The growth of Hungarian e-commerce is now driven by imports

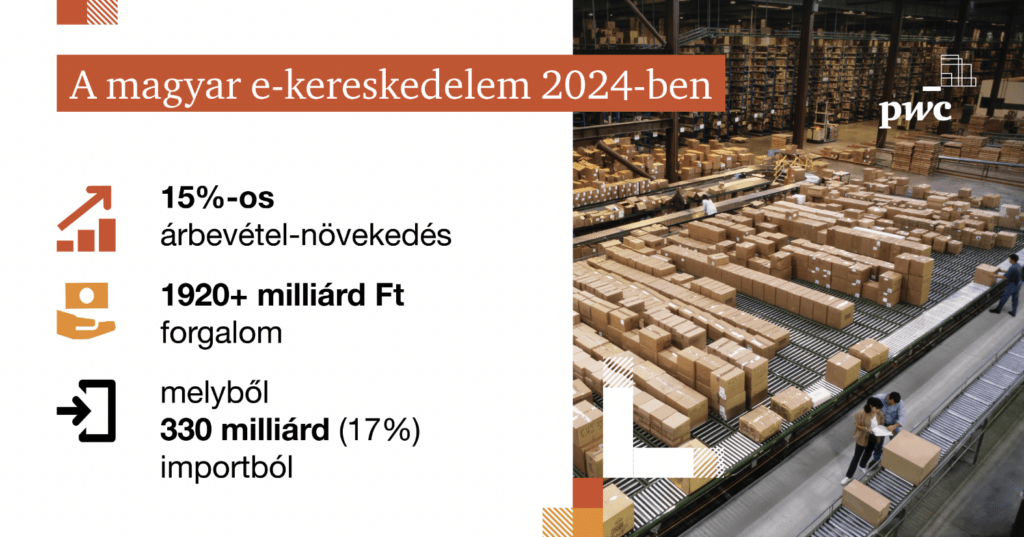

In 2024, the entire Hungarian e-commerce market, based on PwC’s measurements between Q1-Q3 and preliminary data for Q4, could reach a turnover of 1920 billion forints with a 15% increase in sales, of which 17% – about 330 billion – was generated by import trade. Imports clearly became the engine of growth in 2024, as domestic online retail turnover could only increase by 10%. A quarter of online orders reach customers via parcel machines, and Temu became the e-retailer with the largest customer base and order number in 2024, according to the latest edition of PwC’s Digital Commerce Panorama report, prepared in collaboration with the Digital Commerce Association.

Competition is getting fiercer in the shadow of global giants

In 2024, the Hungarian e-commerce market underwent a transformation that has not been seen in the nearly 25 years of the sector’s existence in Hungary. The engine of e-commerce development is no longer domestic and EU merchants, but cross-border, import trade. Therefore, when we talk about the “Hungarian e-commerce market”, it is important to add what we mean by “market”.

“Just a few years ago, the Hungarian e-commerce market consisted almost exclusively of EU merchants operating in Hungary or considering our country as a strategic market (with a Hungarian website and often a local team). In addition to domestic e-commerce merchants, international merchants were for a long time only a relevant source of supply for a small, well-defined customer segment. However, by now, shopping abroad has become a competitive alternative to domestic shopping in terms of customer experience, speed and service level”

– highlighted the most important finding of the Digital Commerce Outlook by Norbert Madar, Head of PwC’s Digital Commerce Team and Vice President of the Digital Commerce Association.

Imports are now driving the e-commerce market

The growth rate of e-commerce followed that of total retail in 2022 and 2023, and was unable to accelerate significantly, primarily due to the diverting effect of high inflation and under-buying. This trend reversed in 2024. With the arrival of the import era, e-commerce in Hungary has become two-polar, as the competition between domestic and imported e-commerce determines the ecosystem. Although complete data is only available for the first three quarters, according to PwC’s measurements, the total turnover of the entire market in 2024 will be approx. It closed at 1920 billion, with an annual growth of 15%. Of this total pie, domestic and EU retailers account for about 1600 billion forints, with a growth of 10%, to which import e-commerce – dominated primarily by Temu – adds another 330 billion forints.

“Temu’s high-level operating model – fast delivery, easy product returns and continuously available customer service – has also raised customer expectations, and domestic retailers are trying to stay competitive by improving service standards (for example, wider, faster logistics) in addition to promotions,”

– added Ildikó Cserjés-Kopándi, e-commerce expert at PwC Hungary.

Related news

Serbian farmers block roads to protest cheap imports

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >US, China and Russia dominate Europe’s ecommerce top 10

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >New customs rules for imported parcels

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Emotions, stories, authenticity – these were the deciding factors in 2025

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Dreher prepared messages from fathers for Women’s Day

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >IVSZ and WiTH are looking for female role models in the digital profession again this year

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >