The impact of the forint exchange rate on GDP growth

The forint’s exchange rate against the euro has been steadily strengthening in recent times; in the past 11 months, the domestic currency has appreciated by 7.3%. The last time the Hungarian currency was this strong against the euro was in January 2024. This has an impact on the entire national economy: it fundamentally influences export performance, household consumption, the inflation path, and ultimately the gross domestic product (GDP). In our current analysis, we examine the short- and long-term effects of the strengthening of the forint on growth based on GKI model calculations.

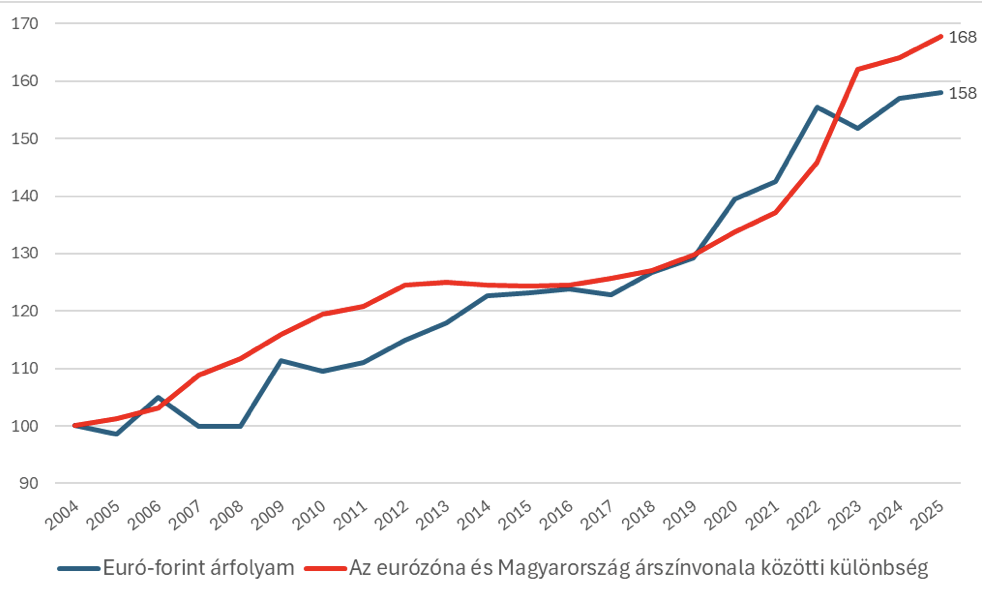

Since the country’s accession to the EU in 2004 until 2024, the exchange rate of the forint against the euro was fundamentally driven by the inflation differential between the eurozone and Hungary. In practice, this resulted in the domestic currency devaluing to the extent that the rate of price increases in Hungary exceeded the rate of price increases in the eurozone. Since 2004, prices have increased by 68% more in our country than in the eurozone, while the forint has depreciated by 58% against the euro. However, from 2023 the two indicators began to diverge, i.e. the higher domestic inflation compared to the eurozone was increasingly reflected in the exchange rate change (i.e. the forint appreciated relatively). In 2025, the inflation difference between the eurozone and Hungary’s data was 2.3 percentage points, while the annual average exchange rate of the euro increased from 395.3 to only 397.8, an increase of only 0.6%. In 2025, the difference between the two indicators became 10 percentage points.

The evolution of the euro-forint exchange rate and the difference between the price level of the eurozone and Hungary (2004=100%)

Source: Eurostat, GKI calculation

The appreciation of the exchange rate triggers economic processes that are opposite to the time difference in the short and long term. The initial, short-term effects of the process are favorable for households, since the primary effect of the appreciation is manifested in a decrease in import prices and thus in the reduction of the consumer price index (inflation). Lower consumer prices increase real income, which entails an expansion of household consumption. In parallel with this process, a slower-reacting opposite effect appears in exports. While costs measured in domestic currency increase at home, due to the strengthening forint, less and less revenue measured in forint is generated from external markets with the same export volume. In other words, the strengthening of the domestic currency may reduce competitiveness in international markets. This particularly affects domestic-owned exporting companies with a high domestic supply ratio and high wage costs (high domestic value-added, export-oriented sectors). For large multinational companies that work mostly on imports, and only a small part of their costs are incurred in forints, this effect is less pronounced.

Hungarian companies producing for the domestic market not only have to reckon with rising wage and other costs, but also with the fact that they are faced with increasing price competition in their own market against imports due to cheaper imported products. In addition, the sector is also affected by the changes. Hungary will have higher prices for foreigners, which may reduce the country’s tourist appeal, while it will become cheaper for Hungarians to travel abroad. If this change in competitiveness is not compensated by a substantial improvement in productivity, the strengthening of the forint may have a long-term impact on the growth rate of GDP, in contrast to the rapid but temporary benefits of a decrease in inflation.

Our modeling results show that a 1 percentage point strengthening of the forint contributes to economic growth by +0.4 percentage points in the next quarter and +0.1 percentage points in the second quarter due to a decrease in consumer prices (and thus an increase in consumption). It would also have a positive effect on economic growth if a strong forint also meant a decreasing interest rate level, as decreasing interest rates would stimulate investments. However, the strong forint is currently due to the high interest rate level, so this effect does not apply.

From the 3rd quarter (-0.2 percentage points), the sign of the effect is reversed, and the forint appreciation already reduces the rate of economic growth. In the future, the reducing effect is increasing (minus 0.3-0.4 percentage points/quarter). This is because the previous, higher-priced imports

Related news

KSH: the GDP-proportionate deficit was 4.2 percent in the third quarter of 2025, and 1.9 percent in the first three quarters in total

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >Related news

Year-round consumer protection inspections – focus on examining discount prices and detecting customer deception

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >