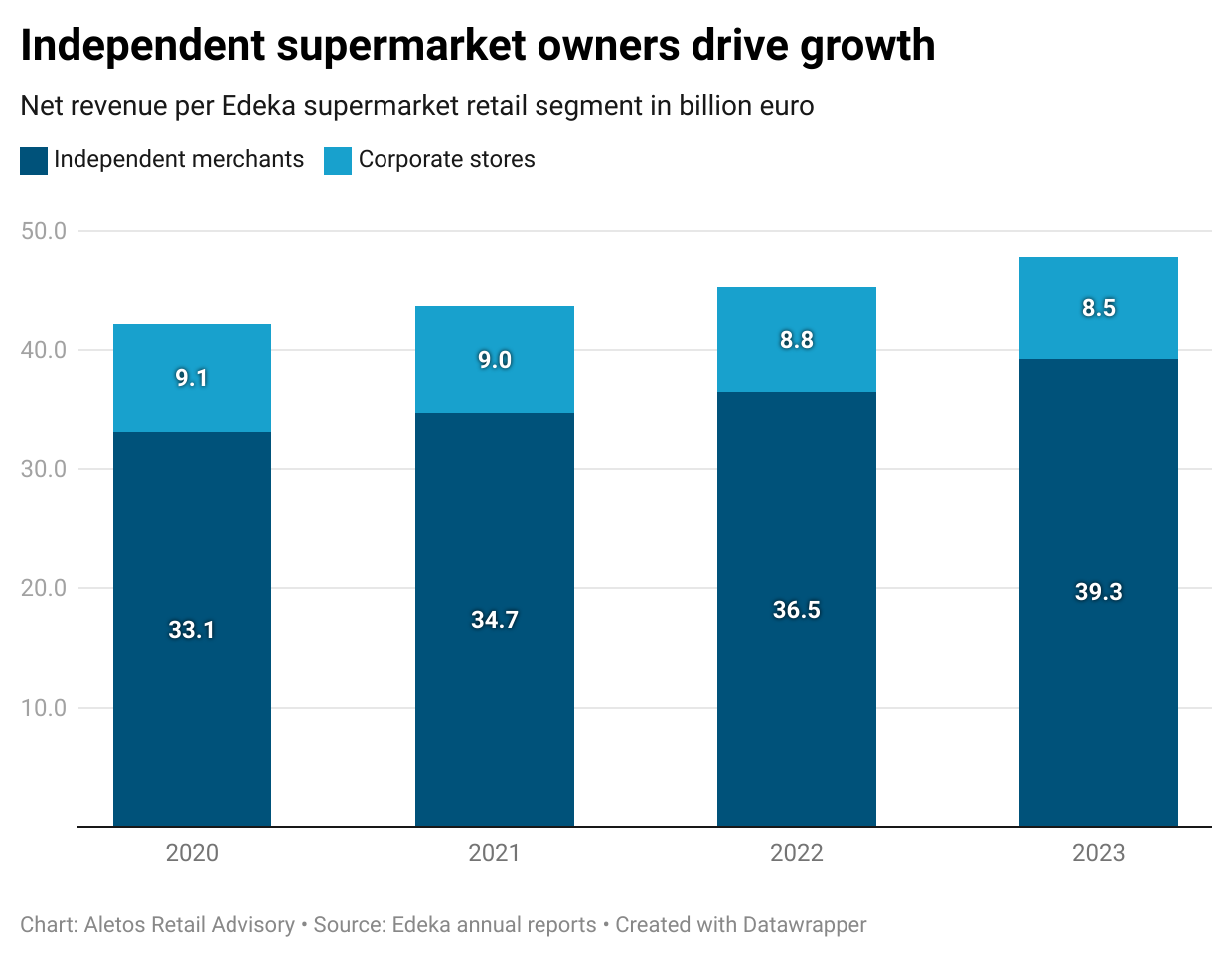

Within the Edeka Group, it was the brand-driven Edeka discounter Netto Marken-Discount that led the way with growth of 8.5% to 17.1 billion euros. Within the supermarket segment, the independent Edeka retailers were the best performers, with net sales up 7.7% to 39.3 billion euros on a comparable store base. The company-operated portfolio of supermarkets, however, lost 3.4% in net sales to 8.5 billion euros, partly due to the fact that the number of company-owned stores fell from 1,015 to 940 during the period.

Related news

Every second German drinks plant-based

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Lidl is building a new administrative and logistics centre in Straubing

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >From the shopfloor: What the Mere format reveals about retail concentration

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

The Store of the Future opens again at the SIRHA Budapest exhibition! (Part 4)

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Spring whirlwind at the 60th anniversary EuroShop trade fair

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >The economic sentiment index deteriorated in the euro area and the EU in February, but improved in Hungary

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >