Carrefour on track with ‘Digital Retail 2026’ strategy

Investment focus in CEE on Romania, while high competition in Poland lets franchise network dwindle

Carrefour improves its financial soundness and moves ahead on its way to becoming Europe’s largest digital retail company. For the full year 2023 the retailer reports gross sales of 94.1 billion euros, an increase of 9.3% at constant exchange rates. At current exchange rates the growth rate comes up to only 3.5%, mainly due to the depreciation of the Argentinian Peso. In times, where investments in price, technology and digital are decisive for future competitiveness the retailer also was able to strengthen its bottom line. Ebitda for the year totaled 4.56 billion euros, an increase of 8.9% at constant exchange rates. The net income for the year rose from 1.57 million euros to 1.64 billion euros.

The positive result was among others carried by cost savings of 1.06 billion euros, in line with the target to save in total 4 billion euros until 2026, as well as the divestiture of Carrefour’s business in Taiwan. This allowed the group to reduce net debt by 818 million euros down to 2.56 billion euros and initiate its next share buyback program for 700 million euros. Carrefour set the ordinary dividend for this year to 600 million euros, an increase of 55% compared to the previous year.

The retail group is on track with its Digital Retail Strategy 2026 agenda, launched end of 2022: E-commerce GMV (gross merchandise value) rose by 26% from 4.2 billion euros in 2022 to 5.3 billion euros in 2023. By 2026 Carrefour wants to reach the figure of 10 billion euros. Instrumental for this is, among others, the launch of its virtual non-food store on the Rakuten marketplace last year. On the digital side Carrefour’s data lake registered 8 billion transactions last year. The company plans to monetize this potential via retail media with the help of the joint venture with multinational French-based advertising company Publicis Groupe.

By finalizing the divestiture of Carrefour’s Taiwan business in summer last year Carrefour also is set to focus on the competitiveness of its physical store network in its core markets in Latin America and Europe. The company has increased its footprint in its home market France with the acquisition of 175 Cora and Match stores from Casino in France and 31 stores from Intermarche. The retailer also expanded its position in Spain by acquiring 47 SuperCor supermarkets from El Corte Ingles as well as Cora’s business consisting of 19 stores in Romania. In a mix of new openings and conversions from Grupo Big stores the retailer has added 92 Atacadão low-price cash & carry hypermarkets in Brazil, aiming at a total of at least 200 new stores by 2026. Across the group Carrefour opened 653 new convenience stores last year, with 2,400 new additions planned in the channel segment by 2026.

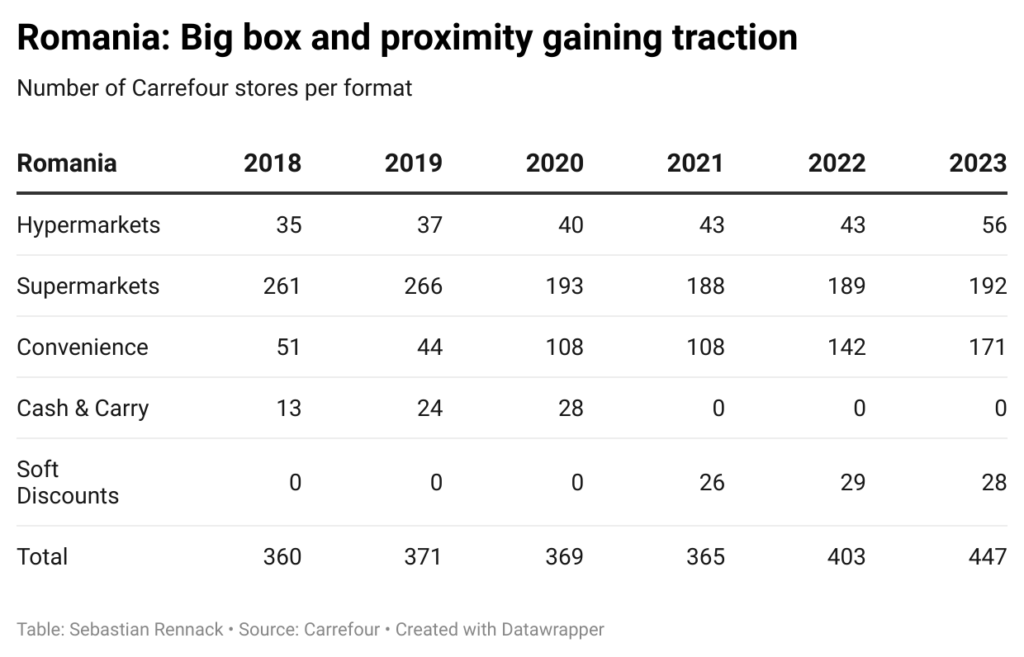

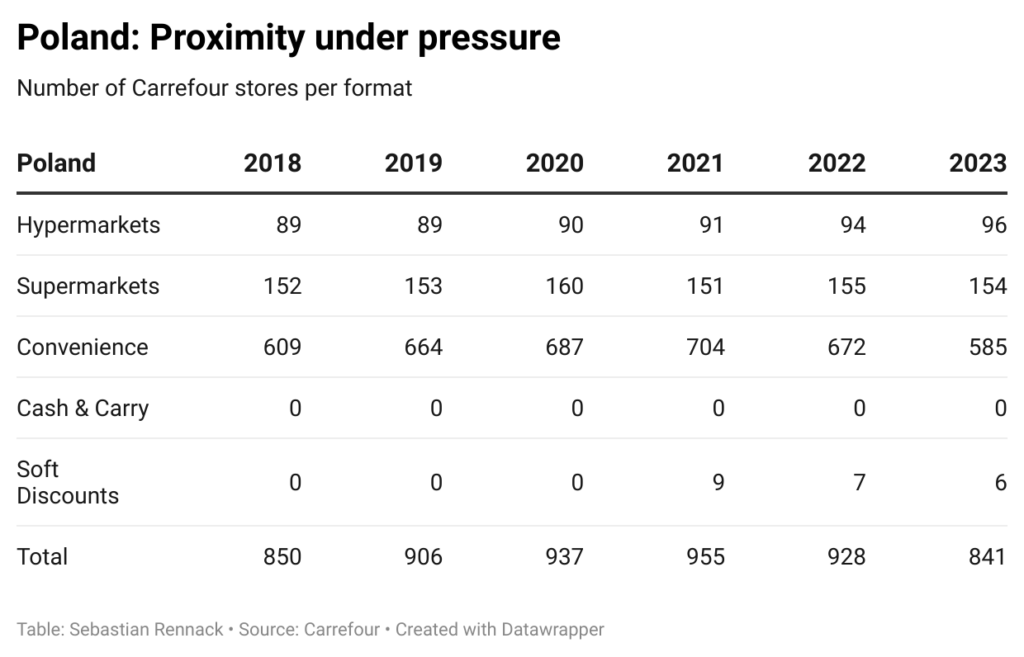

The development in Central and Southeastern Europe is mixed. Carrefour’s Polish business unit was the only country with a negative like-for-like performance of -0.6% in 2023, albeit coming from a high level the previous year. In Romania the retailer achieved a solid +7.0% like-for-like result in sales. In line with this same-sales-area figures, main investments in the region were allocated to the subsidiary in Romania, who ended the year with more than 40 new locations, across all sales formats. In contrast to this, in Poland the franchised store network shrank by close to 90 small-sized stores.

To boost its price competitiveness in a market environment that currently is characterized by high price-sensitivity, Carrefour pushes the development of its private labels. Aiming at a 40% own brand share in food sales by 2026 the retailer was able to increase the ratio last year across the group over 3 percentage points from 33% to 36% of food sales.

Franchise cooperations are part of this strategy. In 2023 the company launched partnerships with retail banners Yenot Bitan in Israel, Altan Joloo in Mongolia as well as with Czech Group JIP Retail. Already in 2020 Carrefour initiated private label sales to Coop in the Nordics, expanding this agreement to branded suppliers in 2021.

Related news

From the shopfloor: What the Mere format reveals about retail concentration

🎧 Hallgasd a cikket: Lejátszás Szünet Folytatás Leállítás Nyelv: Auto…

Read more >