Despite the challenges, the SME sector maintains its position in the Hungarian economy

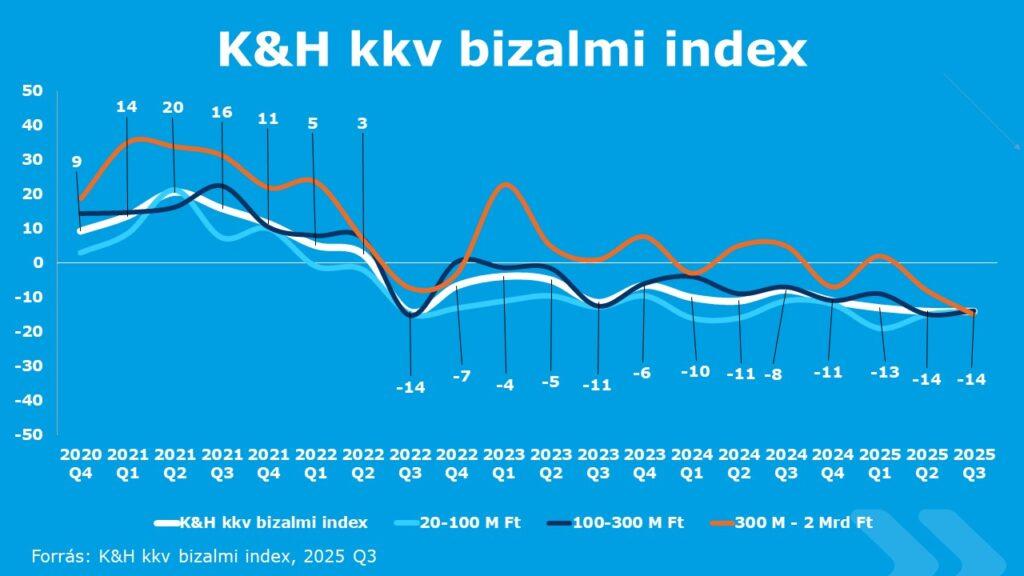

The expectations of domestic businesses are still in the negative range compared to the previous quarter – according to the latest research data from the K&H SME Confidence Index conducted in the third quarter of 2025, which reflects economic expectations based on the responses of 400 domestic small and medium-sized enterprises. The confidence index currently stands at -14 points, so the entrepreneurial sentiment is exactly the same as the value measured in the previous quarter.

Despite the stagnation of the overall indicator, nuanced shifts can be observed in several areas. The four-quarter moving average is now at -14 points, which is the lowest value since the third quarter of 2022, suggesting longer-term uncertainty in the market. It is an unprecedented turn of events that the sentiment of the company category that has typically been the most positive for many years, the companies with the highest sales revenue, has fallen the most, to the level experienced by other company sizes, while the smaller ones have proven to be more stable. At the sectoral level, the players in the trade and service sectors are more pessimistic than average, according to the latest results: the confidence index of trade companies has further decreased from -14 to -18, that of service providers also remained in the negative range, but improved by 2 points from -17 to -15, while that of agriculture has increased by 3 points and approached the neutral level (-1 point), and that of the industrial sector is stagnant at -8 points. According to the regional distribution, the confidence index of the central region is the lowest, while that of the western region is the highest – as has been typical since the beginning of 2024 – but there is only a 7-point difference between the two values (-10 vs. -17 points).

Can the interest rate reduction introduced for state-subsidized loans bring about a recovery?

“The persistently negative level of the confidence index also indicates that domestic enterprises continue to wait and react cautiously to changes in the economic environment. K&H is a committed partner to the SME sector and is doing a lot to provide innovative financing solutions and to ensure faster and easier banking for SMEs with its digital solutions,” said Zoltán Rammacher, Marketing Manager of the K&H Retail and SME Segment. “It is important to note that the news of the fixed 3 percent loan program appeared after the data collection was completed, so its effect is not yet reflected in the mood of companies and their future planning. However, it can be expected that businesses will positively evaluate the interest rate reduction in the Széchenyi Card Program schemes”

– the expert added.

The development of the confidence index can be shaped by several economic factors: strong household consumption and 4-5 percent real wage growth continue to provide a stable point in the economy. In addition, one of the most significant recent measures is the reduction of the Széchenyi Card MAX+ and Széchenyi Liquidity Loan MAX+ products to a fixed 3 percent. This favorable interest rate loan option could represent a new financial source for the SME sector, which could even positively influence plannability and investment willingness in the long term.

Despite the uncertainties, the proportion of those who perceive the government’s economic policy and its measures as more business-friendly was able to increase, the respondents’ assessment improved by 9 percentage points compared to the previous half-year (from -14 to -5 points), the last time it was in a similar range was in the first quarter of 2023, when the value stood at -1 point. This reflects that although the SME sector is currently highly pessimistic, they are ready to use programs aimed at stimulating the economy and are very much looking forward to initiatives that will make their success more efficient.

Related news

Important legislative changes: certain consumer rights now extend to SMEs

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >NGM: Hungarian micro and small enterprises can apply for site development under more flexible conditions

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >SMEs look to 2026 with positive expectations and growing confidence

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Emotions, stories, authenticity – these were the deciding factors in 2025

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Dreher prepared messages from fathers for Women’s Day

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >IVSZ and WiTH are looking for female role models in the digital profession again this year

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >