Aldi UK goes local

Aldi in the UK is investing in British apple growers. The German discounter is the biggest buyer of British apples in terms of volume. Following similar moves by Lidl in the pork sector, Aldi is now securing its supply lines for a key UK fruit. Aldi’s average annual investment is almost four times the UK government’s public funding for all fruit growers combined.

Aldi plans to invest £750 million over the next 20 years in a family-owned fruit farm in Kent. The deal includes the creation of a 200-acre site to be known as the ‘Aldi Orchard’ at Aldi’s exclusive supplier of British apples, AC Goatham & Son. With the German discounter’s long-term commitment, the grower plans to plant an additional 100 acres of apple trees each year exclusively for Aldi. According to the farmer, business with Aldi has grown fivefold since 2016.

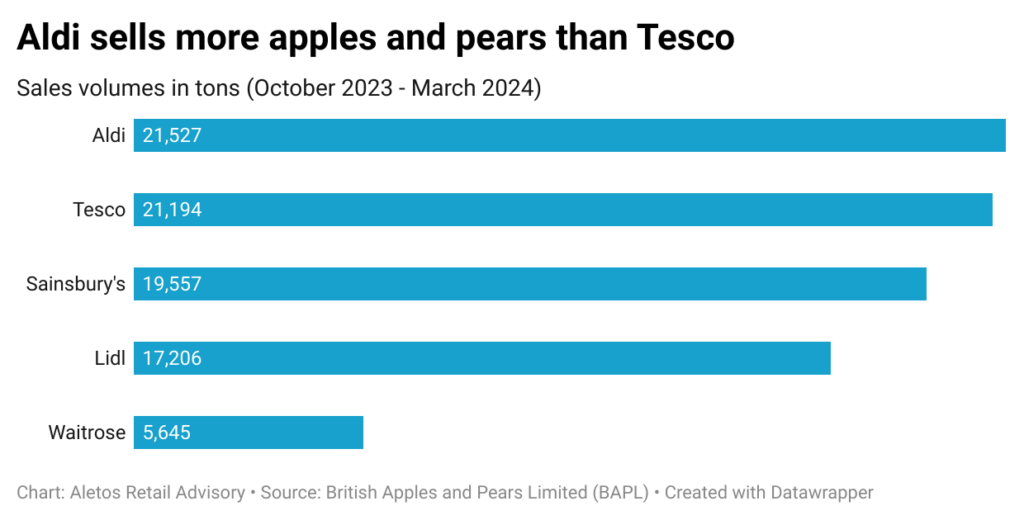

Aldi was the biggest buyer of British apples in the six months to March 2024, according to data from industry body British Apples and Pears Limited (BAPL). In terms of volume, the German discounter actually bought more apples and pears domestically than market leader Tesco over the same period. According to the association, Aldi bought 21,527 tonnes, Tesco 21,194 tonnes, while discount rival Lidl came fourth with 17,206 tonnes (see graph).

As with Lidl’s recent investment in pork farming, securing the long-term supply of apples is a priority for Aldi. The German discounters’ market positioning is much more dependent on domestically produced British apples and pears than that of its British supermarket competitors. BAPL publishes monthly sales statistics for the UK grocery segment. In terms of the category’s share of total retail sales, the German discounters sell disproportionately more than the established UK grocers. In April 2024, market leader Tesco had a 27.4% share of the grocery market and sold 27.6% of all UK apples and pears. The number two grocer, Sainsbury’s, had 15.3% and 16.2%. Aldi had a 10.0% share of the grocery market and sold 22.1% of the fruit. For Lidl the figures were 8.0% and 14.3% respectively.

At the turn of the year, the British media reported that UK apple growers were living on a “knife edge”, with costs rising by 30% last year, while prices sold to supermarkets rose by only 8%. According to the UK government’s recently published Food Security Index 2024, domestically produced fresh vegetables can only meet 55% of domestic demand, for fresh fruit the ratio is much lower, at 17%. As expected by national farming groups, this year’s weather extremes are likely to result in even lower yields on UK farms than in the past. Industry experts predict that similar conditions in the rest of Europe could lead to a significant increase in the price of fresh produce. The UK government plans to ‘turbo-charge’ the country’s horticulture sector by doubling public funding to £80m, of which £10m will go to fruit growers. Aldi’s 20-year investment on average amounts to more than GBP 37 million per year.

Related news

How Lidl uses Poland’s new deposit system as a loyalty tool

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Historic price reduction at ALDI

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Veganuary inspires millions of people in the UK

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Emotions, stories, authenticity – these were the deciding factors in 2025

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Dreher prepared messages from fathers for Women’s Day

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >IVSZ and WiTH are looking for female role models in the digital profession again this year

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >